Exploring the Investment Landscape: A Comparative Analysis of Bitcoin and Traditional Asset Classes

In the ever-evolving financial world, the emergence of Bitcoin as a digital currency and a potential asset class has sparked intense debate and discussion. Some argue that Bitcoin represents an entirely new asset class, while others contend that it is merely a commodity or a speculative instrument. Regardless of its classification, it is essential to compare its returns against those of other traditional asset classes to gain a comprehensive understanding of its investment potential.

Historical Performance of Bitcoin and Traditional Asset Classes

To begin our analysis, let us examine the historical performance of Bitcoin and several traditional asset classes, including stocks, bonds, and gold. Bitcoin’s price has experienced significant volatility since its inception in 2009, with its value skyrocketing from a few cents to an all-time high of almost $65,000 in 2021. In comparison, stocks, represented by the S&P 500 index, have delivered an average annual return of around 10% over the past decade. Bonds, represented by the 10-year US Treasury yield, have provided a relatively stable return of approximately 2% to 3% per annum. Gold, a long-standing safe-haven asset, has delivered an average annual return of around 8% over the same period.

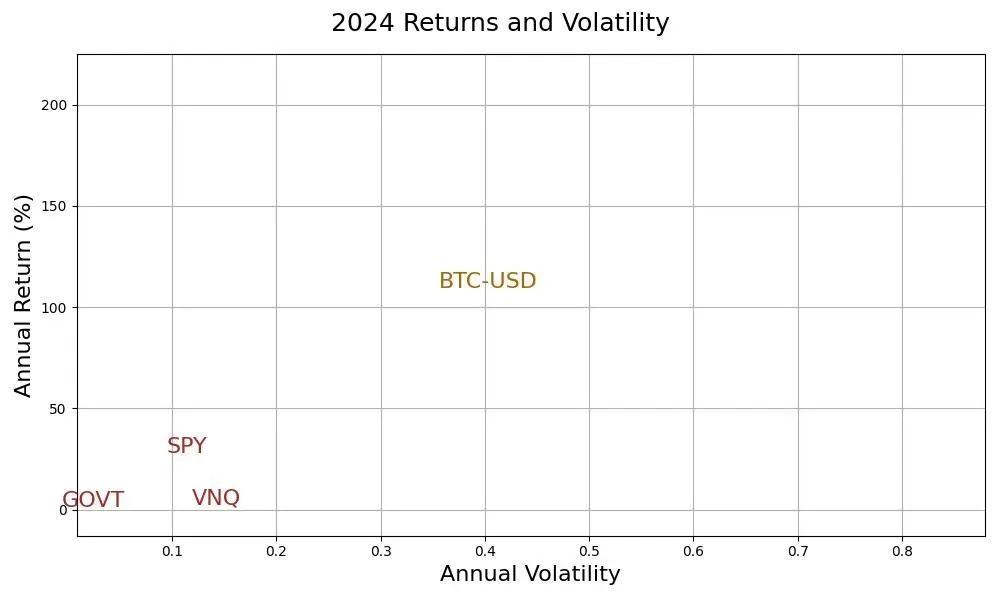

Risk and Return Comparison

When evaluating investment opportunities, it is crucial to consider both risk and return. Bitcoin’s volatility is a significant concern for many investors, with its price experiencing wild swings that can result in substantial gains or losses. In contrast, traditional asset classes like stocks and bonds generally offer more stable returns, albeit with varying degrees of risk. Gold, as a safe-haven asset, is often considered a lower-risk investment compared to stocks and Bitcoin.

Impact on Individual Investors

For individual investors, the emergence of Bitcoin as a potential asset class presents both opportunities and challenges. Those who have invested in Bitcoin early on have reaped significant rewards, but they have also faced the risk of substantial losses. Traditional asset classes, on the other hand, offer more stable returns and are generally considered less risky. However, it is essential to remember that all investments carry some degree of risk, and diversification is crucial to mitigate potential losses.

Global Implications

The impact of Bitcoin on the global financial landscape extends beyond individual investors. The decentralized nature of Bitcoin and other cryptocurrencies challenges traditional financial institutions and governments, potentially disrupting the current financial system. Furthermore, the increasing adoption of Bitcoin by institutional investors, such as Tesla and MicroStrategy, highlights its growing importance as a legitimate asset class. However, the environmental concerns surrounding Bitcoin mining and its energy consumption remain a significant challenge that must be addressed.

Conclusion

In conclusion, the comparison of Bitcoin’s returns against those of traditional asset classes provides valuable insights into its investment potential. While Bitcoin’s volatility and risk make it a challenging investment for some, its potential for high returns has attracted the attention of many. Traditional asset classes, such as stocks, bonds, and gold, offer more stable returns but come with varying degrees of risk. As the financial landscape continues to evolve, it is essential to stay informed and adapt to new investment opportunities while maintaining a well-diversified portfolio.

- Bitcoin’s historical performance and volatility differ significantly from traditional asset classes.

- Individual investors must consider both risk and return when evaluating investment opportunities in Bitcoin and traditional asset classes.

- The impact of Bitcoin on the global financial landscape is significant and ongoing.