Bitcoin Dips Below $100,000 Amid China’s Deepseek News

What Happened?

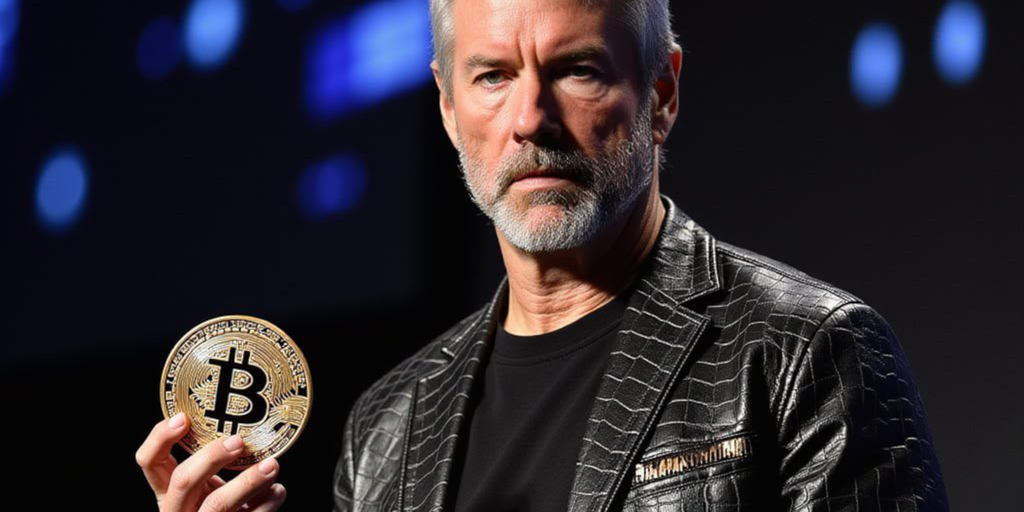

As news of China’s Deepseek circulated over the weekend, bitcoin slipped below $100,000 just a week into Trump’s presidency. Strategic Bitcoin Reserve Needed For Bitcoin Pump QCP Group’s market insights reflected on bitcoin (BTC) dipping below $100,000 with other risk assets also declining, as concerns over China’s Deepseek technology rippled through global markets.

Delving Deeper into Bitcoin’s Performance

Bitcoin, the world’s premier cryptocurrency, has always been subject to volatility due to its speculative nature. However, the recent dip below $100,000 has left many investors on edge, especially considering the impact of China’s Deepseek technology on global markets.

QCP Group’s market insights have pointed towards a need for a strategic Bitcoin reserve to counteract the negative effects of China’s Deepseek. This technology has caused a ripple effect across various risk assets, highlighting the interconnectedness of the global financial system.

As bitcoin struggles to regain its footing, many are left wondering about the long-term implications of China’s Deepseek and how it will affect both individual investors and the world at large.

How Will This Affect Me?

For individual investors, the dip in bitcoin below $100,000 serves as a stark reminder of the unpredictable nature of the cryptocurrency market. It underscores the importance of diversification and strategic planning when it comes to investing in volatile assets like bitcoin.

How Will This Affect the World?

On a larger scale, the impact of China’s Deepseek on global markets can be seen through the decline in various risk assets, including bitcoin. This signals a need for greater cooperation and coordination among countries to address the challenges posed by emerging technologies and their effects on financial stability.

Conclusion

As bitcoin continues to navigate choppy waters in the wake of China’s Deepseek news, it is clear that a strategic approach is needed to mitigate the risks associated with such developments. Individual investors must remain vigilant and adaptable in the face of market uncertainties, while global policymakers must work together to address the broader implications of emerging technologies on the world economy.