The Crypto Market Plunge: What Happened and What to Expect

A Shocking $32 Billion Drop in Market Capitalization

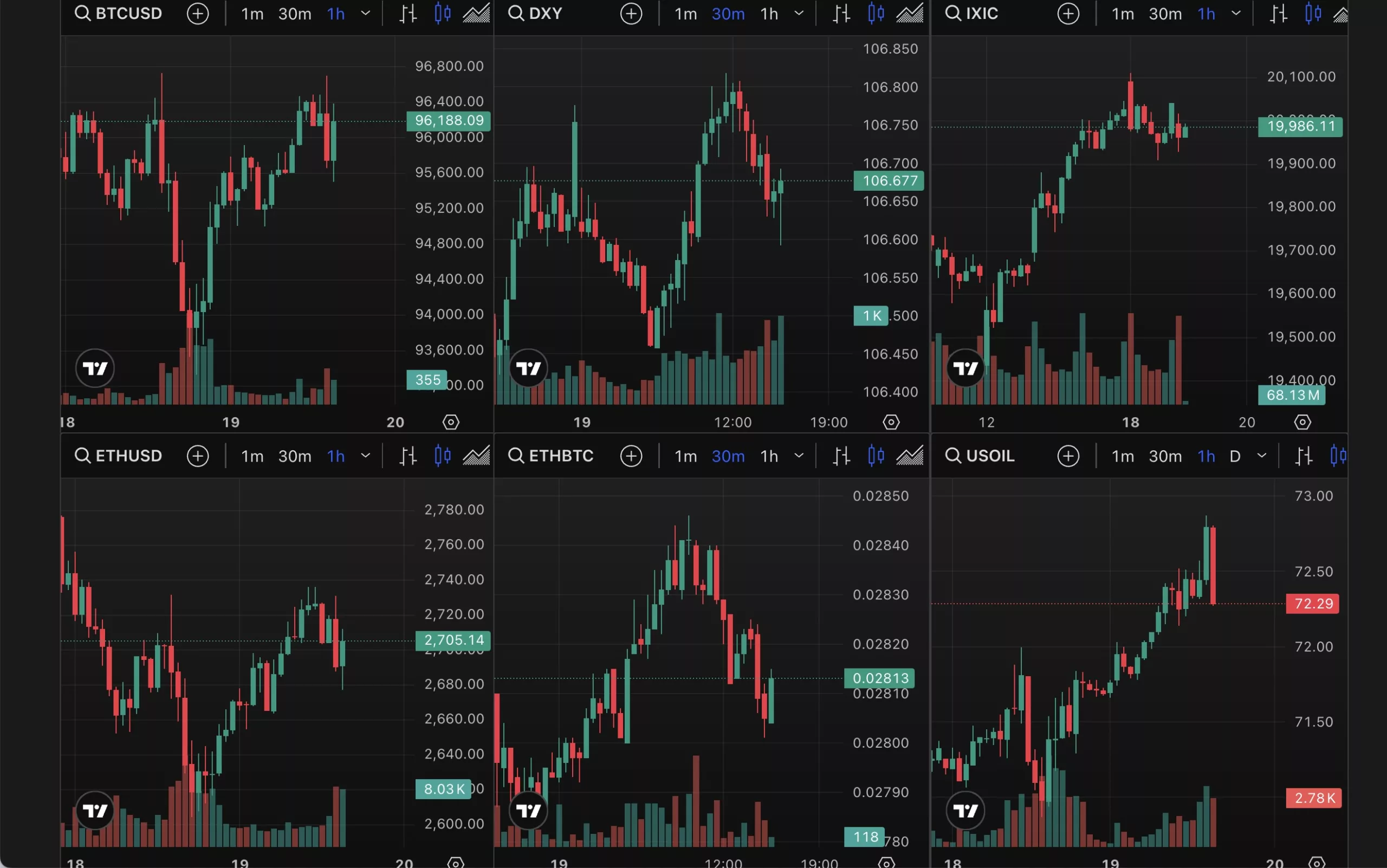

Over the past 24 hours, the cryptocurrency market has experienced a significant decline, causing panic among investors and traders. The total market capitalization of all cryptocurrencies combined has dropped by a staggering $32 billion, leading to a sharp downturn in prices across the board.

Many factors could have contributed to this sudden drop, including market manipulation, regulatory concerns, and overall market sentiment. Regardless of the cause, the effects are being felt by all participants in the crypto market.

The Impact on Individual Investors

Individual investors who have holdings in cryptocurrencies may be feeling the brunt of this market downturn. Those who bought in at higher prices are now facing significant losses, while others may be hesitant to enter the market due to the increased volatility.

It is important for investors to remain calm and not make any hasty decisions during times of market turmoil. Diversifying their portfolios and conducting thorough research before investing can help mitigate some of the risks associated with such sudden market movements.

The Global Ramifications

As the crypto market continues to face challenges, the global financial landscape may also be affected. Institutions and governments around the world are closely monitoring the situation, with some considering stricter regulations to curb volatility and protect investors.

The declining market capitalization of cryptocurrencies could have a ripple effect on other financial markets, leading to increased uncertainty and potentially impacting economies on a larger scale. It is crucial for stakeholders to work together to find sustainable solutions that promote stability and growth in the crypto market.

Conclusion

While the recent drop in crypto market capitalization may have caught many off guard, it is essential to remember that market fluctuations are a natural part of the investing process. By staying informed, exercising caution, and remaining patient, investors can navigate these uncertain times with resilience and determination.