The U.S. Securities and Exchange Commission (SEC) Guide for Terra Luna Investors

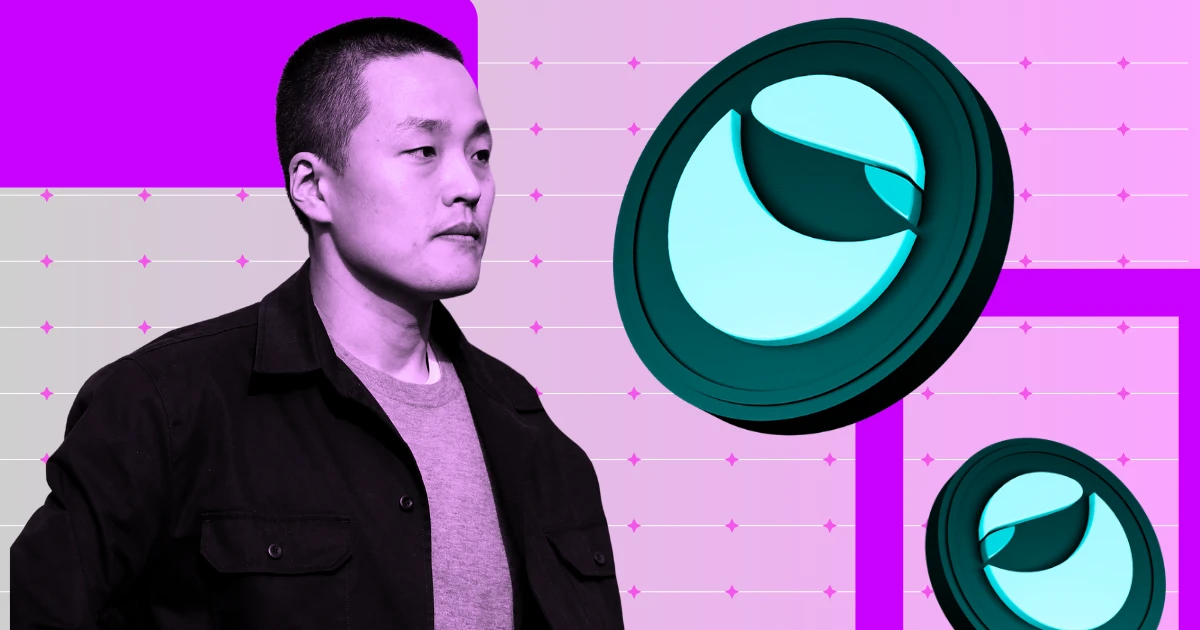

Understanding the $40 Billion Collapse

In 2022, Terra Luna investors were shocked by the sudden collapse of the $40 billion investment firm. Many investors were left wondering how they would recover their lost funds and what steps they should take next. The U.S. Securities and Exchange Commission (SEC) has since stepped in to provide guidance and support for affected investors.

SEC’s Response to Investor Concerns

After receiving numerous inquiries from investors seeking to understand how they can get their money back, the SEC has released a comprehensive guide outlining the compensation process. This guide aims to provide clarity and assurance to investors who have been impacted by the Terra Luna collapse.

The SEC’s guide explains the steps investors need to take to potentially recoup their losses, including how to file a claim and what documentation is required. The SEC is working diligently to ensure that affected investors receive fair compensation for their investments.

How This Affects Individual Investors

For individual investors who have lost money in the Terra Luna collapse, the SEC’s guide provides a roadmap for seeking compensation. By following the instructions outlined in the guide, investors may have the opportunity to recover a portion of their lost funds. It is important for affected investors to act promptly and accurately in order to maximize their chances of receiving compensation.

Individual investors should carefully review the SEC’s guide and take the necessary steps to file a claim. By working closely with the SEC and following the outlined procedures, investors can navigate the compensation process successfully and hopefully reclaim a portion of their investments.

Global Impact of the Terra Luna Collapse

The collapse of Terra Luna and the subsequent fallout have sent shockwaves through the global investment community. Investors worldwide are closely monitoring the situation and assessing the implications for their own portfolios. The SEC’s response to the Terra Luna collapse sets a precedent for regulatory oversight and investor protection on a global scale.

Global financial markets are adjusting to the news of the Terra Luna collapse, with investors reevaluating their investment strategies and risk management approaches. The fallout from the collapse is a stark reminder of the importance of due diligence and regulatory compliance in the investment world.

Conclusion

In conclusion, the SEC’s guide for Terra Luna investors affected by the $40 billion collapse offers a roadmap for seeking compensation and navigating the aftermath of the crisis. Individual investors are encouraged to review the guide carefully and take the necessary steps to file a claim in order to potentially recoup their losses. The global impact of the Terra Luna collapse serves as a stark reminder of the need for regulatory oversight and investor protection in the ever-evolving world of finance.