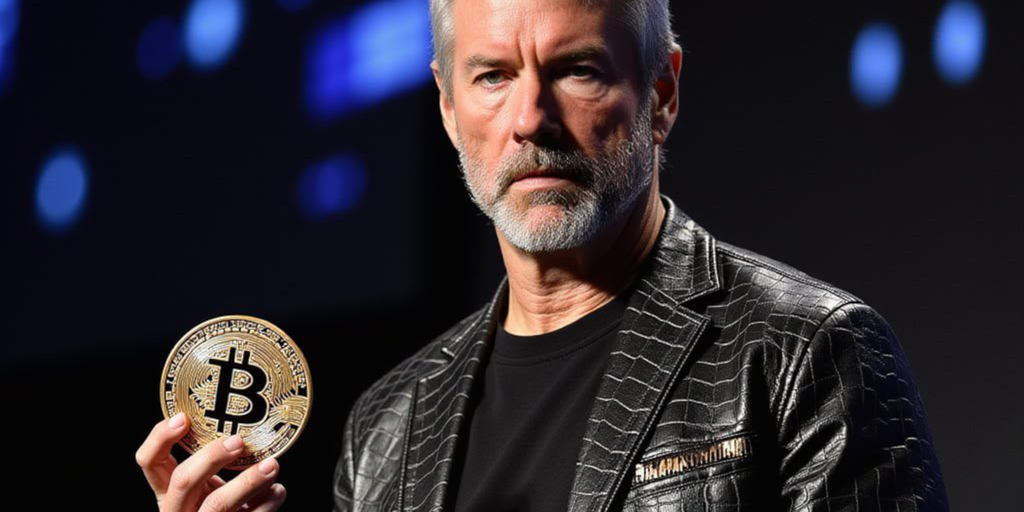

Bitcoin Continues to See Volatility as MicroStrategy Steadily Accumulates BTC

MicroStrategy’s Ongoing Bitcoin Purchases

Bitcoin experienced a dip in price on Monday, but one company seems undeterred by the market fluctuations. MicroStrategy, a business intelligence firm, has announced its 12th consecutive weekly purchase of Bitcoin. This consistent buying streak has propelled the company’s BTC holdings to nearly $50 billion.

The Impact of MicroStrategy’s Bitcoin Accumulation

MicroStrategy’s relentless accumulation of Bitcoin demonstrates a strong vote of confidence in the cryptocurrency. Despite the recent price drop, the company continues to see value in investing in BTC as a long-term asset. This strategic move could potentially pay off in the future if Bitcoin’s price rebounds.

Moreover, MicroStrategy’s actions could also influence other companies to consider adding Bitcoin to their balance sheets. As more businesses follow suit, the demand for Bitcoin may increase, potentially driving up its price in the long run.

How MicroStrategy’s Bitcoin Purchases Could Affect Individuals

For individual investors, MicroStrategy’s consistent Bitcoin purchases serve as a reminder of the cryptocurrency’s potential as a store of value. By observing a reputable company like MicroStrategy continue to invest in BTC, individual investors may feel more confident in holding or acquiring Bitcoin themselves.

Furthermore, seeing MicroStrategy’s bullish stance on Bitcoin could spark curiosity and interest in learning more about cryptocurrencies among the general population. This increased awareness and adoption of Bitcoin could have a positive impact on its overall growth and acceptance in mainstream society.

The Global Impact of MicroStrategy’s Bitcoin Acquisition Strategy

On a global scale, MicroStrategy’s ongoing Bitcoin purchases could contribute to the normalization and acceptance of cryptocurrencies as legitimate financial assets. As more traditional companies like MicroStrategy embrace Bitcoin, it diminishes the skepticism surrounding digital currencies and paves the way for greater institutional adoption.

Additionally, MicroStrategy’s strategic accumulation of Bitcoin could potentially impact the cryptocurrency market as a whole. The company’s significant BTC holdings could influence market dynamics and investor sentiment, shaping the future behavior and value of Bitcoin and other cryptocurrencies.

Conclusion

In conclusion, MicroStrategy’s continued purchases of Bitcoin amidst market fluctuations highlight the company’s confidence in the long-term potential of cryptocurrencies. This trend not only signals a shift in how businesses view digital assets but also has the potential to impact individual investors and the global cryptocurrency market. As MicroStrategy’s BTC holdings approach $50 billion, the implications of its Bitcoin acquisition strategy are worth monitoring for both personal and global financial considerations.