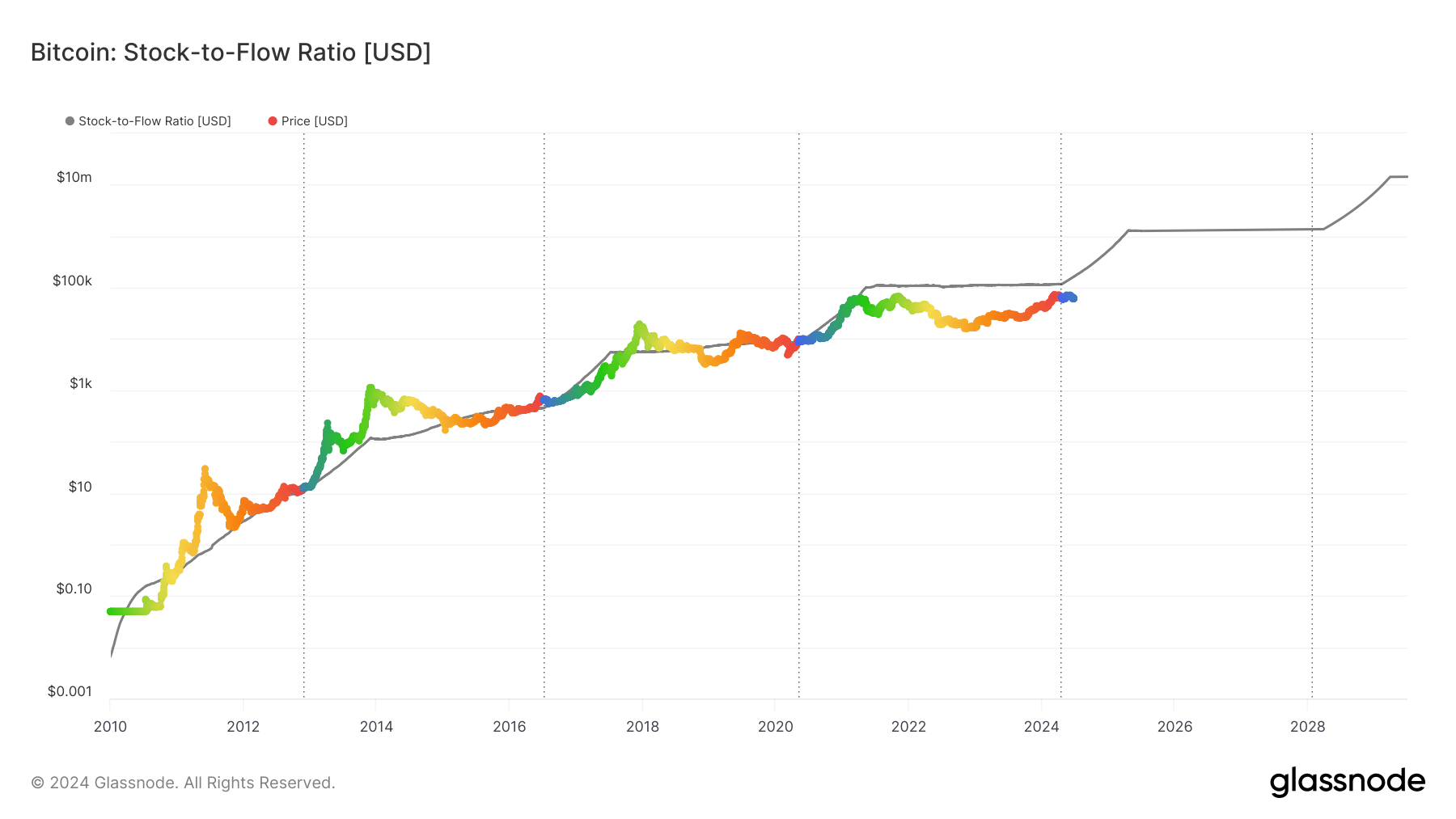

Bitcoin Deviates from Stock-to-Flow Model

Onchain Highlights

DEFINITION: The stock-to-flow (S/F) Ratio is a popular model that assumes scarcity drives value. It is defined as the ratio of the current stock of a commodity (e.g., the circulating Bitcoin supply) to the flow of new production (e.g., newly mined bitcoins). Bitcoin’s price has historically followed the S/F Ratio, which is why it’s important to track.

However, recent analysis has shown that Bitcoin is deviating from this model, causing concern among investors and analysts alike. The S/F Ratio has been a reliable predictor of Bitcoin’s price movements in the past, but the current divergence is raising questions about the future of the cryptocurrency.

One possible explanation for this deviation is the increasing influence of external factors on Bitcoin’s price. Market dynamics, regulatory changes, and macroeconomic trends can all impact the cryptocurrency market, leading to unexpected fluctuations in price that may not align with the stock-to-flow model.

While the stock-to-flow model has provided valuable insights into Bitcoin’s price behavior, it is important to recognize its limitations and consider other factors that may be influencing the market. As the cryptocurrency space continues to evolve, new models and metrics may be needed to accurately predict price movements and make informed investment decisions.

Bitcoin Investors:

For investors in Bitcoin, the deviation from the stock-to-flow model is a reminder of the inherent volatility and uncertainty in the cryptocurrency market. It’s important to stay informed about new developments and trends that may impact the price of Bitcoin, and to diversify your investment portfolio to manage risk effectively.

Global Impact:

The deviation of Bitcoin from the stock-to-flow model may have wider implications for the cryptocurrency market as a whole. It could lead to increased scrutiny from regulators and policymakers, as they seek to understand the factors driving price movements and ensure market stability. Additionally, it may prompt investors and analysts to reevaluate their strategies and predictions for the future of Bitcoin and other cryptocurrencies.

Conclusion

While the deviation of Bitcoin from the stock-to-flow model is a cause for concern, it also presents an opportunity for the cryptocurrency market to evolve and adapt to changing conditions. By staying informed, diversifying investments, and considering alternative models, investors can navigate the uncertain landscape of cryptocurrency with confidence and resilience.