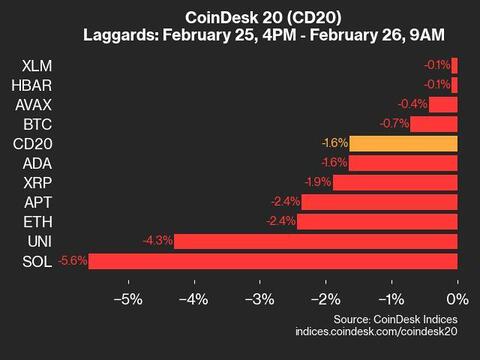

Recent Crypto Market Downturn: Uniswap (UNI) Takes a 4.3% Hit

The cryptocurrency market continues to experience volatility, with several digital assets seeing significant price drops in the past few days. Among the underperformers was Uniswap (UNI), which experienced a 4.3% decline from Tuesday. This setback follows a period of impressive growth for the decentralized exchange (DEX) platform.

Background on Uniswap (UNI)

Uniswap is an automated liquidity protocol built on Ethereum that allows users to trade cryptocurrencies directly from their wallets, eliminating the need for intermediaries. The platform has gained popularity due to its decentralized nature and innovative liquidity model, which incentivizes users to provide liquidity by earning fees.

Market Factors Affecting Uniswap (UNI)

Several factors contributed to the recent downturn in Uniswap’s price. First, the broader cryptocurrency market has been experiencing increased volatility, with Bitcoin and Ethereum both seeing significant price swings. This market instability can create uncertainty and fear among investors, leading to sell-offs and price drops.

Additionally, recent regulatory developments in the United States may have influenced Uniswap’s price. The Securities and Exchange Commission (SEC) has taken a more aggressive stance towards decentralized finance (DeFi) projects, raising concerns among investors about potential regulatory crackdowns. Uniswap, as a prominent DeFi project, may be particularly vulnerable to these concerns.

Impact on Individual Investors

For individual investors holding UNI tokens, the recent price drop may be disheartening. However, it’s important to remember that short-term price fluctuations are a normal part of investing in cryptocurrencies. Long-term investors may view this as an opportunity to buy more UNI at a lower price, with the potential for future gains.

Impact on the Wider World

The impact of Uniswap’s price drop on the wider world may be more far-reaching. Uniswap is one of the most popular DEXs, and its success has helped to popularize the concept of decentralized exchanges. A significant price drop could deter some investors from entering the DeFi space, potentially slowing down the growth of this emerging sector.

Looking Forward

Despite the recent price drop, Uniswap remains a promising project with a strong community and innovative technology. The team behind Uniswap is continually working on new features and improvements, and the platform’s popularity shows no signs of waning. As the cryptocurrency market stabilizes, it’s likely that Uniswap’s price will recover.

- Keep an eye on regulatory developments in the United States and other jurisdictions.

- Consider dollar-cost averaging as a strategy for buying UNI over time.

- Stay informed about Uniswap’s developments and community initiatives.

In conclusion, the recent price drop in Uniswap (UNI) is a reminder of the volatility inherent in the cryptocurrency market. However, for long-term investors, this setback may present an opportunity to buy more UNI at a lower price, with the potential for future gains. For the wider world, the impact of Uniswap’s price drop may deter some investors from entering the DeFi space, but the platform’s popularity and innovative technology suggest that it remains a promising project with a bright future.