BlackRock vs. Fidelity: A Closer Look at the Ethereum ETF Market

The Rise of Ethereum ETFs

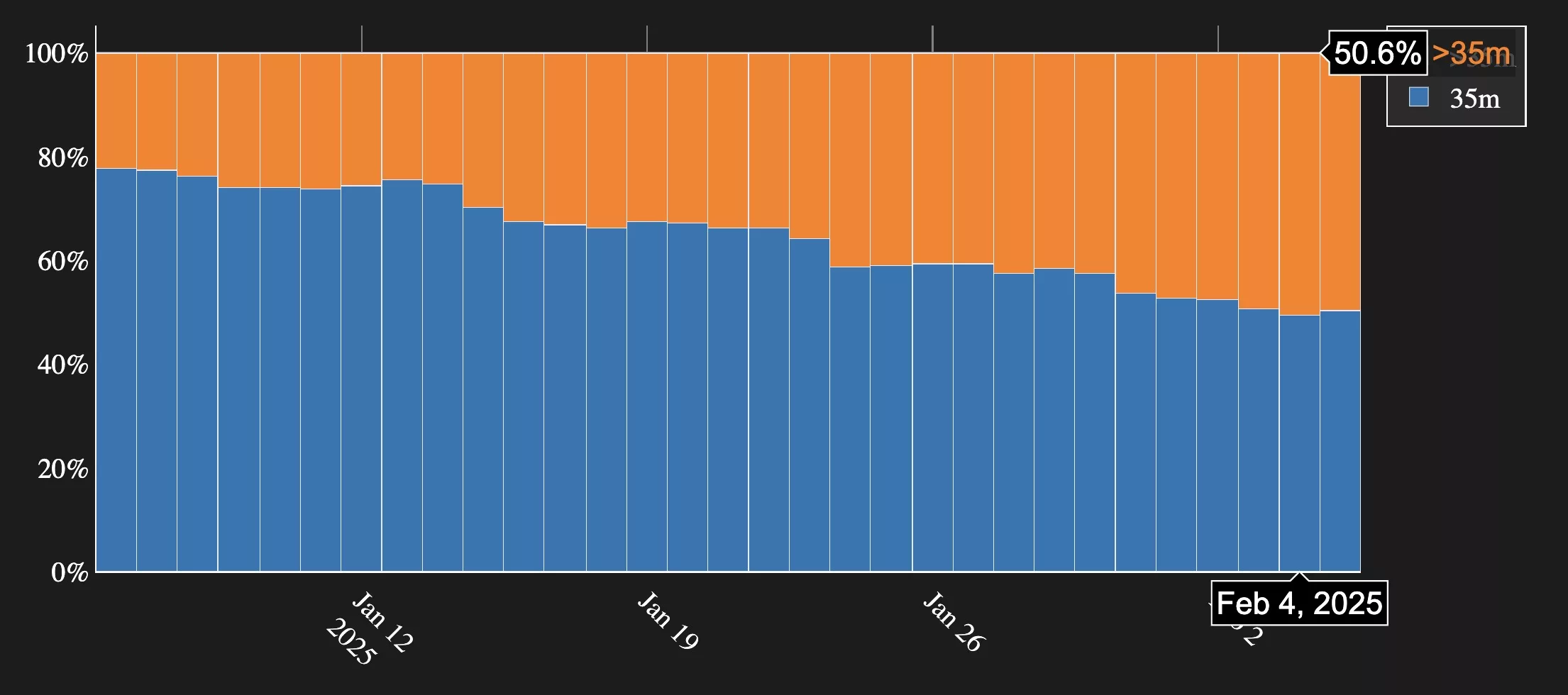

BlackRock’s ETHA and Fidelity’s FETH have been making waves in the world of exchange-traded funds (ETFs), particularly in the Ethereum market. As the Ethereum ETF market closed with a green streak, these two giants accounted for over 98% of the total inflows, showcasing their dominance in this space.

BlackRock’s ETHA

BlackRock, the world’s largest asset manager, introduced the ETHA ETF to provide investors with exposure to the growing Ethereum market. With a strong track record in managing traditional ETFs, BlackRock’s foray into the world of cryptocurrency ETFs has been met with enthusiasm from investors looking to diversify their portfolios.

Fidelity’s FETH

On the other hand, Fidelity, a trusted name in the world of financial services, launched the FETH ETF to tap into the potential of Ethereum. With their reputation for delivering innovative investment solutions, Fidelity’s FETH ETF has quickly gained traction among investors seeking exposure to the burgeoning cryptocurrency market.

The Impact on Investors

For individual investors, the availability of Ethereum ETFs from BlackRock and Fidelity presents an opportunity to gain exposure to this emerging asset class through familiar investment vehicles. This could potentially attract a new wave of investors who are interested in cryptocurrency but may be hesitant to invest directly in digital assets.

The Global Implications

On a larger scale, the success of BlackRock’s ETHA and Fidelity’s FETH ETFs could signify a broader acceptance of cryptocurrencies within the traditional financial sector. As major players like BlackRock and Fidelity enter the cryptocurrency market, it could pave the way for increased institutional adoption of digital assets globally.

Conclusion

With BlackRock and Fidelity leading the charge in the Ethereum ETF market, investors have more options than ever to gain exposure to this promising asset class. The success of ETHA and FETH ETFs not only benefits individual investors looking to diversify their portfolios but also signals a significant shift in the financial industry towards embracing cryptocurrencies as legitimate investment opportunities.

How this will affect you:

The introduction of BlackRock’s ETHA and Fidelity’s FETH ETFs provides individual investors like you with a convenient and familiar way to invest in the Ethereum market. By offering exposure to cryptocurrencies through established ETFs, you can now more easily diversify your investment portfolio and potentially benefit from the growth of the digital asset space.

How this will affect the world:

The dominance of BlackRock and Fidelity in the Ethereum ETF market signifies a major milestone in the acceptance of cryptocurrencies within the global financial sector. As institutional giants embrace digital assets through ETFs, it could lead to increased adoption and integration of cryptocurrencies into the mainstream financial system, shaping the future of finance worldwide.