Hash Ribbon Signals and Bitcoin Price

What are Hash Ribbon Signals?

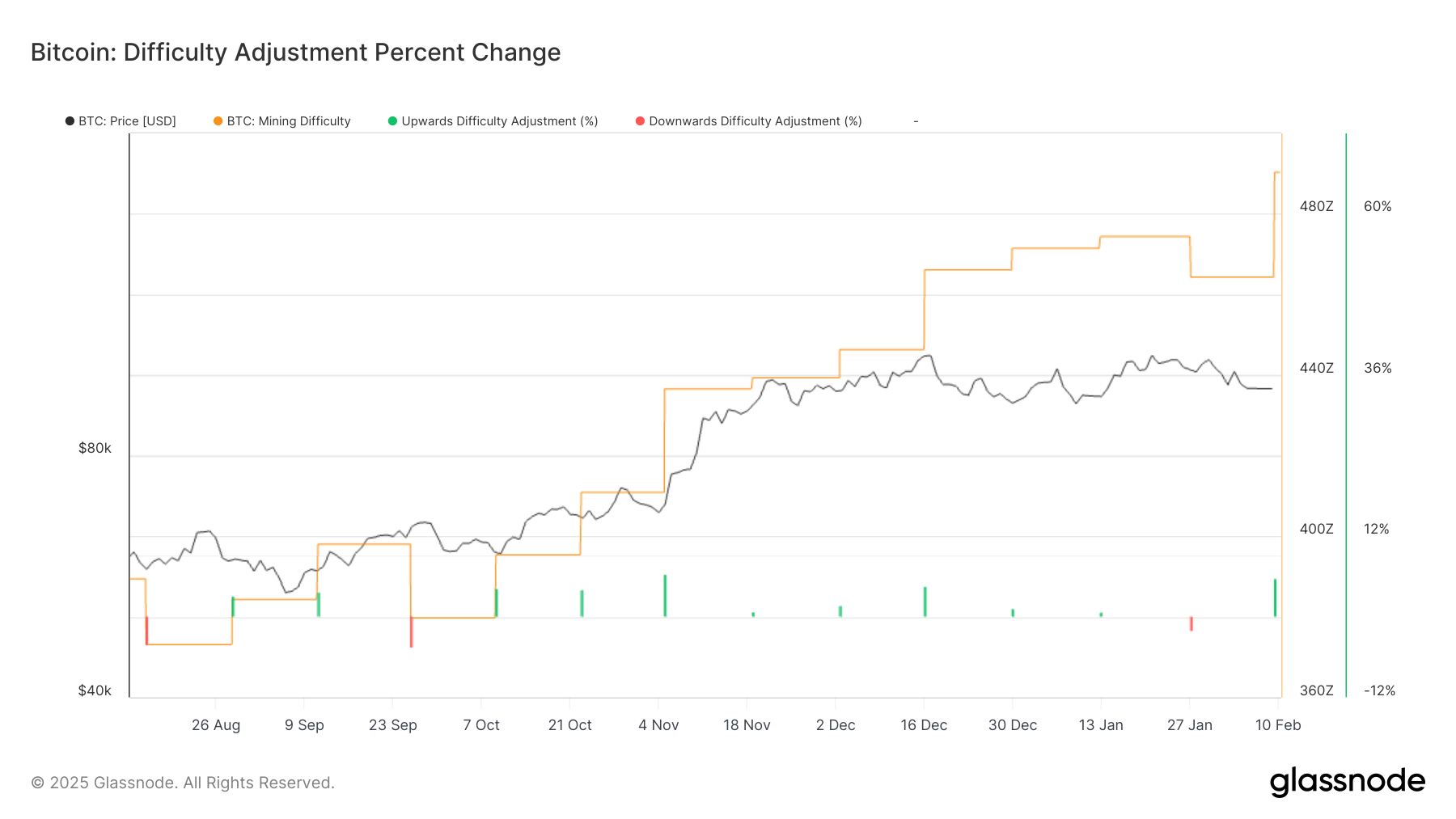

Hash Ribbon signals are indicators used in the world of cryptocurrency, particularly in the bitcoin market. These signals are based on the hash rate of the bitcoin network, which is essentially the processing power of the network. When miners begin to capitulate, it means they are giving up mining bitcoin because it is no longer profitable for them. This can be a sign of a downturn in the market.

Effect on Bitcoin Price

When miners start to capitulate, it often signals a bottom in the bitcoin price. This is because when miners are no longer profitable, they are forced to sell their bitcoin holdings to cover costs, which can drive the price down. However, once this capitulation phase is over, it can mark a turning point for the price of bitcoin, leading to a potential rally.

How Does This Affect Me?

As a bitcoin investor or trader, understanding hash ribbon signals can help you make more informed decisions. When you see signs of miner capitulation, it may be a good time to buy bitcoin at a lower price before a potential rally. On the other hand, if miners are accumulating bitcoin, it could be a sign of a bullish trend.

Impact on the World

The hash ribbon signals and miner capitulation not only affect individual investors, but also have wider implications for the cryptocurrency market as a whole. A bottom in the bitcoin price can lead to increased investor confidence and participation, which can drive adoption and innovation in the industry.

Conclusion

In conclusion, hash ribbon signals and miner capitulation are important indicators to watch in the bitcoin market. Understanding the relationship between miner behavior and the price of bitcoin can help investors and traders navigate the volatile world of cryptocurrency more effectively.