Bitcoin’s Recent Price Drop: What Does It Mean for You and the World?

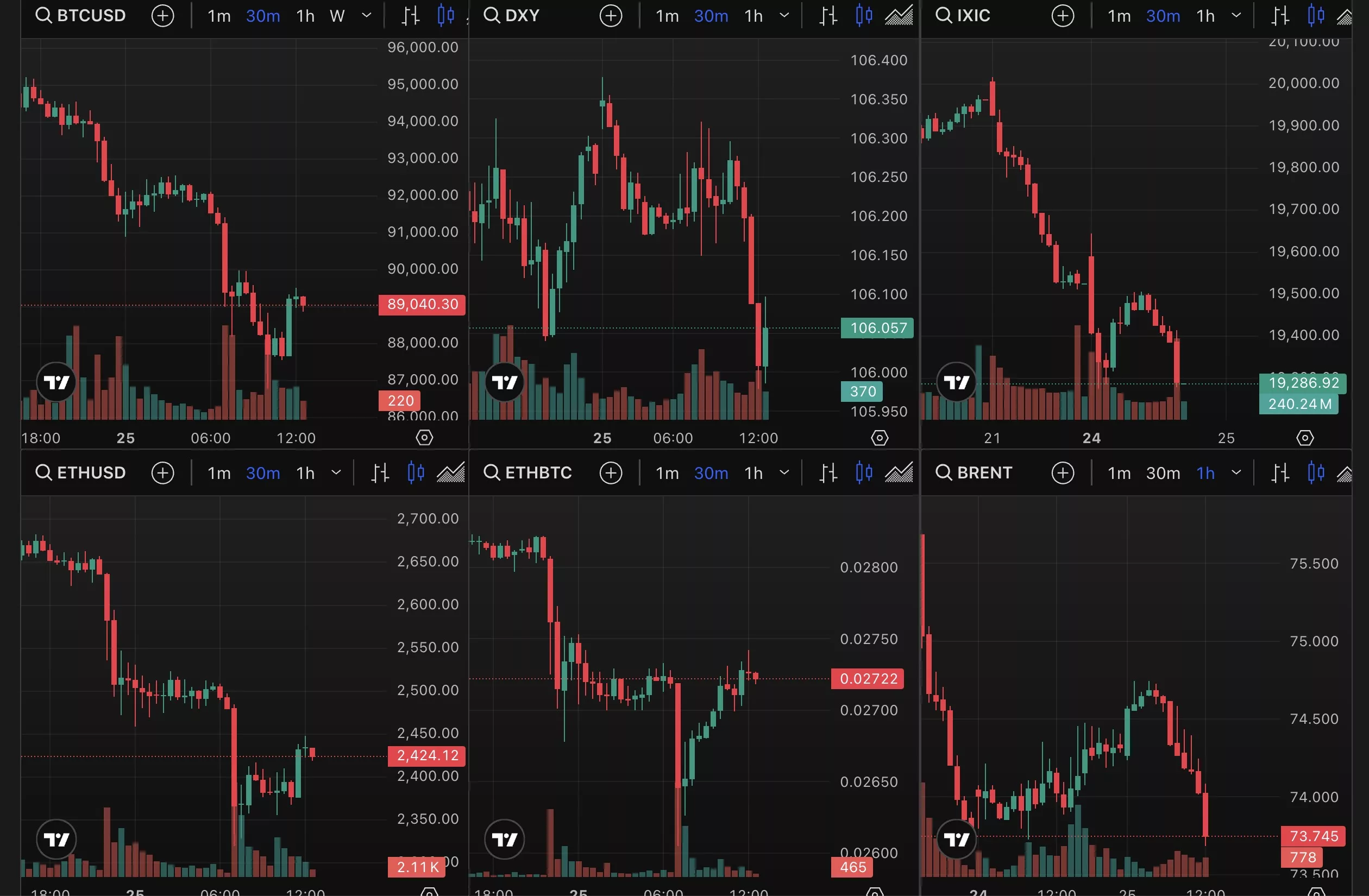

Bitcoin, the world’s largest cryptocurrency by market capitalization, has experienced a significant price drop in recent days. After reaching an all-time high of $90,000 in November 2021, Bitcoin’s price dived to a low of $86,700 before recovering slightly to around $89,000 as of now. This price swing has left many investors and observers wondering about the implications of this trend.

Impact on Individual Investors

For individual investors, the recent price drop in Bitcoin can bring about a mix of emotions, from fear and anxiety to excitement and opportunity. Those who bought Bitcoin at its all-time high might be feeling a sense of regret, while those who have been holding their Bitcoin for a longer period may view this as a normal market fluctuation. For new investors, this could be an opportunity to buy Bitcoin at a lower price than before.

It’s important to remember that investing in Bitcoin, or any other cryptocurrency, comes with inherent risks. The price of Bitcoin can be volatile, and its value can change rapidly due to various factors such as regulatory decisions, market trends, and technological developments.

Impact on the Global Economy

The recent price drop in Bitcoin also has potential implications for the global economy. Bitcoin and other cryptocurrencies have gained increasing attention from financial institutions, governments, and individuals in recent years. Some see Bitcoin as a potential threat to traditional financial systems, while others view it as a complementary technology that can enhance financial inclusion and efficiency.

A significant price drop in Bitcoin could lead to a decrease in investor confidence, which could have ripple effects on other markets. For instance, a drop in Bitcoin’s price could lead to a decrease in the value of Bitcoin-related investments, such as Bitcoin exchange-traded funds (ETFs) or Bitcoin futures contracts. This, in turn, could lead to a decrease in institutional interest in Bitcoin, which could further impact its price.

On the other hand, some argue that the recent price drop in Bitcoin is a normal part of the market cycle and that the long-term potential of Bitcoin remains strong. They point to the fact that Bitcoin has a limited supply of 21 million coins, which makes it a scarce asset, and that its decentralized nature makes it immune to government manipulation and control.

Conclusion

The recent price drop in Bitcoin is a reminder that investing in cryptocurrencies comes with inherent risks. While some may view this as an opportunity to buy Bitcoin at a lower price, others may be feeling the impact of the price drop on their investments. Regardless of one’s perspective, it’s important to stay informed about market trends and to have a well-diversified investment portfolio.

From a global economic perspective, the impact of the Bitcoin price drop is still uncertain. Some argue that it could lead to a decrease in investor confidence and a decrease in institutional interest in Bitcoin. Others argue that the long-term potential of Bitcoin remains strong due to its decentralized nature and limited supply.

Ultimately, the price of Bitcoin is just one aspect of the broader cryptocurrency ecosystem. As the technology continues to evolve and gain wider adoption, it’s important to stay informed about the latest developments and to approach investing with a long-term perspective.

- Bitcoin’s price dropped below $90,000 for the first time since November, reaching a low of $86,700 before recovering to $89,000.

- Individual investors may view this as a normal market fluctuation, an opportunity to buy at a lower price, or a cause for regret.

- The price drop could lead to a decrease in investor confidence and a decrease in institutional interest in Bitcoin.

- The long-term potential of Bitcoin remains strong due to its decentralized nature and limited supply.

- It’s important to stay informed about market trends and to have a well-diversified investment portfolio.