Institutional Investment Firm Avenir Group Makes Major Move in Cryptocurrency Market

Avenir Group’s Latest Investment in Blackrock’s Bitcoin ETF

In a latest development, Hong Kong-based Investment firm Avenir Group reports owning $599 million in Blackrock’s Bitcoin ETF. This investment positions Avenir Group as a significant institutional player in the cryptocurrency market. Notably, in the second quarter of 2024, Avenir Group became the largest institutional holder of two major Bitcoin ETFs in Asia.

Implications of Avenir Group’s Investment

Avenir Group’s decision to invest in Blackrock’s Bitcoin ETF marks a significant milestone for the firm and the cryptocurrency market as a whole. By becoming the largest institutional holder of Bitcoin ETFs in Asia, Avenir Group is solidifying its position as a key player in the growing industry.

This move also highlights the increasing interest and acceptance of cryptocurrency among institutional investors. As more companies like Avenir Group enter the market, it is likely to lead to further legitimization and mainstream adoption of digital assets.

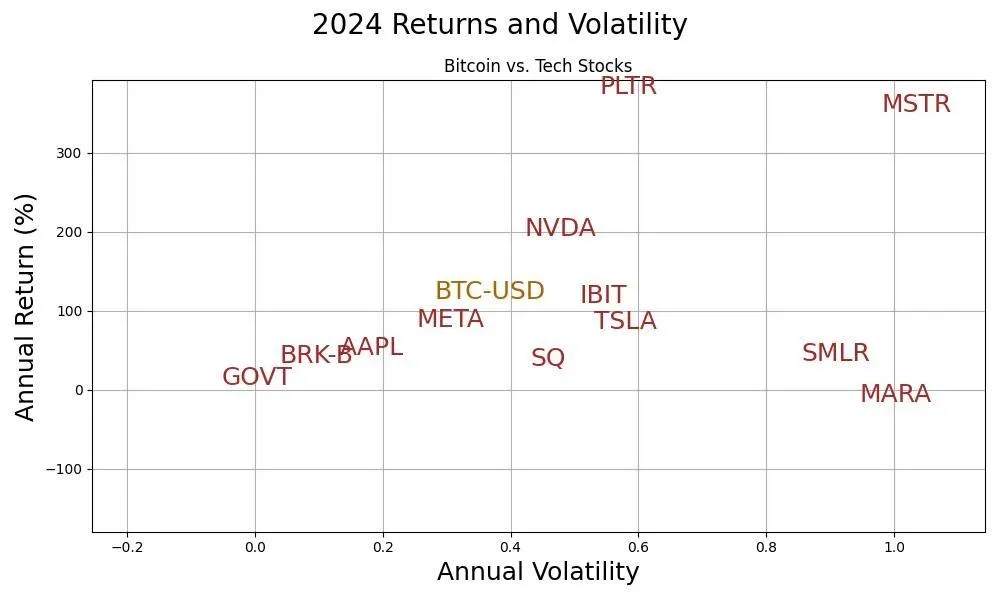

Furthermore, Avenir Group’s investment in Blackrock’s Bitcoin ETF could have a ripple effect on the overall cryptocurrency market, potentially driving up prices and increasing market volatility. It will be interesting to see how other institutional investors respond to this development and whether it will encourage more firms to explore cryptocurrency investments.

Effects on Individuals

For individual investors, Avenir Group’s investment in Blackrock’s Bitcoin ETF could signal a growing confidence in the long-term potential of cryptocurrency. This vote of confidence from a major institutional player could provide reassurance to retail investors and lead to increased interest in digital assets.

Additionally, the increased institutional presence in the cryptocurrency market could result in more regulatory scrutiny and oversight. While this could potentially add a layer of stability to the market, it may also introduce additional complexities for individual investors to navigate.

Effects on the World

Avenir Group’s significant investment in Blackrock’s Bitcoin ETF is likely to have a broader impact on the world economy and financial markets. As institutional interest in cryptocurrency continues to grow, it could potentially reshape the traditional financial landscape and usher in a new era of digital asset investment.

This trend towards institutional adoption of cryptocurrency may also prompt governments and regulatory bodies to reevaluate their stance on digital assets and develop new frameworks to accommodate this evolving market. The implications of this shift could be far-reaching and have lasting effects on global financial systems.

Conclusion

In conclusion, Avenir Group’s investment in Blackrock’s Bitcoin ETF signifies a significant milestone in the institutional adoption of cryptocurrency. This move has the potential to reshape the cryptocurrency market, driving up prices and increasing interest from both individual and institutional investors.

As the digital asset space continues to evolve, it will be crucial for all stakeholders to carefully monitor developments and adapt to the changing landscape. Avenir Group’s bold move is just the beginning of what promises to be an exciting journey towards mainstream acceptance of cryptocurrency.