Bitcoin-Gold Correlation: A Rollercoaster Ride

What is Onchain Highlights?

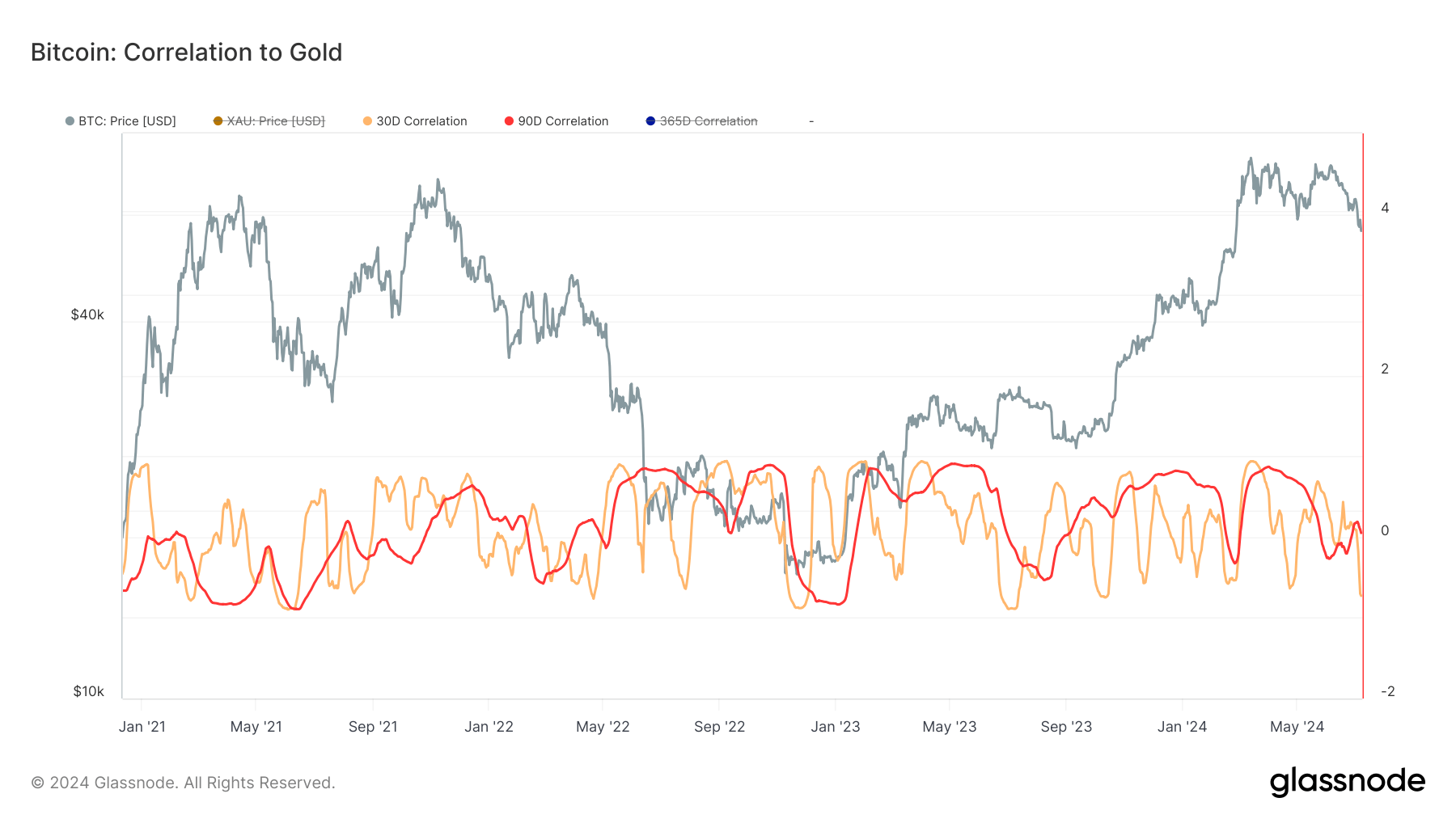

Onchain Highlights is a term used to describe the correlation between Bitcoin and gold over different time periods, typically 30-day and 90-day periods. This metric helps measure the strength and direction of their price relationship, offering insights into the market dynamics of these two assets.

The Fluctuating Trends

Bitcoin’s correlation to gold has exhibited fluctuating trends over the past three years. The 30-day and 90-day correlation metrics show intermittent peaks and troughs, indicating varying degrees of correlation between Bitcoin and gold.

Post-Halving Effect

After the recent Bitcoin halving event, the correlation between Bitcoin and gold has shown a downwards trend. This trend suggests a shift in the relationship between these assets, potentially leading to new opportunities and challenges for investors.

Impact on Individuals

For individual investors, the changing correlation between Bitcoin and gold could have both positive and negative consequences. It might offer diversification benefits for those looking to hedge against market volatility, but it could also introduce new risks and uncertainties into their investment portfolios.

Impact on the World

On a larger scale, the evolving correlation between Bitcoin and gold has the potential to impact the global financial markets. As these two assets continue to gain mainstream acceptance, their relationship could influence the way traditional financial systems operate, leading to significant shifts in the global economy.

Conclusion

In conclusion, the Bitcoin-gold correlation is a complex and dynamic phenomenon that continues to evolve over time. As investors navigate this ever-changing landscape, it is important to stay informed and adapt to new market trends to make informed decisions about their investment strategies.