Bitcoin vs. Individual Stocks: A Comparison

Introduction

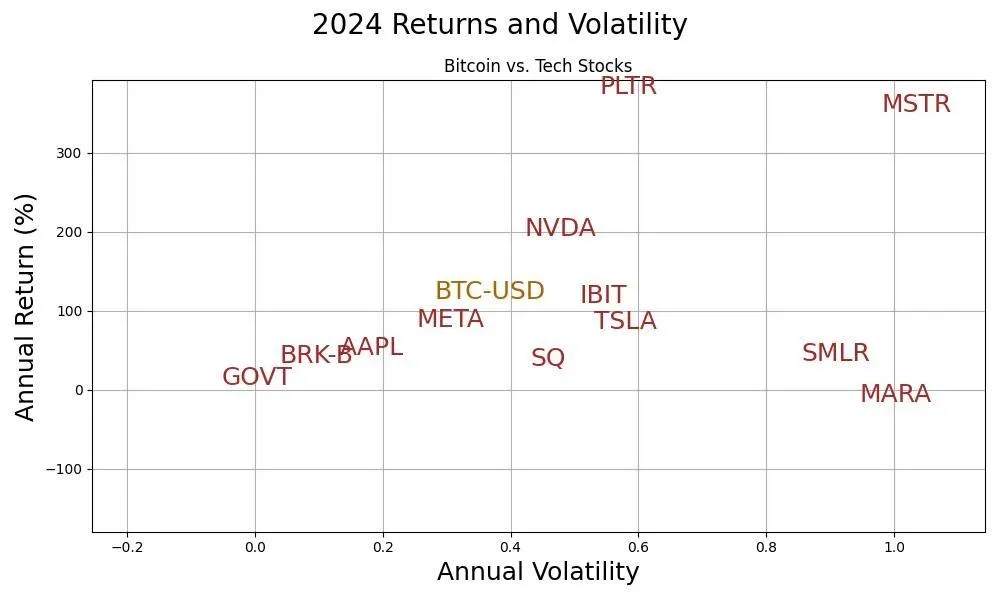

In 2024, Bitcoin proved to be a strong performer in comparison to traditional assets such as bonds, gold, real estate, and the equity market as a whole. However, one question remains: how does Bitcoin fare against individual stocks?

Bitcoin’s Performance

In recent years, Bitcoin has gained significant traction as a valuable asset in many investors’ portfolios. Its decentralized nature and potential for high returns have attracted both institutional and retail investors alike. In 2024, Bitcoin continued its upward trajectory, outperforming many traditional assets.

Individual Stocks

Individual stocks, on the other hand, represent ownership in a specific company. The performance of individual stocks can vary greatly depending on the company’s financial health, industry trends, and market conditions. While some stocks may experience significant growth, others may falter.

When comparing Bitcoin to individual stocks, it’s important to consider the differences in risk and potential returns. Bitcoin is known for its volatility, with the price of the digital currency experiencing sharp fluctuations. On the other hand, individual stocks may offer more stable returns but also come with company-specific risks.

How Will This Affect Me?

As an investor, the comparison between Bitcoin and individual stocks can help you make informed decisions about your portfolio. If you are seeking high-risk, high-reward opportunities, Bitcoin may be a suitable option. However, if you prefer more stable returns with lower volatility, investing in individual stocks may be more appealing.

How Will This Affect the World?

The performance of Bitcoin and individual stocks can have broader implications for the financial markets and the global economy. A strong performance by Bitcoin may attract more investors to the cryptocurrency market, leading to increased adoption and mainstream acceptance. On the other hand, a downturn in individual stocks could signal broader economic challenges and impact consumer confidence.

Conclusion

In conclusion, the comparison between Bitcoin and individual stocks highlights the unique characteristics and potential risks associated with each asset class. As the financial landscape continues to evolve, investors must carefully consider their risk tolerance and investment objectives when building a diversified portfolio.