The Great Bitcoin Debate: ECB vs Czech National Bank

What’s All the Fuss About?

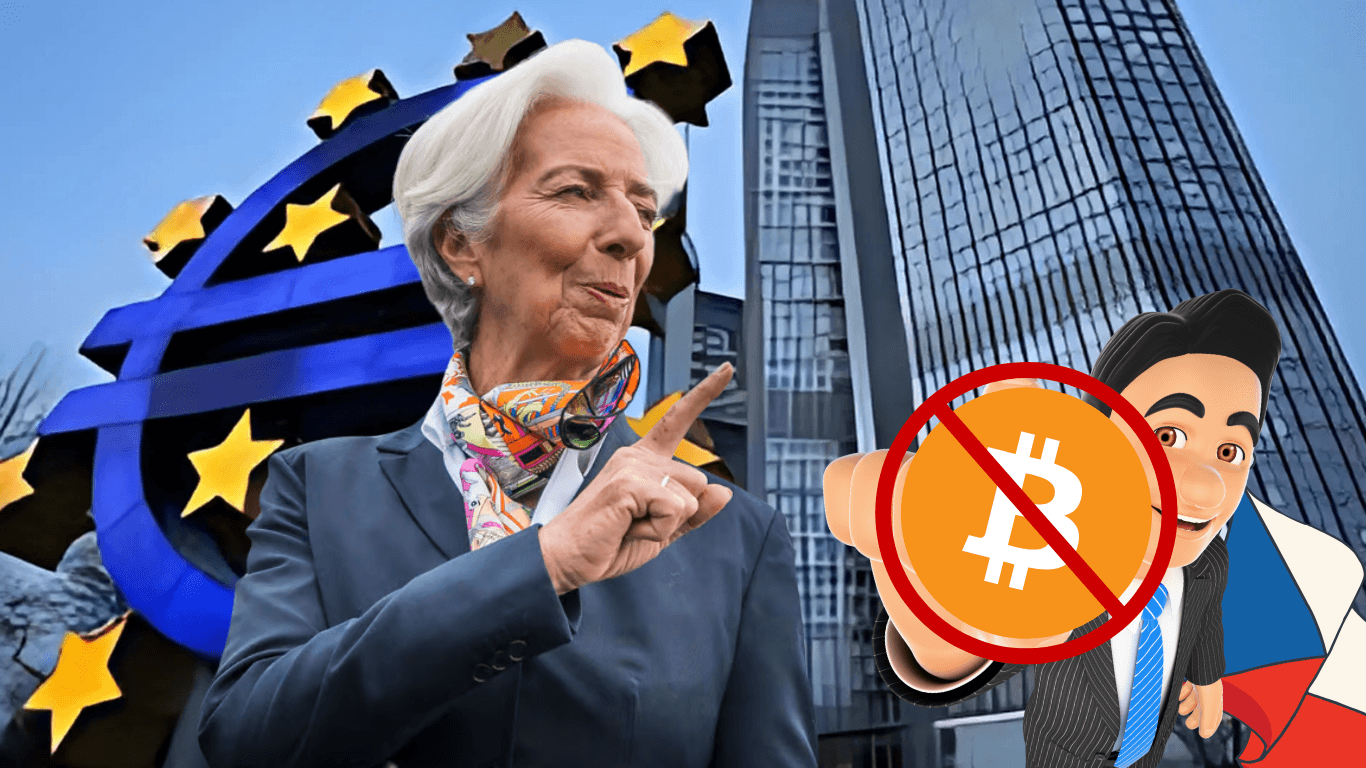

Recently, the European Central Bank (ECB) made headlines by rejecting Bitcoin as a reserve asset, while the Czech National Bank is considering investing in the popular cryptocurrency. This move has brought to light a stark policy divide within Europe when it comes to the acceptance and adoption of Bitcoin.

The ECB’s Stance

The ECB, led by Christine Lagarde, has been vocal about its skepticism towards Bitcoin and other cryptocurrencies. Lagarde has raised concerns about the potential risks and volatility associated with digital assets, stating that Bitcoin is not a real currency and should not be considered as a reliable store of value.

The Czech National Bank’s Consideration

On the other hand, the Czech National Bank seems to have a more open-minded approach towards Bitcoin. The central bank of the Czech Republic is reportedly exploring the possibility of investing in Bitcoin as a reserve asset, signaling a possible shift in attitudes towards digital currencies within the European banking community.

While the ECB’s rejection of Bitcoin reflects a more cautious and conservative stance, the Czech National Bank’s interest in the cryptocurrency highlights a growing acceptance and curiosity about the potential benefits of digital assets.

How Will This Affect You?

As an individual investor or consumer, the differing views on Bitcoin from prominent European financial institutions could have an impact on your own perceptions and decisions regarding digital currencies. Depending on where you reside and what regulations are put in place, you may find yourself facing new opportunities or challenges when it comes to investing in or using Bitcoin.

How Will This Affect the World?

The ECB’s rejection and the Czech National Bank’s consideration of Bitcoin represent a larger debate within the global financial community about the future of digital currencies and blockchain technology. While some countries and institutions may continue to resist the rise of cryptocurrencies, others are beginning to embrace the potential benefits and innovations that they bring.

Conclusion

Ultimately, the conflicting views on Bitcoin from the ECB and the Czech National Bank illustrate the ongoing evolution and diversification of attitudes towards digital assets in Europe and beyond. As the world continues to navigate the complexities of a rapidly changing financial landscape, it will be crucial for individuals and institutions alike to stay informed and adaptable in order to effectively navigate the uncertainties and opportunities that lie ahead.