Bitcoin Futures Term Structure Indicates Bullish Sentiment

On-chain Highlights

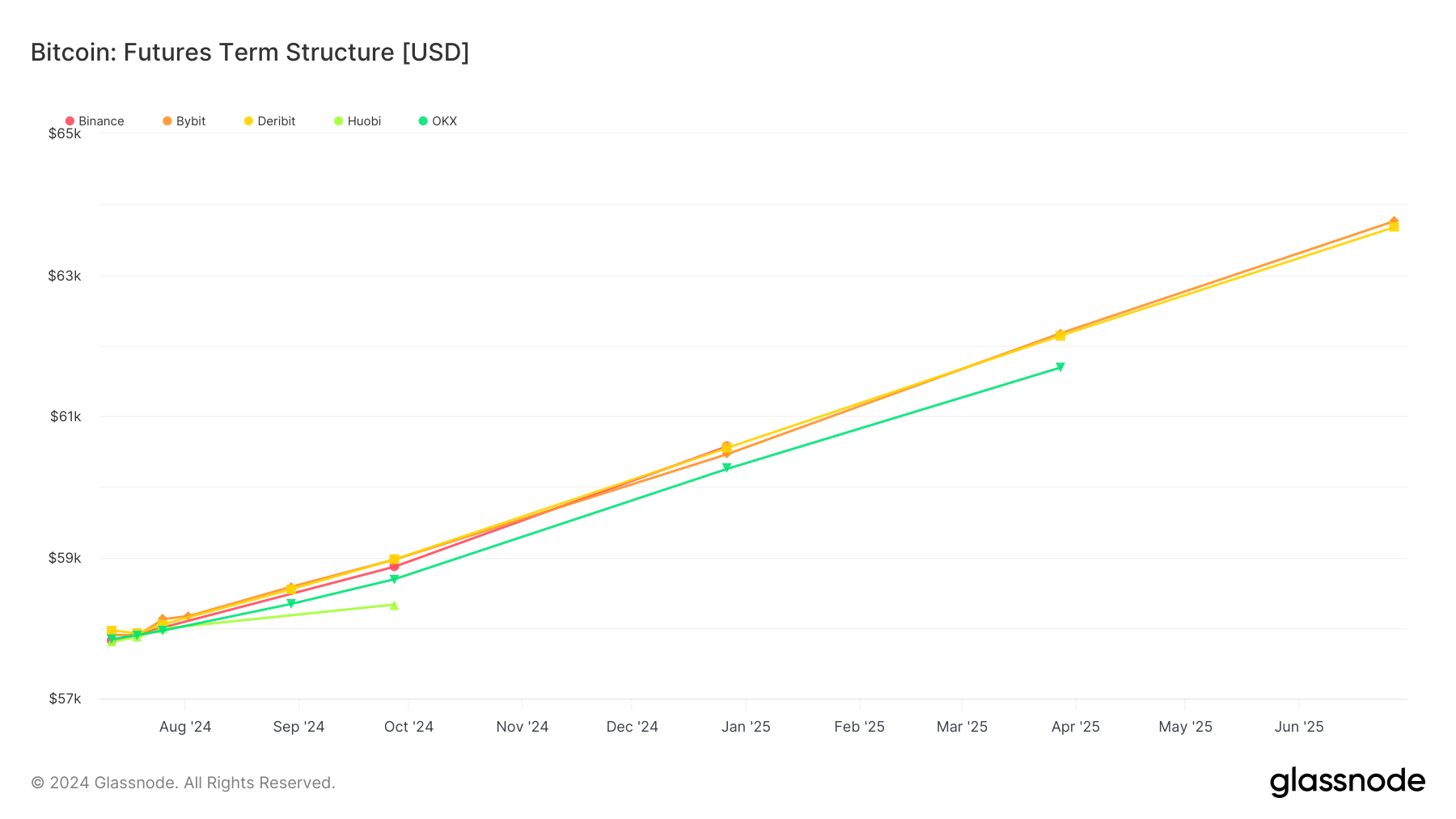

DEFINITION: The Futures Term Structure is a graphical representation of the pricing for futures contracts expiring at increasingly distant dates into the future. The most common state of the graph, an upward slope, indicates a premium must be paid to purchase exposure, or delivery, of an asset in the future. Conversely, a downward slope…

When it comes to Bitcoin futures trading, one key indicator that traders often look at is the futures term structure. This term structure can provide valuable insights into market sentiment and help traders make informed decisions about their investments.

Understanding the Futures Term Structure

The futures term structure is a graphical representation of the pricing for futures contracts that expire at different dates in the future. In simple terms, it shows how the price of a futures contract changes as the expiration date approaches.

Typically, the futures term structure will have an upward slope, indicating that traders are willing to pay a premium for exposure to Bitcoin in the future. This bullish sentiment suggests that investors believe the price of Bitcoin will increase over time, making it more valuable to hold onto a futures contract.

On the other hand, a downward slope in the futures term structure would indicate a bearish sentiment, where traders are less willing to pay a premium for future exposure to Bitcoin. This could suggest that investors believe the price of Bitcoin will decrease, making it less desirable to hold onto a futures contract.

Impact on Traders

For traders in the Bitcoin futures market, the futures term structure can be a valuable tool for predicting future price movements and making informed investment decisions. By analyzing the slope of the term structure, traders can gain insights into market sentiment and adjust their trading strategies accordingly.

If the futures term structure is indicating a bullish sentiment, traders may choose to go long on Bitcoin futures contracts, anticipating that the price of Bitcoin will increase in the future. Conversely, if the term structure is bearish, traders may opt to short Bitcoin futures contracts, expecting the price of Bitcoin to decline.

Impact on the World

While the futures term structure is primarily used by traders in the Bitcoin market, its implications can extend to the broader financial world. A bullish sentiment in the futures term structure could attract more investors to Bitcoin, driving up demand and potentially increasing the price of the cryptocurrency.

On a larger scale, a positive outlook on Bitcoin futures could also boost confidence in the wider cryptocurrency market, leading to increased investment in other digital assets. This could have a ripple effect on the global economy, as more investors flock to cryptocurrencies as a hedge against traditional financial markets.

Conclusion

In conclusion, the futures term structure is an important indicator that can provide valuable insights into market sentiment and help traders make informed decisions about their Bitcoin investments. By analyzing the slope of the term structure, traders can gain a better understanding of future price movements and adjust their strategies accordingly. Ultimately, a bullish sentiment in the futures term structure could have a positive impact on both individual traders and the broader cryptocurrency market.