XRP Weathers the Cryptocurrency Storm: A Closer Look

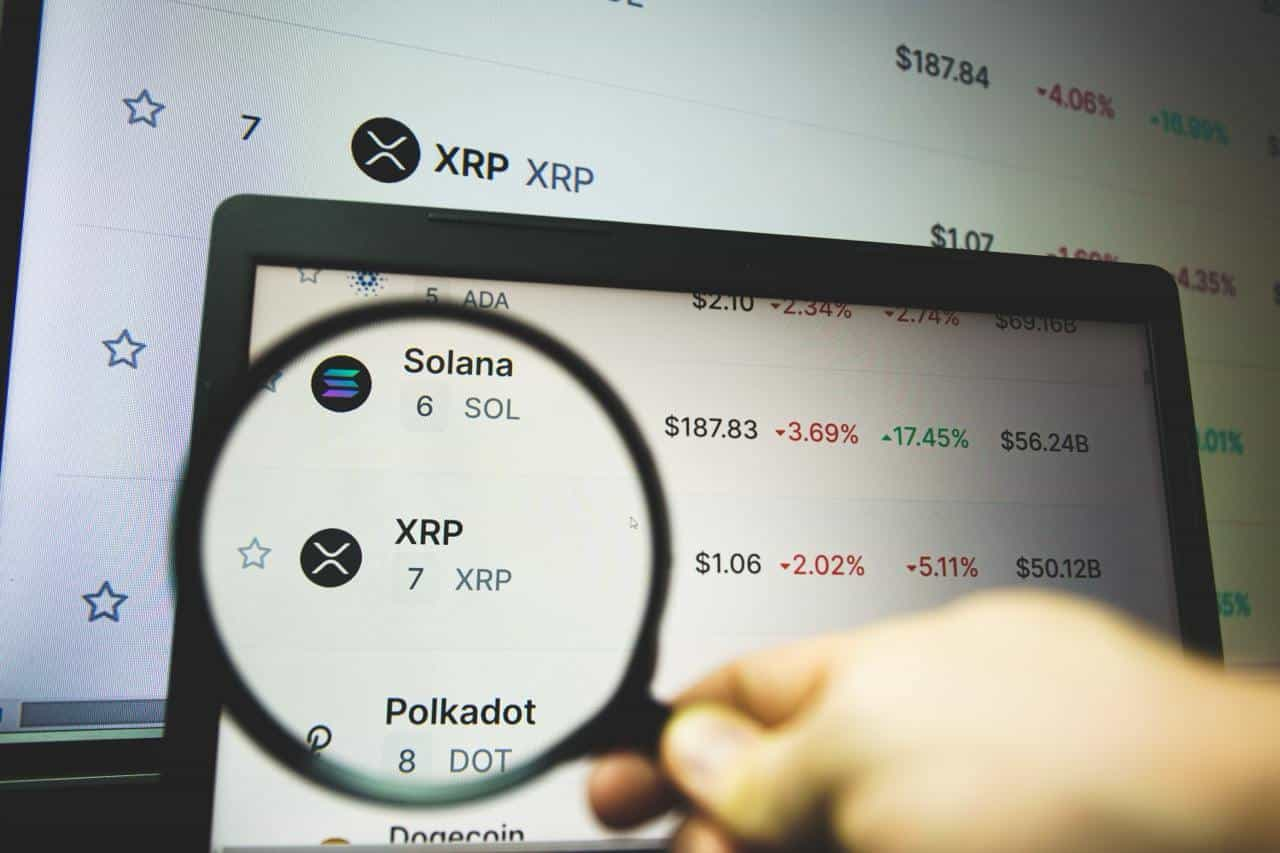

The cryptocurrency market has been a rollercoaster ride for investors in recent months. With Bitcoin’s (BTC) price plummeting to new lows and Ethereum (ETH) following suit, one cryptocurrency has managed to hold its ground stronger than most: Ripple’s XRP.

What’s So Special About XRP?

XRP is a digital asset native to the Ripple platform, an open-source payment protocol designed for fast and cheap cross-border payments. Unlike Bitcoin and Ethereum, which are decentralized and rely on blockchain technology for their security and verification, Ripple is a centralized system. This means that transactions are processed by the company itself, rather than by a decentralized network of computers.

The Ripple Effect

One of the reasons XRP has remained relatively stable during the market downturn is its close relationship with traditional financial institutions. Ripple has partnered with numerous banks and payment providers, including Santander, MoneyGram, and American Express, to facilitate cross-border payments using XRP as a bridge currency. This real-world adoption gives XRP a level of stability that other cryptocurrencies lack.

Impact on Individual Investors

For individual investors, the strength of XRP during the cryptocurrency market downturn may be seen as a silver lining. Those who have held onto their XRP may have seen their investments maintain or even grow in value, while others have seen their Bitcoin and Ethereum holdings decrease significantly. However, it’s important to remember that past performance is not indicative of future results, and investing in cryptocurrencies always comes with risks.

Impact on the World

The stability of XRP during the market downturn could have significant implications for the global financial system. If Ripple’s partnerships with traditional financial institutions continue to grow, it could lead to a more interconnected and efficient global financial system. Faster and cheaper cross-border payments could make it easier for businesses to operate internationally and for individuals to send money to their loved ones across borders.

Conclusion: XRP – A Beacon of Stability in Uncertain Times

While the cryptocurrency market continues to be a source of uncertainty and volatility, XRP has proven to be a beacon of stability. Its close relationship with traditional financial institutions and use case as a bridge currency for cross-border payments have given it a level of resilience that other cryptocurrencies lack. However, it’s important for investors to remember that past performance is not indicative of future results, and investing in cryptocurrencies always comes with risks.

- XRP is a digital asset native to the Ripple platform, designed for fast and cheap cross-border payments.

- Unlike Bitcoin and Ethereum, Ripple is a centralized system, with transactions processed by the company itself.

- XRP has remained relatively stable during the recent cryptocurrency market downturn due to its real-world adoption by financial institutions.

- Individual investors may see their XRP investments maintain or even grow in value during market downturns.

- The stability of XRP could lead to a more interconnected and efficient global financial system.

In a world of uncertainty, XRP’s stability is a welcome sight for those invested in the cryptocurrency market. But as always, it’s important to remember that investing in cryptocurrencies always comes with risks. So, keep your eyes on the Ripple effect, but don’t forget to keep a diversified portfolio.