Bitcoin transaction fees in April 2024 mirror past spikes during market events

On-chain Highlights

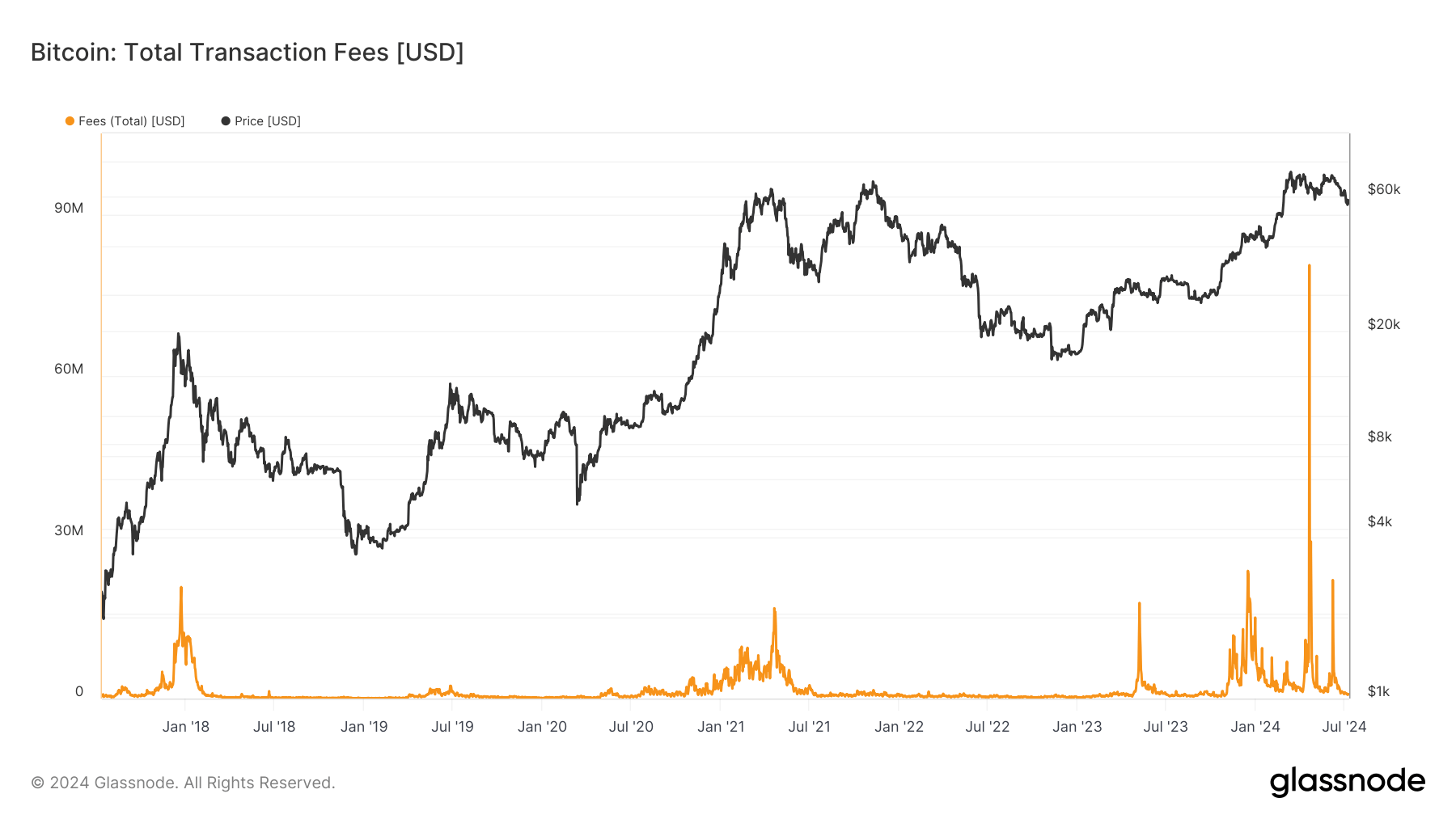

DEFINITION: The total amount of fees (USD Value) paid to miners. Issued (minted) coins are not included. Bitcoin’s total transaction fees exhibit significant fluctuations over time. The charts illustrate a substantial spike in transaction fees around April this year. The peak around this period suggests increased network activity and congestion, which directly results in higher fees for users.

Exploring the Spike in Transaction Fees

Bitcoin, the world’s leading cryptocurrency, experienced a surge in transaction fees during April 2024. This spike in fees can be attributed to various factors, such as increased network activity and congestion. As more users engage in transactions on the Bitcoin network, miners prioritize transactions with higher fees attached, leading to an overall increase in transaction fees.

Interestingly, this spike in transaction fees is not unprecedented. In the past, similar spikes in fees have occurred during significant market events, indicating a correlation between network activity and fee fluctuations. While these fluctuations may inconvenience some users, they also reflect the growing interest and adoption of Bitcoin as a payment method and store of value.

How Does This Impact Me?

As a Bitcoin user, the spike in transaction fees during April 2024 may result in higher costs for sending and receiving Bitcoin. It is important to consider these fees when planning your transactions and adjust your fee settings accordingly to ensure timely processing. Additionally, being aware of market events and network activity can help you anticipate potential fee spikes and plan your transactions accordingly.

Global Implications

The spike in Bitcoin transaction fees in April 2024 not only impacts individual users but also has broader implications for the cryptocurrency market and blockchain ecosystem. Increased fees may deter some users from engaging in frequent transactions, potentially affecting overall network activity and liquidity. However, it also highlights the scalability challenges facing blockchain networks and the need for innovative solutions to address congestion issues.

Conclusion

In conclusion, the spike in Bitcoin transaction fees during April 2024 reflects the dynamic nature of the cryptocurrency market and the growing popularity of Bitcoin. While fee fluctuations can be a source of inconvenience for users, they also signify the increasing use and adoption of Bitcoin as a digital asset. By staying informed and adapting to changing fee dynamics, users can navigate the evolving landscape of blockchain technology and cryptocurrency transactions effectively.