The Strength of Bitcoin and Ether’s Performance

Understanding the Crypto Market

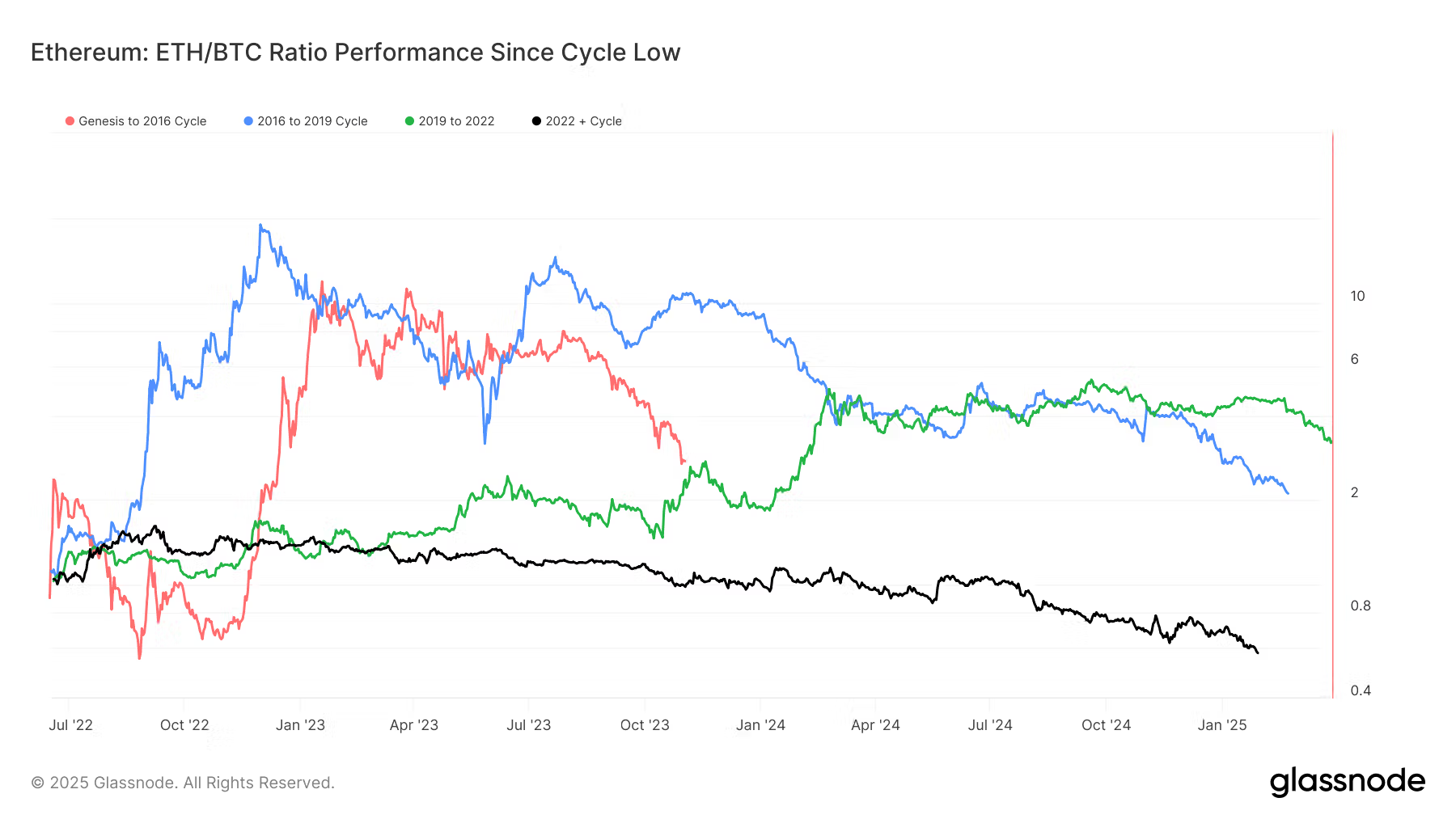

Recently, there has been a lot of discussion surrounding the performance of Bitcoin and Ether in the cryptocurrency market. Many observers have noted that the relative performance of these two tokens is more a sign of Bitcoin’s strength rather than Ether’s weakness. This has sparked a debate among investors and analysts about the underlying factors driving this trend.

Bitcoin Dominance

Bitcoin has long been considered the king of cryptocurrencies, with the largest market cap and the highest trading volume. As a result, its performance often sets the tone for the rest of the market. When Bitcoin is performing well, it tends to boost confidence in the overall market and lead to positive price movements for other cryptocurrencies like Ether.

Ether’s Unique Value Proposition

While Bitcoin may dominate in terms of market share, Ether has its own unique value proposition. As the native token of the Ethereum network, Ether is used to power smart contracts and decentralized applications. This gives it a utility that goes beyond simply being a store of value like Bitcoin. However, this utility also means that Ether’s price movements are often more closely tied to the success of the Ethereum network.

The Future of Bitcoin and Ether

Looking ahead, it will be interesting to see how the relationship between Bitcoin and Ether evolves. As more institutional investors and mainstream companies embrace cryptocurrency, both tokens are likely to see increased adoption and investment. This could lead to a more decoupled relationship between the two, with each token being valued for its own unique strengths.

Effect on Individuals

For individual investors, the strength of Bitcoin and Ether can have a direct impact on their portfolio. Understanding the dynamics between these two tokens can help investors make more informed decisions about their investments and better navigate the volatility of the cryptocurrency market.

Effect on the World

On a larger scale, the performance of Bitcoin and Ether can also have broader implications for the world economy. As more industries adopt blockchain technology and cryptocurrencies, the success of tokens like Bitcoin and Ether can drive innovation and reshape traditional financial systems.

Conclusion

In conclusion, the relative performance of Bitcoin and Ether is a complex topic that reflects the evolving landscape of the cryptocurrency market. While Bitcoin’s dominance may be a sign of strength, Ether’s unique value proposition offers a different perspective on the future of digital assets. By understanding the dynamics between these two tokens, investors can navigate the market more effectively and contribute to the growing impact of cryptocurrencies on the world economy.