Cryptocurrency Markets Trading Lower Despite Federal Reserve Rate Cut

The cryptocurrency markets are experiencing a downturn on Wednesday, with prices dropping across the board despite the Federal Reserve’s recent announcement of a 0.25% rate cut during its latest FOMC meeting. This unexpected turn of events has left investors and analysts puzzled, as traditional market indicators would suggest a bullish trend following such a decision.

Cryptocurrency Price Gains/Losses:

Bitcoin (CRYPTO: BTC) – $102,173.74 (-3.9%)

Ethereum (CRYPTO: ETH) – $3,714.81 (-5.5%)

Solana (CRYPTO: SOL) – $210.29 (-7.3%)

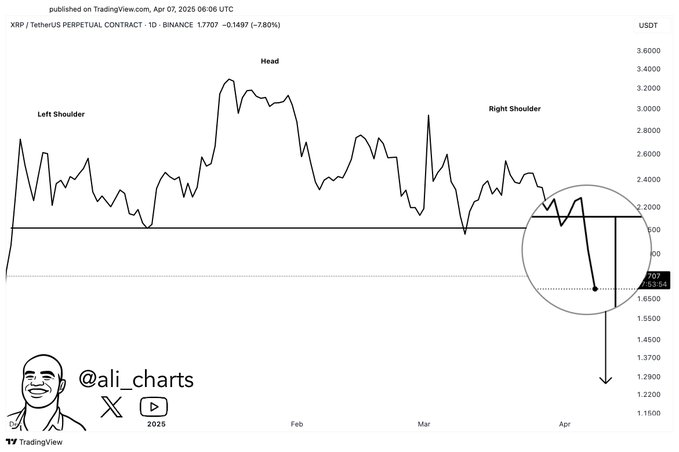

XRP (CRYPTO: XRP) – $2.36 (-9.3%)

Dogecoin (CRYPTO: DOGE) – $0.3654 (-8.4%)

Shiba Inu (CRYPTO: SHIB) – $0.00002458 (-8.2%)

Notable Statistics:

According to IntoTheBlock data, large transaction volume has decreased by 3.4% and daily active addresses have fallen by 12.8%. These metrics indicate a significant decline in user activity and investor interest in the cryptocurrency market.

How Will This Affect Me?

As an investor or trader in the cryptocurrency market, the current downturn may have a direct impact on your portfolio. It is important to closely monitor the market trends and consider adjusting your investment strategy accordingly to mitigate potential losses.

How Will This Affect the World?

The cryptocurrency market’s negative response to the Federal Reserve’s rate cut could have broader implications for the world economy. If the trend continues, it may signal a lack of confidence in central bank policies and could lead to increased market volatility and uncertainty.

Conclusion:

In conclusion, the cryptocurrency markets are currently trading lower despite the Federal Reserve’s rate cut, indicating a shift in investor sentiment and market dynamics. It is crucial for investors to stay informed and adaptable in times of market volatility to navigate potential risks and opportunities effectively.