Here’s why Arthur Hayes anticipates a 30% BTC price correction in the near term

The Current Bitcoin Market

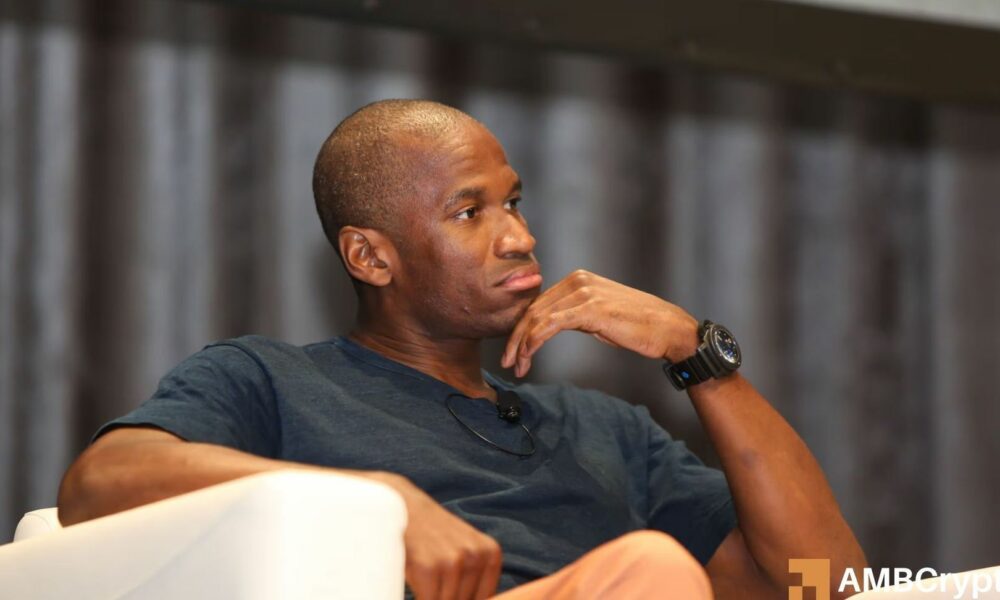

Bitcoin has been on a wild ride in recent months, with prices reaching all-time highs and then experiencing sharp drops. Arthur Hayes, co-founder of the cryptocurrency exchange BitMEX, has been closely following the market trends and he believes that a significant correction is on the horizon.

Market Correction Predictions

According to Hayes, Bitcoin’s price has climbed too high, too fast, and a correction of around 30% is imminent. He points to factors such as over-leveraged long positions and a lack of new buyers entering the market as reasons for this anticipated drop. Hayes predicts that the correction could happen in the near term, although he does not provide a specific timeline.

While some investors may be concerned about the prospect of a price correction, others see it as a healthy and normal part of market cycles. Corrections can help to shake out weak hands and pave the way for future growth and stability in the market.

Impact on Individuals

If Hayes’ prediction of a 30% BTC price correction comes to fruition, individual investors who are heavily exposed to Bitcoin may see a temporary decrease in the value of their holdings. However, those who hold a diversified portfolio that includes other assets may be better positioned to weather the storm.

Impact on the World

As one of the most widely traded cryptocurrencies, a significant price correction in Bitcoin could have ripple effects throughout the entire cryptocurrency market. It may lead to increased volatility and uncertainty, as well as potential shifts in investor sentiment towards digital assets.

Conclusion

While the prospect of a 30% BTC price correction may be daunting for some, it is important to remember that market fluctuations are a natural part of investing in cryptocurrencies. By staying informed and diversifying their portfolios, investors can better navigate the ups and downs of the market and position themselves for long-term success.