The SEC’s Selective Enforcement: A Tale of Two Cryptopreneurs

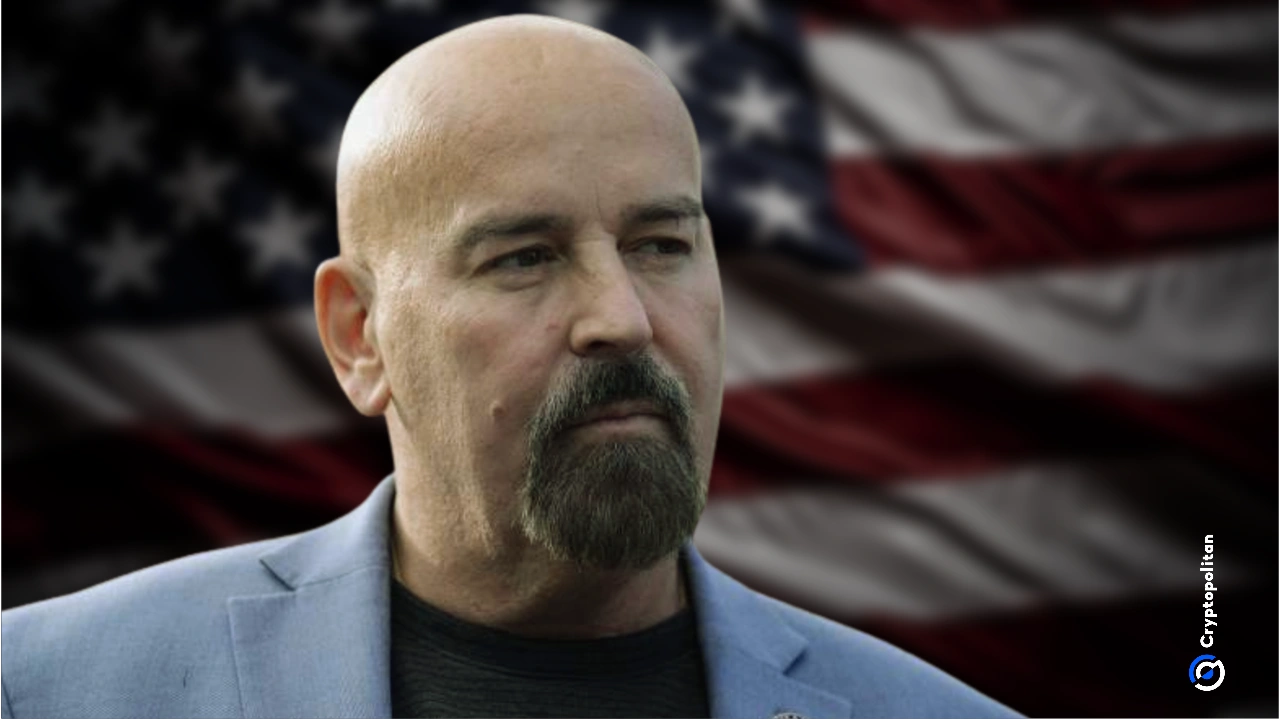

In the wild world of cryptocurrencies, where fortunes are made and lost in the blink of an eye, the line between innovation and fraud can sometimes be as blurry as a pixelated Bitcoin logo. Amidst this chaos, one man has dared to question the fairness of the Securities and Exchange Commission’s (SEC) regulatory actions:

John Deaton, a dedicated XRP lawyer and advocate, recently took to social media to voice his concerns. In a post on X, he accused the SEC of targeting legitimate crypto companies while seemingly turning a blind eye to apparent fraudsters like Sam Bankman-Fried (SBF) and Do Kwon.

The SEC’s Targets: John Deaton’s Perspective

According to Deaton, the SEC’s selective enforcement of securities laws has left many in the crypto community scratching their heads. He points to the ongoing legal battle between the SEC and Ripple Labs over the sale of XRP as a prime example. Deaton argues that, while Ripple executives were targeted, other alleged fraudsters like SBF and Kwon have managed to fly under the regulatory radar.

The Alleged Fraudsters: Sam Bankman-Fried and Do Kwon

Sam Bankman-Fried is the CEO of FTX, a cryptocurrency derivatives exchange. In 2021, Bankman-Fried was accused of operating an unregistered securities exchange. However, no formal action has been taken against him or FTX by the SEC. Meanwhile, Do Kwon is the founder of Terra, a blockchain project that experienced a massive collapse in 2022, leading to significant losses for investors. Kwon has not been charged with any securities-related crimes, but the Terra collapse is currently under SEC investigation.

The Wider Implications

Deaton’s accusations have sparked a heated debate in the crypto community. Some argue that the SEC’s actions are necessary to protect investors from fraud and ensure compliance with securities laws. Others, however, see it as an unfair targeting of specific projects and executives, potentially stifling innovation in the process.

The potential consequences of the SEC’s actions extend beyond the crypto community. If the SEC continues to focus on targeting specific companies while ignoring apparent fraudsters, it could undermine investor confidence and harm the broader financial ecosystem. Moreover, it could set a dangerous precedent for future regulatory actions.

What Does This Mean for Me?

As an individual investor, it’s essential to stay informed about regulatory developments in the crypto space. While it’s impossible to predict the outcome of ongoing legal battles, it’s crucial to protect your investments by doing your due diligence and staying up-to-date on the latest news. And, if you’re feeling frustrated with the regulatory landscape, consider joining the conversation and advocating for fair and transparent enforcement.

What Does This Mean for the World?

The outcome of the SEC’s actions could have far-reaching consequences for the global financial system. If the SEC continues to focus on specific targets while ignoring apparent fraudsters, it could lead to a loss of trust in the regulatory system and potentially harm the reputation of the crypto industry as a whole. On the other hand, if the SEC manages to successfully prosecute cases against alleged fraudsters, it could help restore investor confidence and pave the way for a more regulated and stable crypto market. Ultimately, the future of the crypto industry depends on a balanced and fair regulatory approach.

So, as we eagerly await the outcome of ongoing legal battles and regulatory developments, let’s remember that transparency, fairness, and a healthy dose of skepticism are our best allies in the wild world of cryptocurrencies.

Conclusion

In the end, the SEC’s selective enforcement of securities laws raises important questions about fairness, transparency, and the role of regulation in the crypto industry. As John Deaton’s accusations continue to spark debate, it’s essential for investors, regulators, and industry insiders to stay informed and engaged. By working together, we can help ensure a fair and transparent regulatory landscape that fosters innovation while protecting investors from fraud.