Strategy’s Convertible Senior Notes Offering

Description

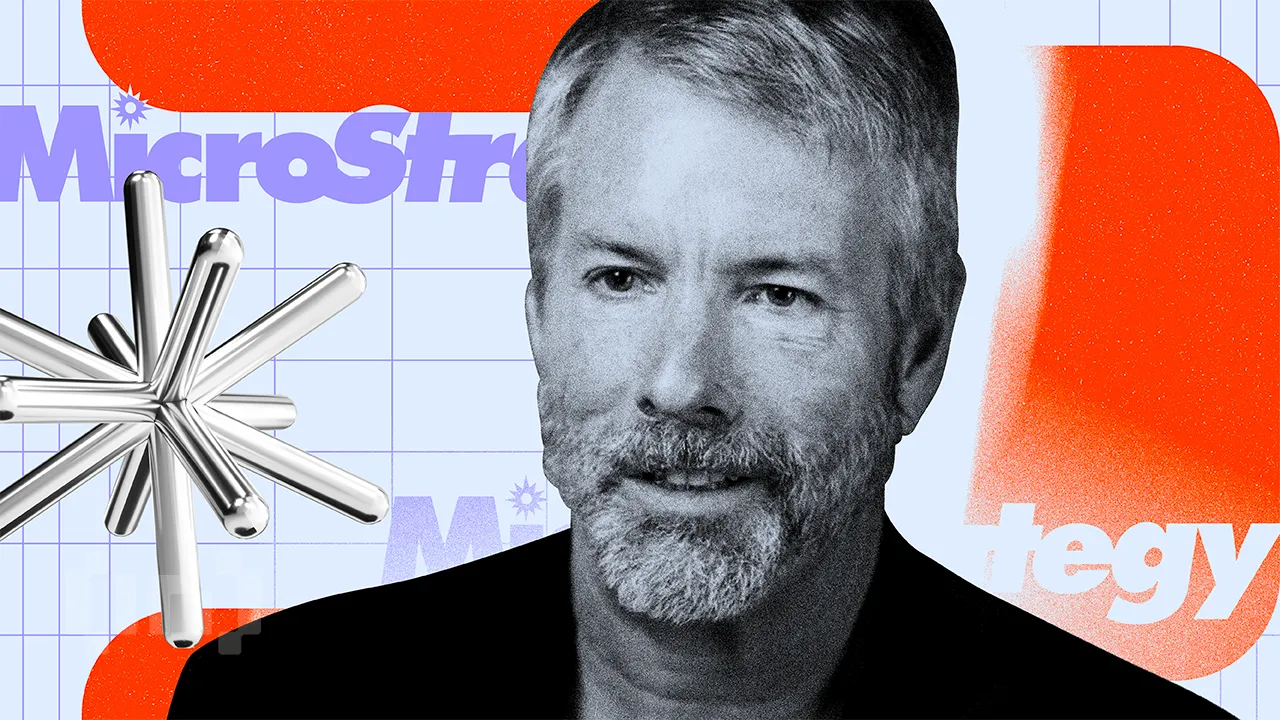

Strategy, formerly known as MicroStrategy, has announced that it will be conducting a private offering of convertible senior notes. The firm plans to offer $2 billion of these assets, with the proceeds being used to buy more Bitcoin.

Background

Strategy made headlines last year when it became one of the first publicly traded companies to invest in Bitcoin as part of its treasury reserve strategy. The move paid off handsomely as the price of Bitcoin soared, resulting in significant gains for the company.

Now, Strategy is betting big on Bitcoin once again with this new offering of convertible senior notes. These notes are a type of debt security that can be converted into a specified number of shares of the issuing company’s stock. This allows investors to benefit from any potential upside in the company’s stock price while still receiving the fixed income from the notes.

Impact on Investors

For investors, this offering presents a unique opportunity to indirectly invest in Bitcoin through Strategy’s stock. By purchasing convertible senior notes, investors can gain exposure to the cryptocurrency market without the volatility and regulatory hurdles that come with directly investing in Bitcoin.

Additionally, if Strategy’s Bitcoin holdings continue to appreciate in value, investors who hold the notes will stand to benefit from the potential upside in the company’s stock price as well.

Impact on the World

Strategy’s decision to raise $2 billion through a private offering of convertible senior notes to buy more Bitcoin is a bold move that could have far-reaching implications for the cryptocurrency market. As one of the largest corporate holders of Bitcoin, Strategy’s actions could influence other companies to follow suit and diversify their treasury reserves with cryptocurrencies.

Furthermore, if Strategy’s bet on Bitcoin pays off once again, it could further legitimize cryptocurrencies as a store of value and a hedge against inflation. This could lead to increased adoption of cryptocurrencies by mainstream investors and institutions, ultimately reshaping the global financial landscape.

Conclusion

In conclusion, Strategy’s decision to conduct a private offering of convertible senior notes to buy more Bitcoin is a strategic move that could have significant implications for both investors and the world at large. By offering investors a way to indirectly invest in Bitcoin through its stock, Strategy is providing a unique opportunity to gain exposure to the cryptocurrency market. Additionally, if Strategy’s bet on Bitcoin pays off, it could pave the way for greater acceptance and adoption of cryptocurrencies on a global scale.