Bitcoin Price Fluctuations: A Rollercoaster Ride for Investors

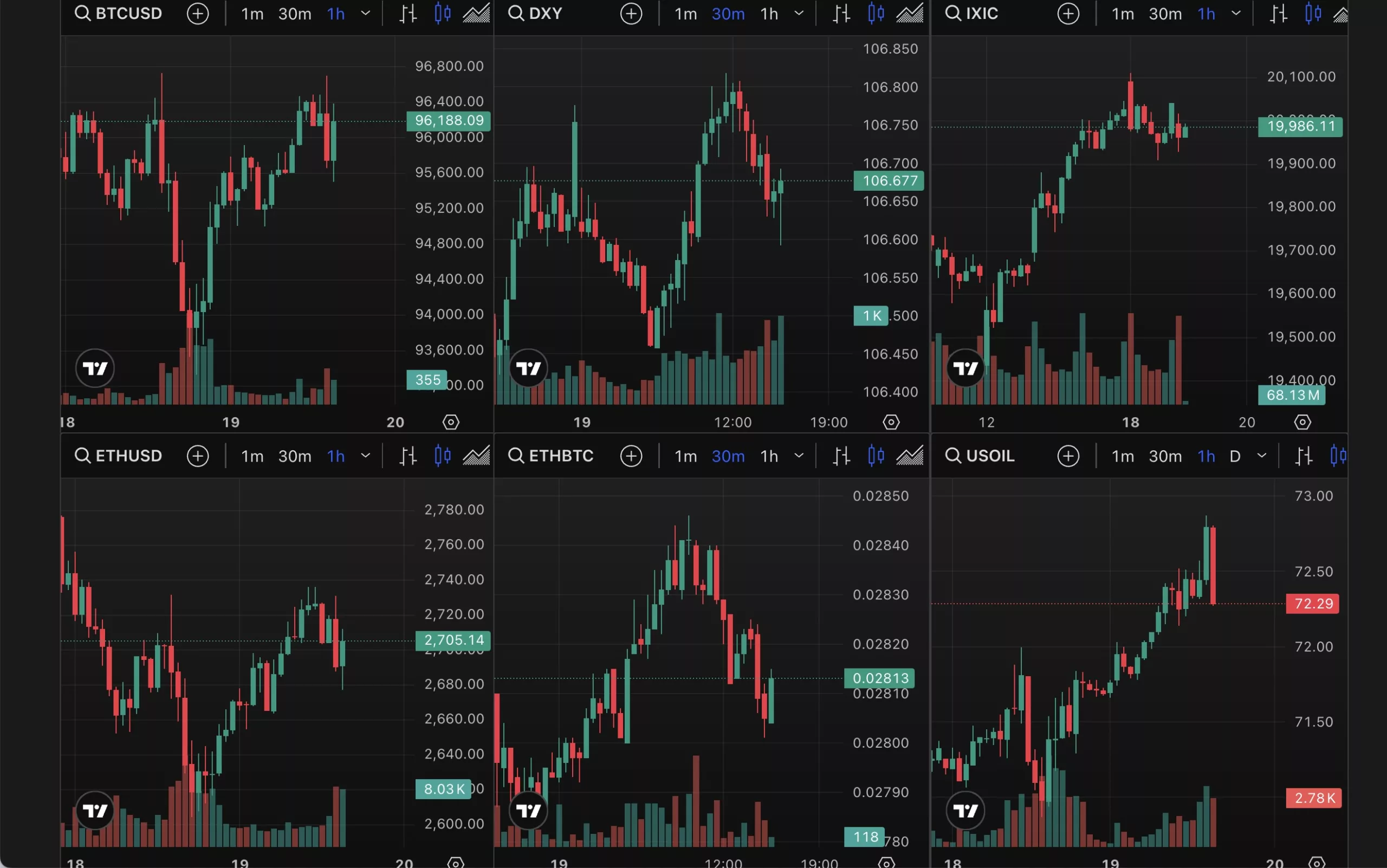

Bitcoin, the groundbreaking cryptocurrency that took the financial world by storm, is currently experiencing a period of volatility. After a brief dip to $93,000, Bitcoin is now trading at $96,000. However, despite this slight recovery, the currency has been lagging behind Nasdaq, leaving investors uncertain about its future trajectory.

The Impact of Bitcoin’s Price Fluctuations

For investors in Bitcoin, these price fluctuations can be both thrilling and nerve-wracking. The uncertainty surrounding the cryptocurrency market makes it difficult to predict whether Bitcoin will continue to rise or if it will face further dips in the near future. This volatility can be particularly challenging for those who have invested heavily in Bitcoin, as their financial futures are tied to the success of the currency.

While some investors may see these fluctuations as an opportunity to buy low and sell high, others may be more cautious, fearing that the market will continue to be unpredictable. Regardless of one’s investment strategy, it is clear that Bitcoin’s price movements have the potential to have a significant impact on individual investors.

The Global Ramifications of Bitcoin’s Performance

Bitcoin’s performance not only affects individual investors but also has the potential to impact the global economy. As one of the most widely traded cryptocurrencies, Bitcoin plays a significant role in the financial markets. If Bitcoin were to experience a major crash, it could have ripple effects throughout the entire financial system, potentially leading to widespread economic instability.

Furthermore, Bitcoin’s performance can also influence the adoption of blockchain technology, which underpins the cryptocurrency. A sharp decline in Bitcoin’s price could diminish confidence in blockchain technology, slowing down its adoption in various industries. This, in turn, could hinder the development of innovative solutions that rely on blockchain technology.

Conclusion

As Bitcoin continues to navigate through a period of volatility, investors must stay informed and vigilant. While the current price fluctuations may be unsettling, they also present opportunities for savvy investors to capitalize on market movements. Whether Bitcoin will continue to recover or face further dips remains to be seen, but one thing is certain – the cryptocurrency market is as unpredictable as ever.

How Bitcoin’s Price Fluctuations Will Affect Me:

As an individual investor, the fluctuations in Bitcoin’s price can have a direct impact on my financial well-being. Depending on how I have invested in Bitcoin, these price movements can either lead to significant gains or losses. It is essential for me to closely monitor the market and make informed decisions to navigate through this period of volatility.

How Bitcoin’s Price Fluctuations Will Affect the World:

Bitcoin’s price fluctuations have the potential to influence the global economy and the adoption of blockchain technology. A major crash in Bitcoin could have far-reaching consequences, leading to economic instability and hindering the adoption of innovative blockchain solutions. It is crucial for policymakers and industry leaders to closely monitor Bitcoin’s performance and its broader implications.