Welcome to the World of Stablecoins in 2024!

Stablecoins: The Unsung Heroes of Peer-to-Peer Payments

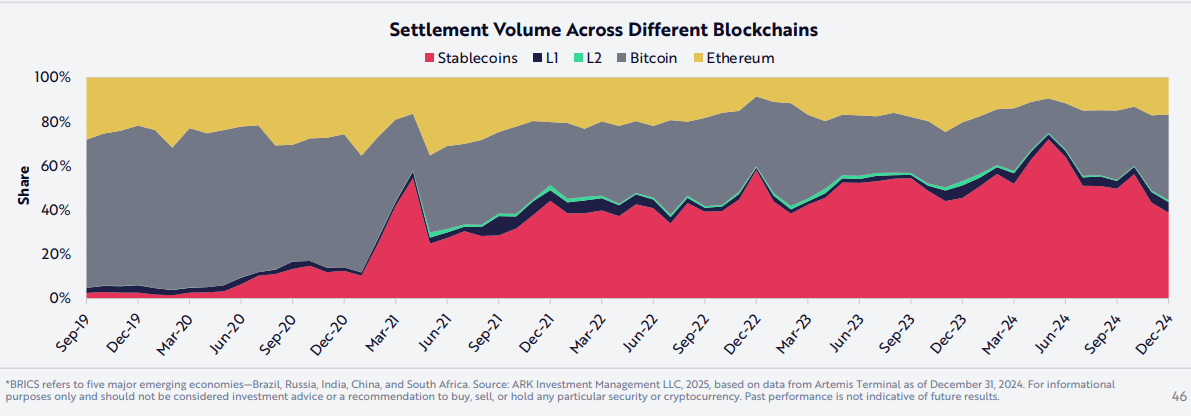

In 2024, stablecoins have taken the financial world by storm, expanding their activity and solidifying their position as a crucial tool for peer-to-peer payments. These digital assets have become a mainstay in the world of cryptocurrencies, making up to 50% of on-chain traffic. But what exactly are stablecoins, and why have they become so popular?

What are Stablecoins?

Stablecoins are a type of cryptocurrency that are pegged to a stable asset, such as a fiat currency like the US Dollar or a commodity like gold. This pegging ensures that the value of the stablecoin remains relatively stable, unlike other cryptocurrencies such as Bitcoin which are known for their price volatility. This stability makes stablecoins an attractive option for users looking to make transactions without the risk of losing value due to price fluctuations.

Why are Stablecoins So Popular for Peer-to-Peer Payments?

One of the main reasons why stablecoins have become so popular for peer-to-peer payments is their ability to facilitate fast and low-cost transactions. Unlike traditional payment methods that can be slow and expensive, stablecoin transactions can be completed in a matter of seconds and with minimal fees. This makes them an ideal choice for individuals looking to send money to friends and family, make online purchases, or even remit funds internationally.

Furthermore, stablecoins offer a level of privacy and security that is unmatched by traditional payment methods. Because transactions are conducted on a blockchain, they are transparent and immutable, meaning that they cannot be altered or tampered with. This level of security is especially appealing to users who value their financial privacy and want to ensure that their transactions are secure.

The Future of Stablecoins: What to Expect

As stablecoins continue to gain traction in the world of finance, it is likely that we will see even greater adoption in the coming years. More and more businesses are beginning to accept stablecoins as a form of payment, and some countries are even exploring the possibility of creating their own central bank digital currencies based on the stablecoin model. With their convenience, speed, and security, stablecoins are poised to revolutionize the way we think about money and payments.

How Stablecoins Will Affect Me

Stablecoins have the potential to greatly impact the way I conduct financial transactions. With their fast transaction speeds and low fees, I can expect to send and receive money more efficiently, whether it’s paying a friend back for dinner or making an online purchase. The stability of stablecoins also gives me peace of mind knowing that the value of my digital assets will not fluctuate wildly, unlike other cryptocurrencies.

How Stablecoins Will Affect the World

The widespread adoption of stablecoins has the potential to revolutionize the global economy. By providing an efficient and secure means of conducting transactions, stablecoins can help streamline cross-border payments, reduce remittance fees, and provide financial services to the unbanked populations around the world. Additionally, the transparency of blockchain technology can help prevent fraud and corruption, making financial transactions more secure and trustworthy on a global scale.

Conclusion

In conclusion, stablecoins have expanded their activity in 2024, becoming a staple in the world of peer-to-peer payments. With their speed, security, and stability, stablecoins offer a convenient and reliable alternative to traditional payment methods. As they continue to gain popularity and adoption, we can expect to see stablecoins play an increasingly important role in shaping the future of finance.