The Unsettling News for Ethereum Holders: A 19% Drop Triggers the First Liquidation

If you’ve been keeping an eye on the cryptocurrency market, you may have heard the latest buzz surrounding Ethereum (ETH). The second-largest cryptocurrency by market capitalization has been experiencing some turbulence, with its value taking a hit in recent days. But what does it mean for Ethereum holders when the price drops another 19%? Let’s dive into the details.

Understanding Liquidation

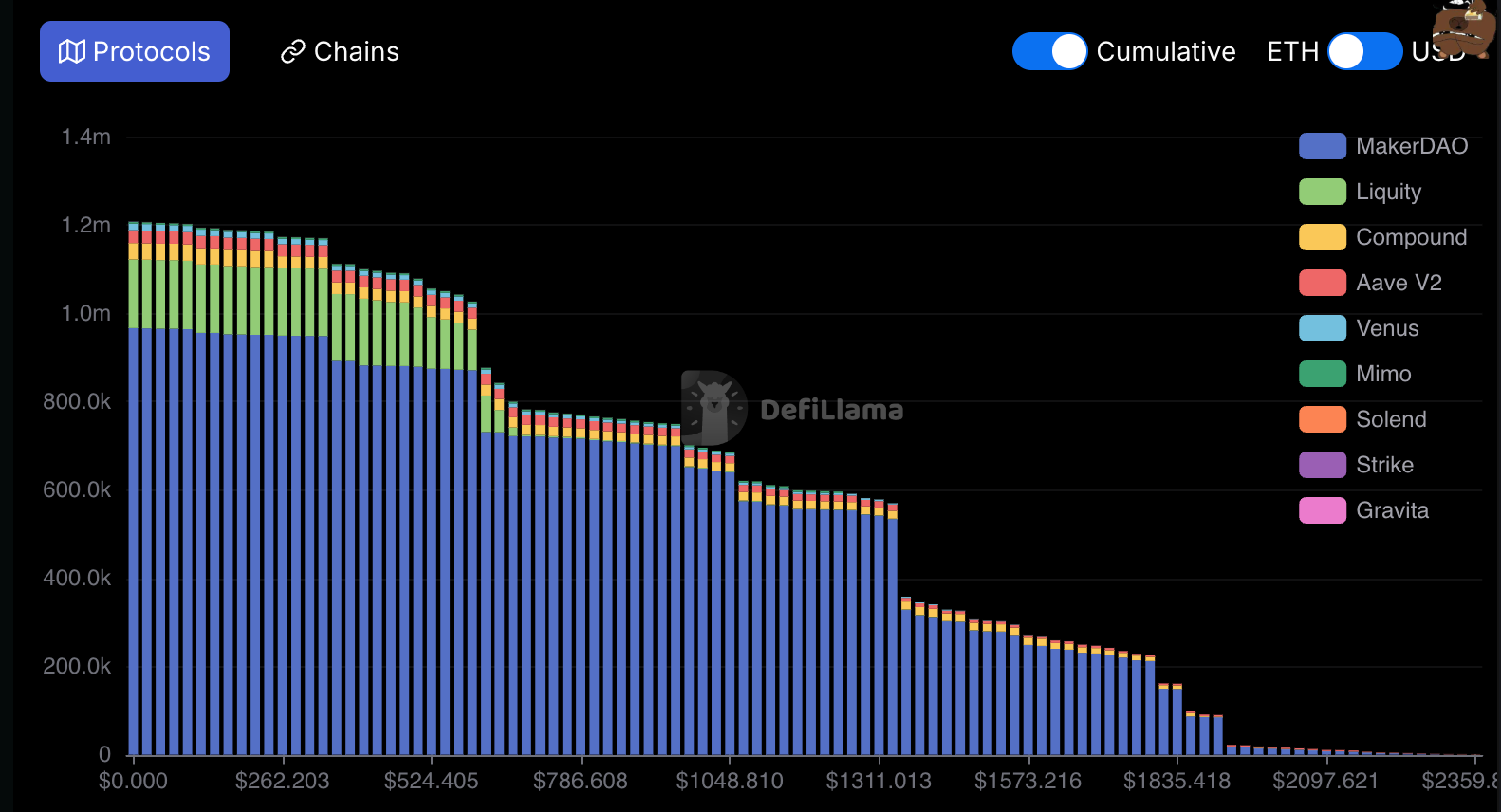

First, let’s clarify what liquidation means in the context of cryptocurrency trading. Liquidation is a process that occurs when a trader’s position is closed due to insufficient collateral to cover potential losses. This is usually enforced by the automated system of a margin trading platform to protect against excessive risk.

How It Affects Ethereum Holders

For Ethereum holders, a 19% drop could mean the difference between holding onto their investment or being forced to sell at a loss due to a margin call. A margin call occurs when the value of the collateral held by a trader falls below the required level to maintain an open position. In the case of Ethereum, this means that if the price drops by 19% and a trader’s collateral is not sufficient to cover potential losses, their position will be automatically liquidated.

Impact on Traders

Traders who have taken on leverage to increase their potential gains may be particularly affected by this development. Leverage allows traders to borrow funds to increase their buying power, but it also amplifies potential losses. As a result, traders who have taken on significant leverage may find themselves in a precarious position if Ethereum’s price continues to slide.

Ripple Effects on the Cryptocurrency Market

The potential for widespread liquidations could have ripple effects on the cryptocurrency market as a whole. As more and more traders are forced to sell their Ethereum holdings to cover their losses, the price could continue to slide. This could lead to a vicious cycle of selling, driving the price down further and triggering even more liquidations.

Impact on the Wider Economy

The potential for widespread liquidations in the cryptocurrency market could also have implications for the wider economy. Some analysts argue that cryptocurrencies, particularly Bitcoin and Ethereum, have become an integral part of the global financial system. As such, significant movements in the cryptocurrency market could have ripple effects on traditional financial markets.

What’s Next for Ethereum Holders?

The situation is fluid, and it’s impossible to predict with certainty what will happen next to Ethereum’s price. However, Ethereum holders may want to consider taking steps to protect their investments. This could include reducing their exposure to Ethereum or seeking out insurance products that provide protection against potential losses.

- Consider reducing your exposure to Ethereum by selling a portion of your holdings.

- Explore insurance products that provide protection against potential losses.

- Stay informed about market developments and adjust your strategy accordingly.

Conclusion

The news that Ethereum needs to drop another 19% to trigger the first liquidation is undoubtedly unsettling for holders of the cryptocurrency. However, it’s essential to remember that the market is dynamic, and prices can be unpredictable. By staying informed and taking steps to protect your investments, you can weather the storm and come out the other side stronger.

As always, it’s important to remember that investing in cryptocurrencies carries inherent risks, and it’s essential to do your own research and consult with financial professionals before making any investment decisions. Stay calm, stay informed, and stay curious.