Getting Bearish in the Tech Market

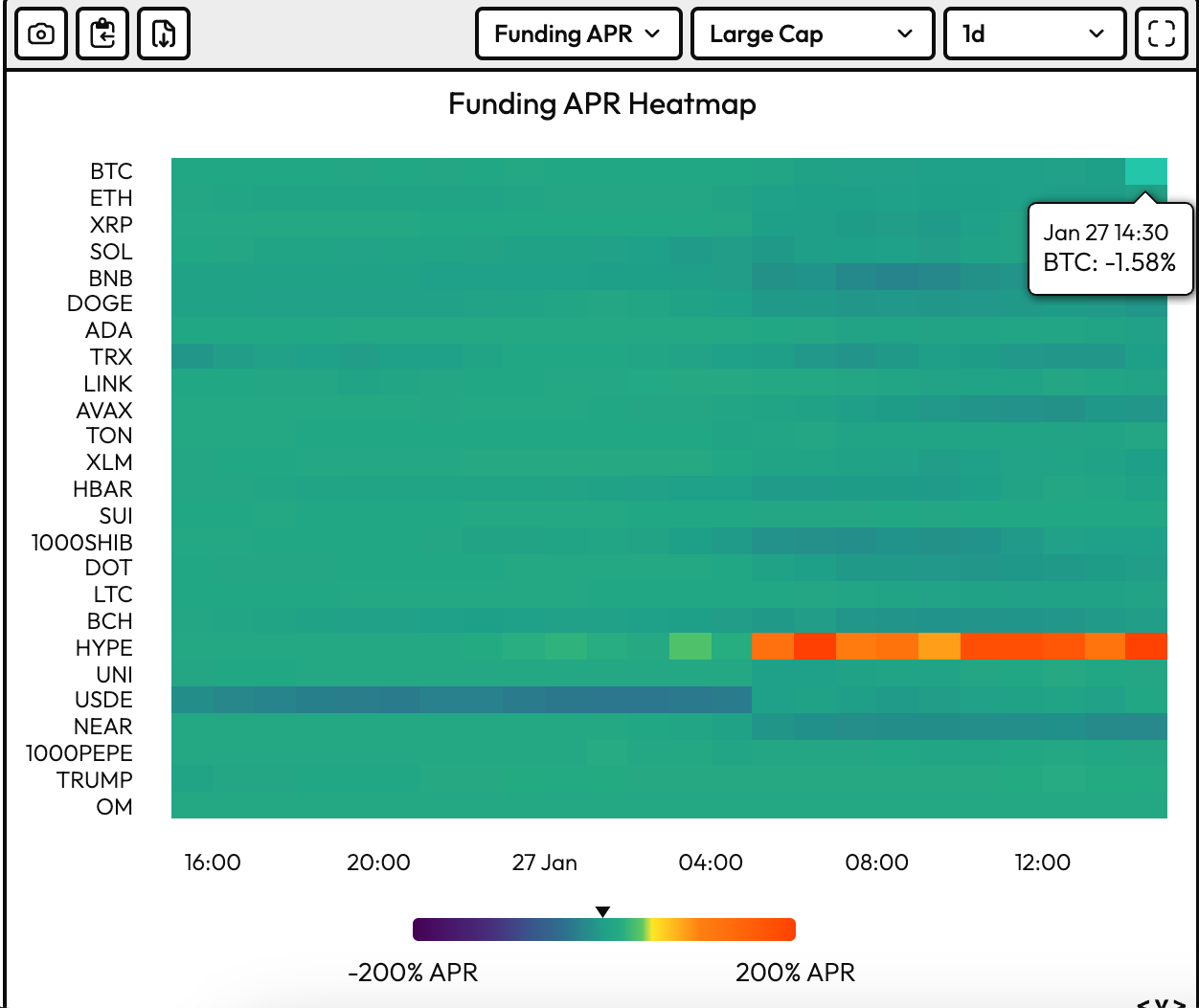

The renewed bearish flip in funding rates comes amid risk-off in Wall Street’s tech-heavy Nasdaq index. With investors starting to show signs of concern, the once red-hot tech sector is starting to cool off. But what does this mean for the average investor? Let’s dive in and take a closer look.

The Current State of the Tech Market

For the past few years, tech stocks have been on a tear, with companies like Apple, Amazon, and Google seeing massive gains. However, recent events have caused a shift in sentiment, leading to a more cautious approach by investors. The sharp increase in funding rates is a clear indication that investors are starting to reevaluate their positions in tech stocks.

How Will This Affect Me?

If you have investments in tech stocks, the renewed bearish sentiment could lead to lower valuations and potential losses in your portfolio. It’s important to keep a close eye on the market and consider diversifying your investments to mitigate risk. Additionally, now might be a good time to reassess your investment strategy and make any necessary adjustments.

How Will This Affect the World?

The tech sector plays a crucial role in driving innovation and economic growth across the globe. A downturn in tech stocks could have far-reaching consequences, impacting everything from job creation to consumer spending. As the tech market cools off, we may see a slowdown in technological advancements and a shift in market dynamics.

Conclusion

In conclusion, the renewed bearish flip in funding rates is a sign that the tech market is entering a period of uncertainty. While this may spell trouble for investors in the short term, it’s important to remember that the market goes through ups and downs. By staying informed and making smart investment decisions, you can weather the storm and come out stronger on the other side.