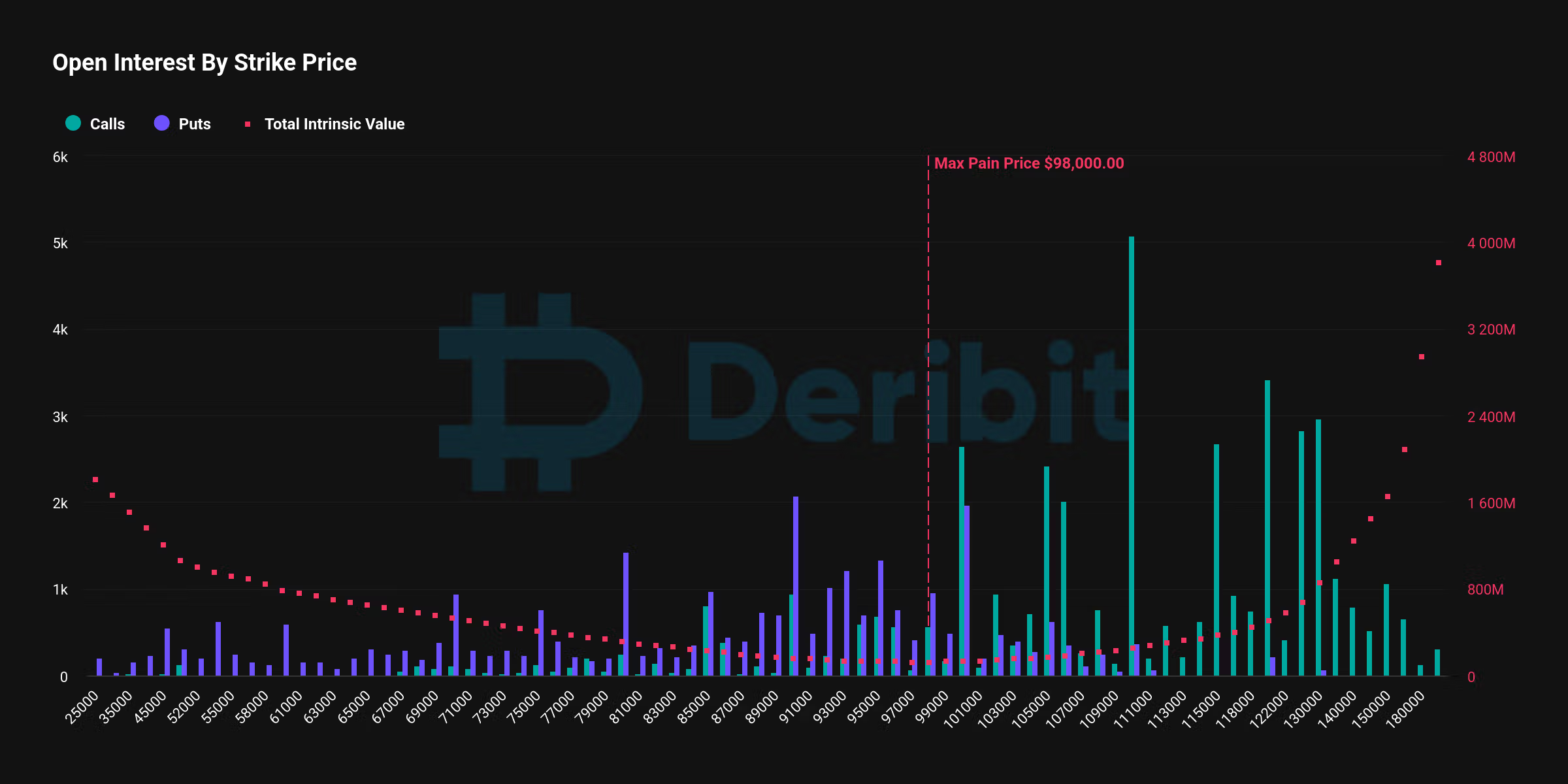

The Future of Bitcoin: What Happens When $6 Billion Expires Out of the Money?

What does it mean when $6 billion in bitcoin expires out of the money?

Bitcoin, the world’s most popular cryptocurrency, has been making headlines recently as $6 billion of its notional value is set to expire out of the money. But what exactly does this mean for the future of bitcoin and its investors?

When we say that $6 billion of bitcoin is expiring out of the money, we are referring to a situation where the current price of bitcoin is below the strike price of options or futures contracts. This essentially means that if these contracts were to expire today, they would be worthless as the price of bitcoin is not profitable for the contract holders.

This news has certainly raised some concerns among investors and traders in the cryptocurrency market. With such a large amount of notional value expiring out of the money, we can expect to see increased volatility and potentially a drop in the price of bitcoin in the near future.

How will this affect me?

As a bitcoin investor or trader, the expiration of $6 billion out of the money can have a significant impact on your portfolio. It may lead to increased uncertainty and volatility in the market, which could result in significant losses if you are not prepared.

It is important to stay informed and monitor the market closely during this time to make informed decisions about your investments. Consider diversifying your portfolio and implementing risk management strategies to protect yourself from potential losses.

How will this affect the world?

The expiration of $6 billion out of the money in bitcoin can have broader implications for the world economy. As one of the largest cryptocurrencies in the world, bitcoin’s price movements can have a ripple effect on other financial markets and industries.

If the price of bitcoin drops significantly due to the expiration of these contracts, it could lead to a decrease in investor confidence in the cryptocurrency market as a whole. This could also impact technological innovation and adoption of blockchain technology in various sectors.

Conclusion

In conclusion, the expiration of $6 billion out of the money in bitcoin is a significant event that could have far-reaching consequences for investors and the world economy. It is crucial to stay informed, monitor the market closely, and take appropriate measures to protect your investments during this time of increased volatility.