BlackRock’s Major Move: Acquiring $276.16 Million Worth of Ethereum

The News

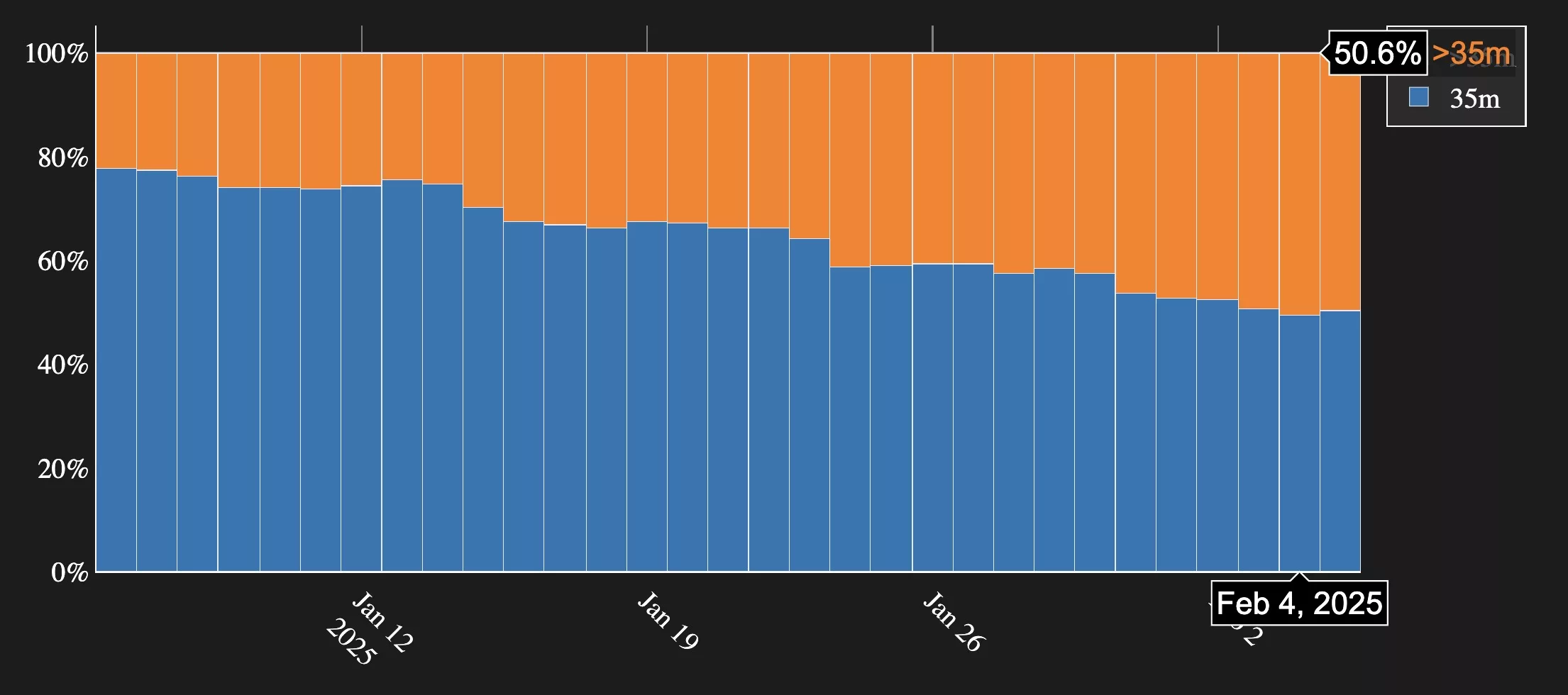

On Feb. 4, the asset management giant BlackRock made headlines in the cryptocurrency world by purchasing approximately $276.16 million worth of Ethereum (ETH). This move came as a surprise to many, as BlackRock has typically been more focused on traditional investments such as stocks and bonds. The news was first reported by Crypto Rover, a leading source of cryptocurrency news and analysis.

Implications

BlackRock’s decision to invest such a significant amount of money in Ethereum is a clear sign of the growing acceptance and adoption of cryptocurrencies by institutional investors. Ethereum, the second-largest cryptocurrency by market capitalization, has been gaining popularity for its smart contract capabilities and decentralized applications. With BlackRock joining the ranks of other institutional investors in the crypto space, it further legitimizes the industry and paves the way for more mainstream adoption.

Effects on Individuals

For individual investors, BlackRock’s investment in Ethereum could signal a shift towards cryptocurrencies as a viable asset class for diversification. As more institutional investors like BlackRock enter the market, it could lead to increased demand for cryptocurrencies and potentially drive up prices. This could present new opportunities for individual investors to capitalize on the growing interest in digital assets.

Effects on the World

From a broader perspective, BlackRock’s purchase of Ethereum has implications that extend beyond the world of finance. The mainstream acceptance of cryptocurrencies by major institutions like BlackRock could accelerate the development of blockchain technology and drive innovation in various industries. As more companies and organizations explore the potential of blockchain, we could see significant advancements in areas such as supply chain management, identity verification, and decentralized finance.

Conclusion

BlackRock’s investment in Ethereum is a significant milestone for the cryptocurrency industry and a clear indication of the growing interest in digital assets among institutional investors. As the crypto market continues to evolve, we can expect to see further adoption and acceptance of cryptocurrencies as a legitimate asset class. Whether you’re an individual investor looking to diversify your portfolio or a company exploring the potential of blockchain technology, this move by BlackRock serves as a reminder of the transformative power of cryptocurrencies and their underlying technology.