Bitcoin’s Impact on El Salvador’s Reserves

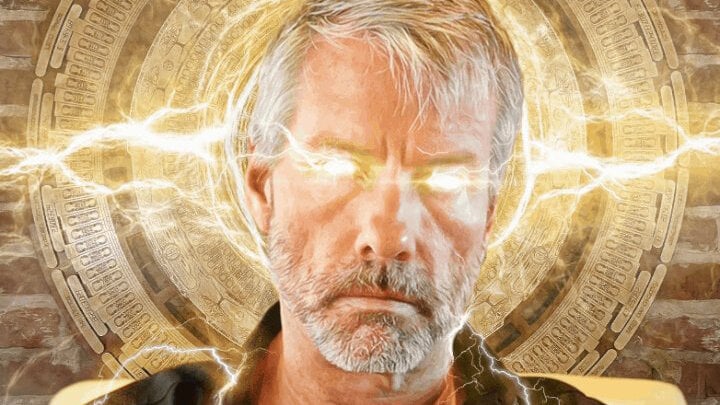

The Bold Crypto Strategy of President Bukele

Bitcoin accounts for nearly 15% of El Salvador’s reserves as President Bukele doubles down on his bold crypto strategy, even after inking a deal with the IMF.

The recent news of Bitcoin accounting for nearly 15% of El Salvador’s reserves has sent shockwaves through the financial world. This bold move by President Bukele showcases his commitment to embracing cryptocurrency and revolutionizing the country’s financial system.

Despite facing backlash from traditional financial institutions and skeptics, President Bukele remains steadfast in his belief that Bitcoin is the future of money. By integrating Bitcoin into the country’s reserves, El Salvador is paving the way for other nations to follow suit and embrace the decentralized nature of cryptocurrency.

President Bukele’s decision to double down on his crypto strategy even after signing a deal with the IMF demonstrates his unwavering dedication to modernizing El Salvador’s economy. While some may view this move as risky, others see it as a bold and innovative step towards financial independence.

As El Salvador continues to make headlines for its progressive approach to cryptocurrency, the rest of the world watches closely to see the impact of Bitcoin on the country’s economy and its people. Only time will tell if President Bukele’s gamble will pay off, but one thing is certain – the world is witnessing a historic moment in the evolution of money.

How will this affect me?

As an individual, the impact of El Salvador’s embrace of Bitcoin may vary depending on your interest and involvement in cryptocurrency. If you are a Bitcoin investor, this news could potentially lead to increased volatility in the market as more countries follow El Salvador’s lead. Additionally, it could open up new opportunities for businesses and consumers to transact using cryptocurrency, leading to a shift in how we think about money and finance.

How will this affect the world?

El Salvador’s decision to incorporate Bitcoin into its reserves could have far-reaching implications for the global economy. If successful, it may inspire other countries to adopt similar strategies and move towards a more decentralized financial system. This could challenge the traditional banking industry and lead to a shift in power dynamics within the financial sector. Additionally, it may pave the way for increased adoption and acceptance of cryptocurrency on a global scale.

Conclusion

President Bukele’s bold crypto strategy in El Salvador marks a turning point in the evolution of money and finance. By incorporating Bitcoin into the country’s reserves, he is challenging the status quo and paving the way for a more decentralized financial system. While the long-term implications of this move remain uncertain, one thing is clear – the world is witnessing a historic moment in the transformation of money as we know it.