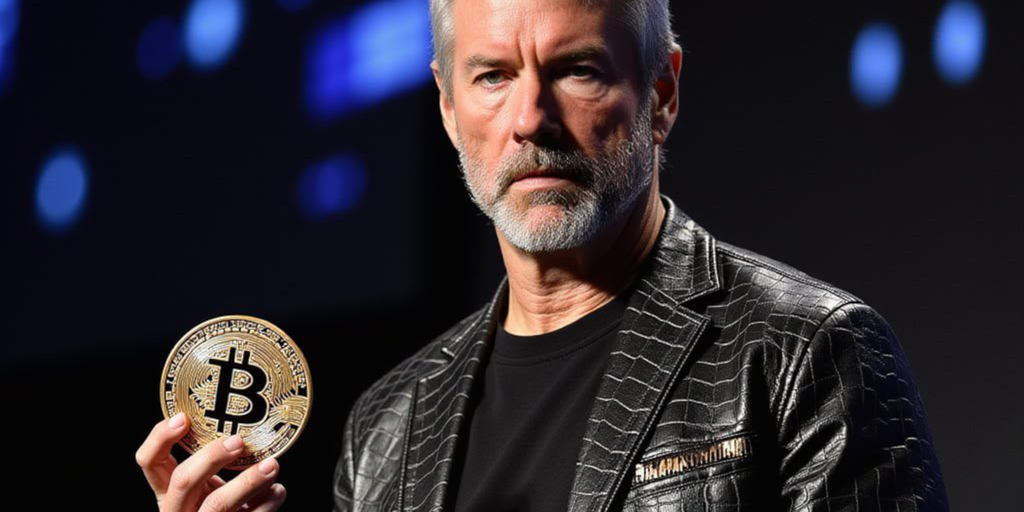

Michael Saylor’s Bold Move: MicroStrategy Acquires $1.1 Billion in Bitcoin

MicroStrategy Makes Headlines Yet Again

Today, Michael Saylor, the CEO of MicroStrategy, made waves in the finance world with the announcement that the company has acquired 10,107 Bitcoin at a total cost of $1.1 billion. This purchase comes just six days after a similar bold move by the firm, signaling a clear shift in the company’s purchasing strategy.

A Strategic Shift

MicroStrategy’s latest Bitcoin acquisition is not an isolated incident but rather part of a broader trend in the company’s approach to investing. Saylor has been vocal about his belief in the long-term potential of Bitcoin as a store of value and a hedge against inflation. By allocating a significant portion of the company’s treasury reserves to the cryptocurrency, MicroStrategy is making a statement about its confidence in the digital asset.

This latest purchase brings the total amount of Bitcoin owned by MicroStrategy to over 91,000, solidifying the company’s position as one of the largest institutional holders of the cryptocurrency. The move has not gone unnoticed by industry observers, with many applauding Saylor’s boldness and vision.

Impact on Individuals

For individual investors, MicroStrategy’s continued investment in Bitcoin may serve as a vote of confidence in the cryptocurrency. As more institutional players enter the market, it could lead to increased adoption and mainstream acceptance of Bitcoin as a legitimate asset class. This could potentially drive up the price of Bitcoin and offer opportunities for those already invested in the cryptocurrency.

Global Implications

On a larger scale, MicroStrategy’s aggressive Bitcoin purchases could have far-reaching implications for the finance industry and the global economy. The increasing acceptance of Bitcoin by institutional investors could lead to greater regulatory clarity and oversight in the cryptocurrency market. It could also pave the way for other companies to follow in MicroStrategy’s footsteps and diversify their treasury reserves with digital assets.

Conclusion

Michael Saylor’s decision to acquire $1.1 billion worth of Bitcoin is a bold move that has captured the attention of the finance world. As MicroStrategy continues to add to its already substantial holdings of the cryptocurrency, the implications for both individual investors and the global economy are significant. Whether this trend towards institutional adoption of Bitcoin will continue remains to be seen, but one thing is certain: Saylor’s confidence in the digital asset is unwavering.