Analysis of the Bitcoin and Crypto Bull Run by Arthur Hayes

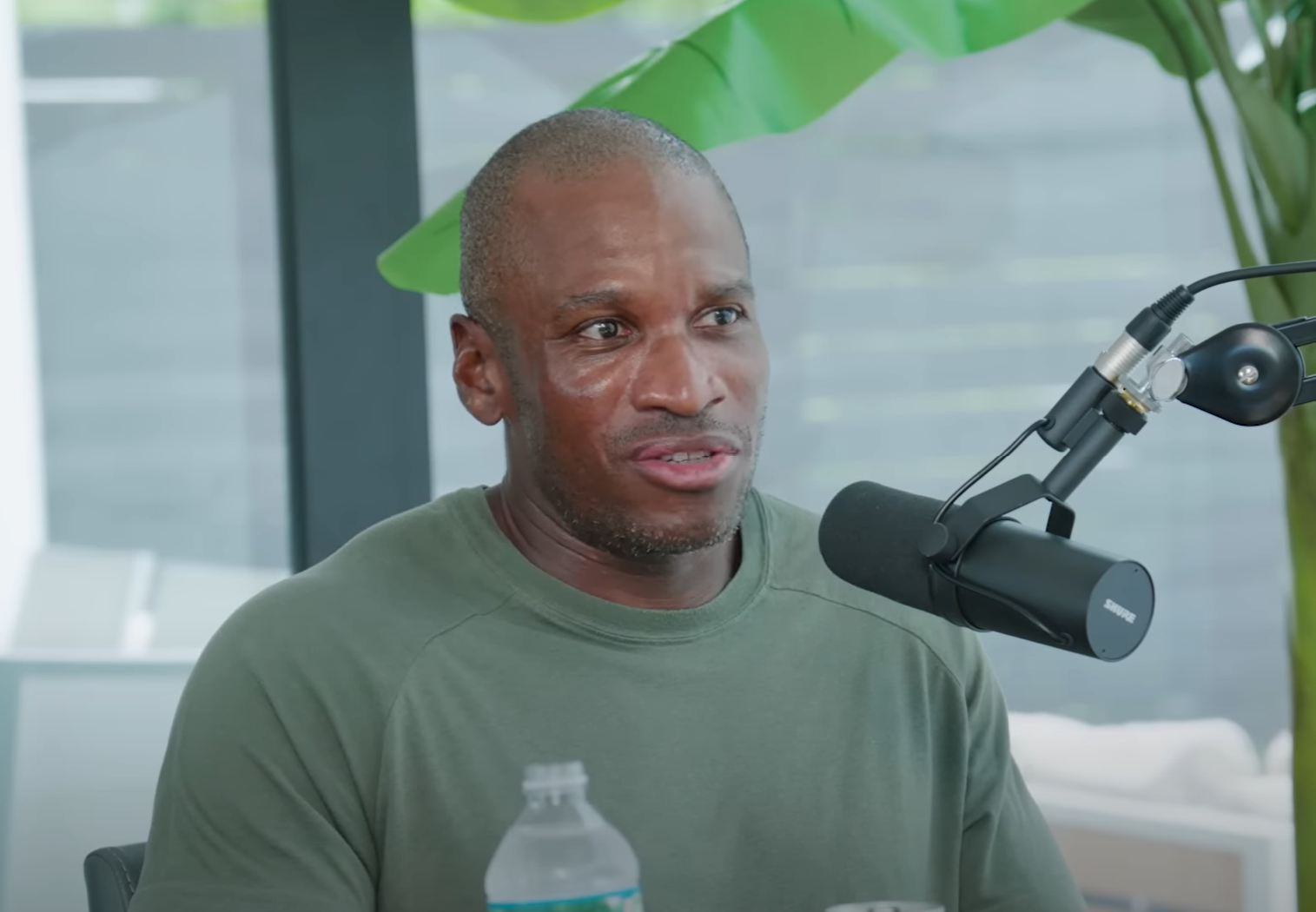

Arthur Hayes, the co-founder of crypto exchange BitMEX, has recently offered a comprehensive analysis in his latest essay, “Zoom Out,” drawing compelling parallels between the economic upheavals of the 1930s-1970s and today’s financial landscape. Hayes specifically focuses on the implications for the Bitcoin and crypto bull run in his in-depth examination.

Understanding Historical Economic Patterns

Hayes argues that by looking at historical economic patterns, we can gain insights into the potential revival of the Bitcoin and crypto bull run. He suggests that the economic upheavals of the 1930s-1970s, including the Great Depression and the oil crisis, can serve as a blueprint for understanding the current financial landscape.

Implications for Bitcoin

Hayes believes that the current economic uncertainty, coupled with central bank interventions and stimulus measures, could drive investors towards alternative assets like Bitcoin. He suggests that Bitcoin’s decentralized nature and limited supply make it an attractive hedge against inflation and economic instability.

Hayes points out that the recent halving event, which reduced the rewards for Bitcoin miners, could further fuel the cryptocurrency’s price growth. He predicts that the combination of increased demand and limited supply could lead to a significant bull run for Bitcoin and other cryptocurrencies.

How will this affect me?

As an individual investor, the potential revival of the Bitcoin and crypto bull run could present new opportunities for investment growth. By understanding the historical economic patterns and implications for Bitcoin, you can make informed decisions about incorporating cryptocurrencies into your investment portfolio.

How will this affect the world?

The revival of the Bitcoin and crypto bull run could have broader implications for the global economy. As more investors turn to alternative assets like Bitcoin, traditional financial institutions may need to adapt their policies and strategies to accommodate the growing interest in cryptocurrencies. This shift could lead to increased mainstream adoption of Bitcoin and other digital assets.

Conclusion

In conclusion, Arthur Hayes’ analysis of the Bitcoin and crypto bull run provides valuable insights into the potential growth of digital assets in today’s financial landscape. By examining historical economic patterns, investors can better understand the factors driving the revival of Bitcoin and other cryptocurrencies. As individuals and institutions navigate these changes, the future of cryptocurrency remains a dynamic and evolving space worth watching closely.