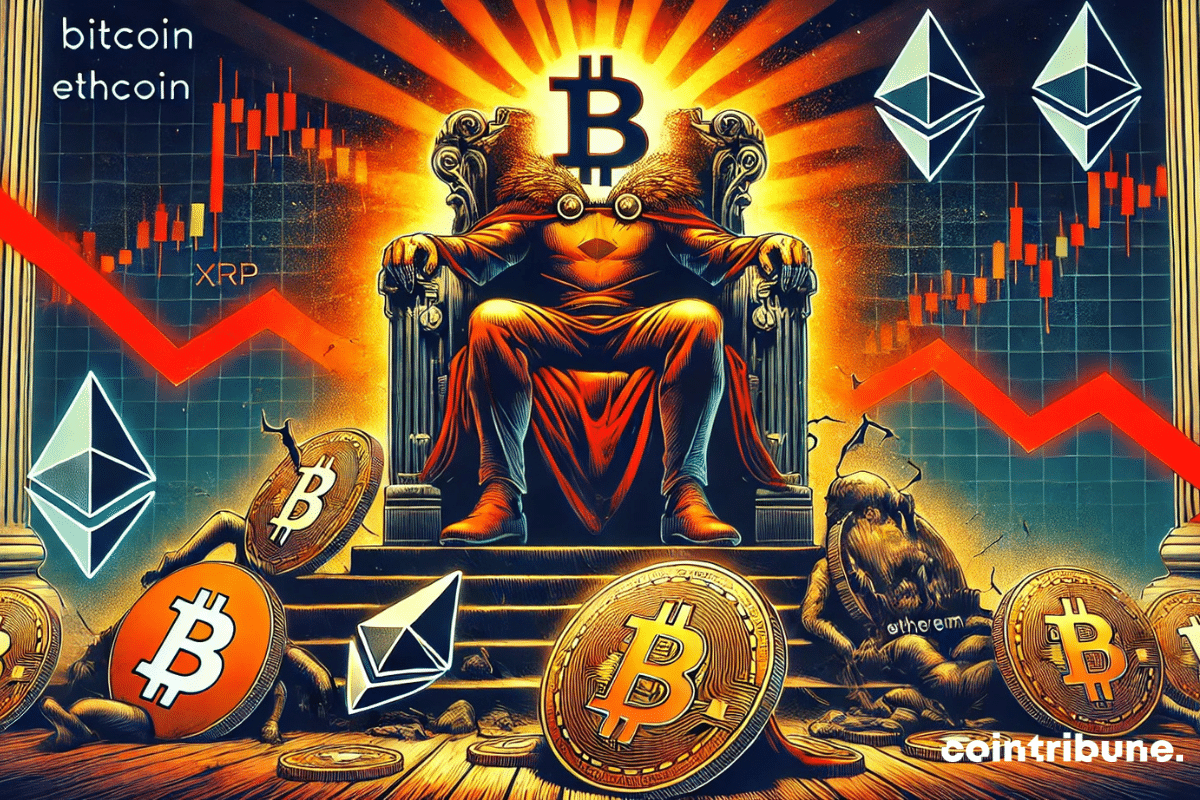

Bitcoin Dominance Reaches 60% as Altcoins Suffer Losses

The Rise of the Queen of Cryptos

On February 2, Bitcoin made headlines as its market share crossed the symbolic threshold of 60%. This significant milestone solidified Bitcoin’s dominant position in the world of cryptocurrencies, asserting its superiority over altcoins. The queen of cryptos continues to reign supreme, outshining all other digital assets in the market.

Altcoins Facing Challenges

While Bitcoin celebrated its triumph, altcoins faced a different fate. Following new trade measures imposed by President Trump, altcoins suffered significant losses. The regulatory crackdown on these alternative cryptocurrencies has left investors worried about the future of the digital asset market.

How This Affects Me

As a cryptocurrency investor, the rise of Bitcoin and fall of altcoins can have a direct impact on my portfolio. With Bitcoin’s dominance increasing, it may be wise to consider reallocating my investments to focus more on the queen of cryptos to mitigate potential losses in the current market environment.

How This Affects the World

The shift in market dynamics towards Bitcoin dominance and the struggles faced by altcoins can have wider implications for the world. As the most well-known and widely adopted cryptocurrency, Bitcoin’s success or failure can influence global perceptions of the digital asset market and shape future regulatory decisions by governments around the world.

Conclusion

In conclusion, Bitcoin’s dominance reaching 60% and the struggles of altcoins in the wake of new trade measures is a clear indication of the ever-changing landscape of the cryptocurrency market. As investors and global citizens, we must stay informed and adapt to these developments to navigate the complexities of this evolving space.