Bitcoin: A Potential Correction on the Horizon – An In-depth Analysis

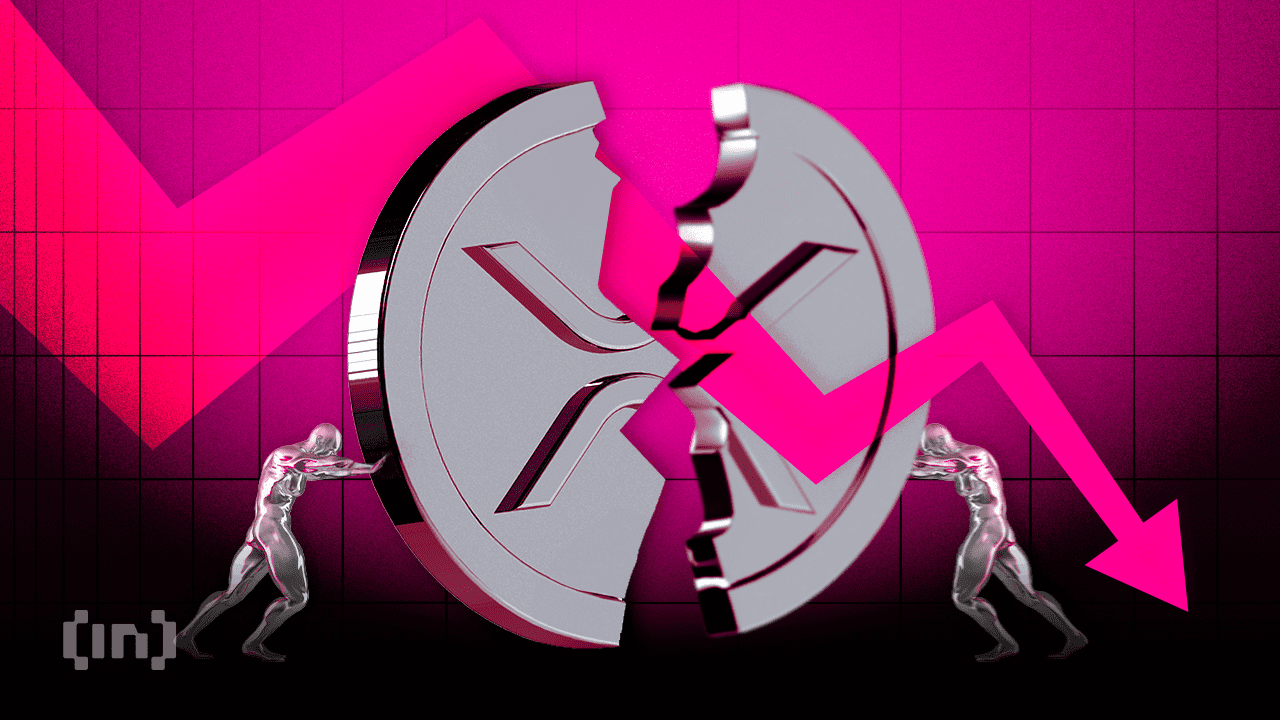

The cryptocurrency market has been experiencing a rollercoaster ride in 2023, with Bitcoin leading the charge. The world’s largest digital asset by market capitalization has seen a significant surge in value, reaching new all-time highs. However, recent trends have left some analysts and investors concerned, as they have identified a top-formation pattern that bears a striking resemblance to the one seen in 2021.

The 2021 Top-Formation Pattern: A Refresher

Before diving into the current situation, let’s take a quick look back at the 2021 top-formation pattern. Bitcoin’s price action in the first half of that year was characterized by a steady uptrend, with occasional corrections. However, as the price neared the all-time high of around $65,000, a significant correction occurred, leading to a 10-20% drop in value. This correction was followed by a consolidation phase, during which the price remained relatively stable before resuming the uptrend.

The 2023 Top-Formation Pattern: Similarities and Differences

Fast forward to 2023, and Bitcoin’s price action bears a striking resemblance to the 2021 pattern. After a strong uptrend that took the price to new all-time highs, a significant correction occurred, leading to a drop of around 10-20% from the recent highs. The correction was followed by a consolidation phase, during which the price has remained relatively stable.

What Does This Mean for Bitcoin Investors?

For investors holding Bitcoin, this top-formation pattern might be cause for concern. A further correction of 10-20% could result in significant losses for those who have recently entered the market or have a large position size. However, it’s important to remember that market trends are not always exact, and this pattern might not play out in the same way as it did in 2021. Additionally, Bitcoin’s fundamentals, such as its increasing adoption by institutional investors and governments, could mitigate the impact of a correction.

What Does This Mean for the World?

The potential correction in Bitcoin’s price could have far-reaching implications for the world economy. Bitcoin’s correlation with traditional assets, such as stocks and bonds, has been increasing, meaning that a significant correction in Bitcoin could lead to a ripple effect in other markets. Additionally, Bitcoin’s role as a store of value and a hedge against inflation could be impacted, as a correction could lead to a loss of confidence in the digital asset. However, it’s important to note that Bitcoin’s impact on the world is still largely speculative, and its true potential is yet to be fully realized.

Conclusion: Navigating the Cryptocurrency Market

In conclusion, the potential for a further correction in Bitcoin’s price, as indicated by a top-formation pattern similar to 2021, is a cause for concern for some investors. However, it’s important to remember that market trends are not always exact, and other factors, such as Bitcoin’s fundamentals and its impact on the world economy, should be considered. As always, it’s essential to do thorough research and consult with financial advisors before making any investment decisions.

- Bitcoin has seen a significant surge in value, reaching new all-time highs in 2023.

- Analysts have identified a top-formation pattern that bears a striking resemblance to the one seen in 2021.

- A potential correction of 10-20% could lead to significant losses for investors.

- Bitcoin’s impact on the world economy could be far-reaching, with potential ripple effects in other markets.

- It’s essential to do thorough research and consult with financial advisors before making any investment decisions.