Bitcoin Trading at a Discount on South Korean Exchanges

Introduction

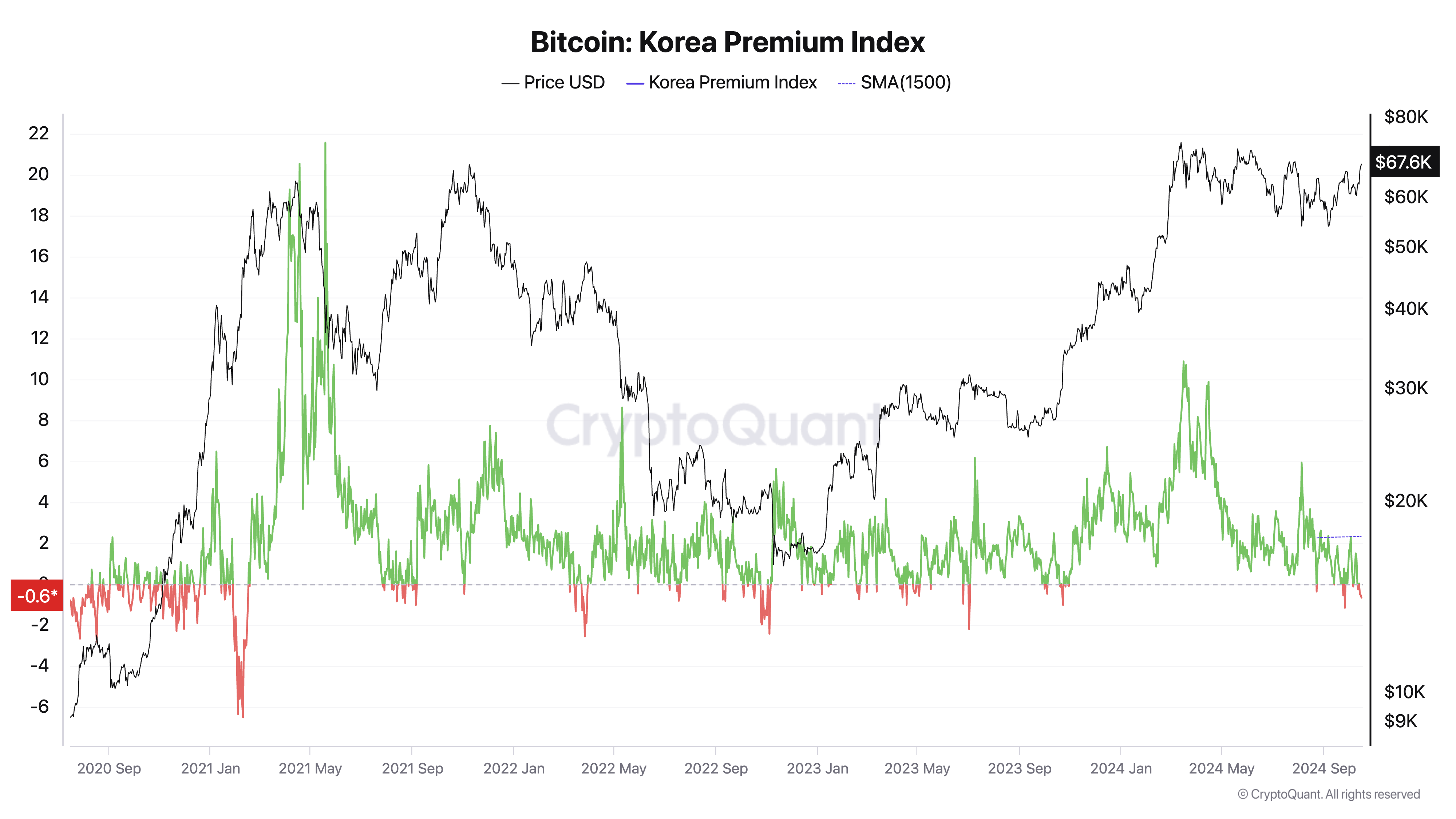

Recently, Bitcoin has been trading at a discount on South Korean exchanges, which is a reversal from the traditional “kimchi premium” that has historically indicated bullish market sentiment. According to The Korea Times, the cryptocurrency is priced approximately 700,000 won ($511.73) lower domestically compared to global exchanges, resulting in a negative premium (discount) of -0.74% as of Thursday afternoon.

Why is this Happening?

The discrepancy in Bitcoin prices on South Korean exchanges compared to global exchanges can be attributed to various factors, including regulatory changes, market sentiment, and supply and demand dynamics in the local market. South Korea has been known for its active participation in the cryptocurrency market, but recent regulatory crackdowns and stricter guidelines may have dampened investors’ enthusiasm, leading to the current discount.

Implications for Investors

For individual investors in South Korea, this presents an opportunity to buy Bitcoin at a lower price compared to global exchanges. However, it also reflects a shift in sentiment and may indicate caution among local traders. The discount on South Korean exchanges could potentially impact trading volumes and market liquidity in the region.

Impact on the World

From a global perspective, the discount on South Korean exchanges may signal a broader trend in the cryptocurrency market. As one of the major trading hubs for Bitcoin, South Korea’s pricing dynamics can influence market trends and investor sentiment worldwide. Traders and analysts will be closely monitoring how this discount plays out in the coming days and its implications for the overall market.

Conclusion

In conclusion, the current discount on South Korean exchanges highlights the complexity and interconnectedness of the cryptocurrency market. While it presents opportunities for investors in the region, it also reflects shifting dynamics and regulatory challenges that can impact prices and market behavior. As the situation evolves, it will be important for stakeholders to stay informed and adapt to changing market conditions.