On-chain Highlights

Bitcoin futures volume peaks in March, declines in sync with price drop

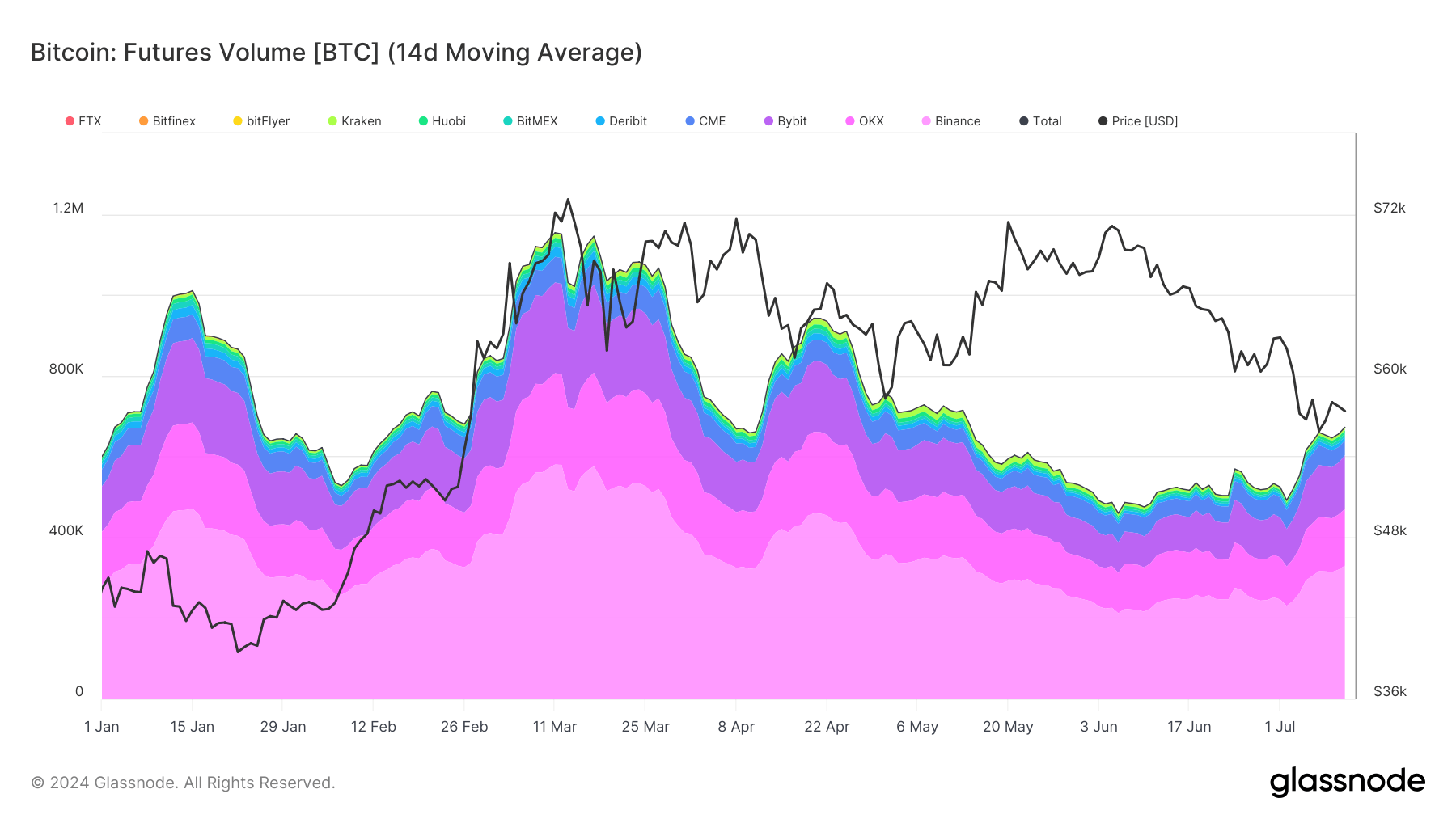

DEFINITION: The total volume traded in futures contracts in the last 24 hours Bitcoin futures volume on major exchanges shows varied trends throughout 2024. The Glassnode charts illustrate a significant shift in futures trading activity. From the start of the year, the volume fluctuated, peaking in early March with almost 1.2 million BTC […].

The Bitcoin futures volume on major exchanges has been a topic of interest for many in the crypto community. The volume of futures trading activity has seen significant fluctuations throughout 2024, with peaks and valleys corresponding to shifts in the market.

In early March, there was a notable peak in Bitcoin futures volume, with almost 1.2 million BTC traded in a 24-hour period. This surge in trading activity coincided with a bullish trend in the market, as Bitcoin’s price was on the rise.

However, as the price of Bitcoin started to decline in the following weeks, so did the volume of futures trading. This decline in trading activity mirrors the drop in price, indicating a correlation between the two variables.

How this will affect me:

As a cryptocurrency trader or investor, the fluctuations in Bitcoin futures volume can provide valuable insights into market trends. By keeping an eye on volume trends, you can potentially anticipate price movements and make more informed trading decisions.

How this will affect the world:

The trends in Bitcoin futures volume not only impact individual traders, but they also have broader implications for the cryptocurrency market as a whole. Market movements driven by futures trading can influence the overall sentiment and direction of the market, affecting traders, investors, and even regulatory decisions.

Conclusion

Overall, the peak in Bitcoin futures volume in March followed by a decline in sync with the price drop highlights the interconnected nature of trading activity and market movements. By paying attention to on-chain data like futures volume, traders can gain a deeper understanding of market dynamics and potentially make more strategic decisions.