Mid-sized Bitcoin transactions rise, reflecting market maturation

Onchain Highlights

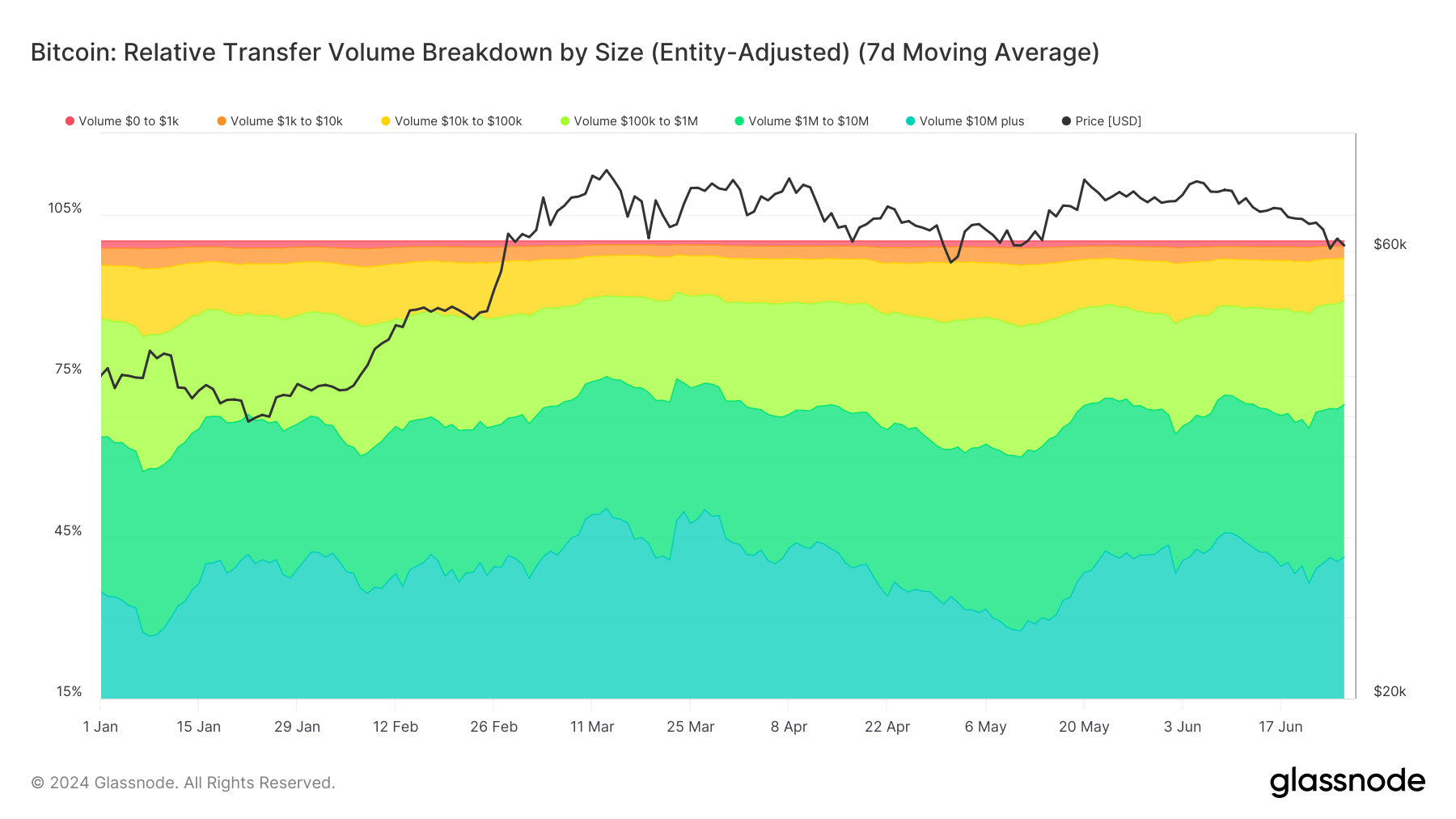

Entity-adjusted relative on-chain volume breakdown by the USD value of the transfers. Bitcoin’s relative transfer volume, when adjusted by entity and categorized by transfer size, exhibits nuanced trends across varying transaction bands. In January 2024, transfers under $1,000 constituted a minor portion of overall activity. Notably, transactions between $1,000 and $10,000 experienced a rise in activity…

Bitcoin, the popular digital currency, has been experiencing a shift in its on-chain transaction activities. A closer look at the entity-adjusted relative on-chain volume breakdown by the USD value of the transfers reveals interesting trends. In January 2024, transfers under $1,000 made up just a small portion of the overall activity.

However, what caught the attention of many analysts and experts is the increase in mid-sized Bitcoin transactions, particularly those ranging from $1,000 to $10,000. This surge in activity reflects a maturation of the market and indicates a growing confidence among investors in utilizing Bitcoin for transactions of larger amounts.

How will this affect me?

As a Bitcoin investor or user, the rise in mid-sized transactions can have several implications for you. Firstly, it may signal a shift towards using Bitcoin for larger purchases or investments, as more people feel comfortable carrying out transactions in the $1,000 to $10,000 range. This could lead to increased liquidity in the market and potentially drive up the value of Bitcoin in the long run.

Additionally, the growing activity in mid-sized transactions could attract more institutional investors and larger businesses to adopt Bitcoin as a payment method, further legitimizing its use and potentially leading to greater acceptance and integration of the digital currency in mainstream financial systems.

How will this affect the world?

The rise in mid-sized Bitcoin transactions is not just significant for individual users, but also has broader implications for the global financial landscape. As Bitcoin continues to gain traction as a medium of exchange for larger transactions, it could challenge traditional payment systems and banking institutions, paving the way for a more decentralized and accessible financial ecosystem.

Furthermore, the increase in mid-sized transactions reflects a growing trust and confidence in the capabilities of blockchain technology and cryptocurrencies to revolutionize financial systems and provide more secure and efficient means of conducting transactions on a global scale.

Conclusion

In conclusion, the rise in mid-sized Bitcoin transactions highlights the evolving nature of the cryptocurrency market and the growing acceptance of digital currencies as a viable alternative to traditional financial systems. As more investors and users engage in larger transactions using Bitcoin, we can expect to see a continued maturation of the market and increased integration of cryptocurrencies in the global economy.