Power-law model suggests Bitcoin’s maturity post-2024 halving

Onchain Highlights

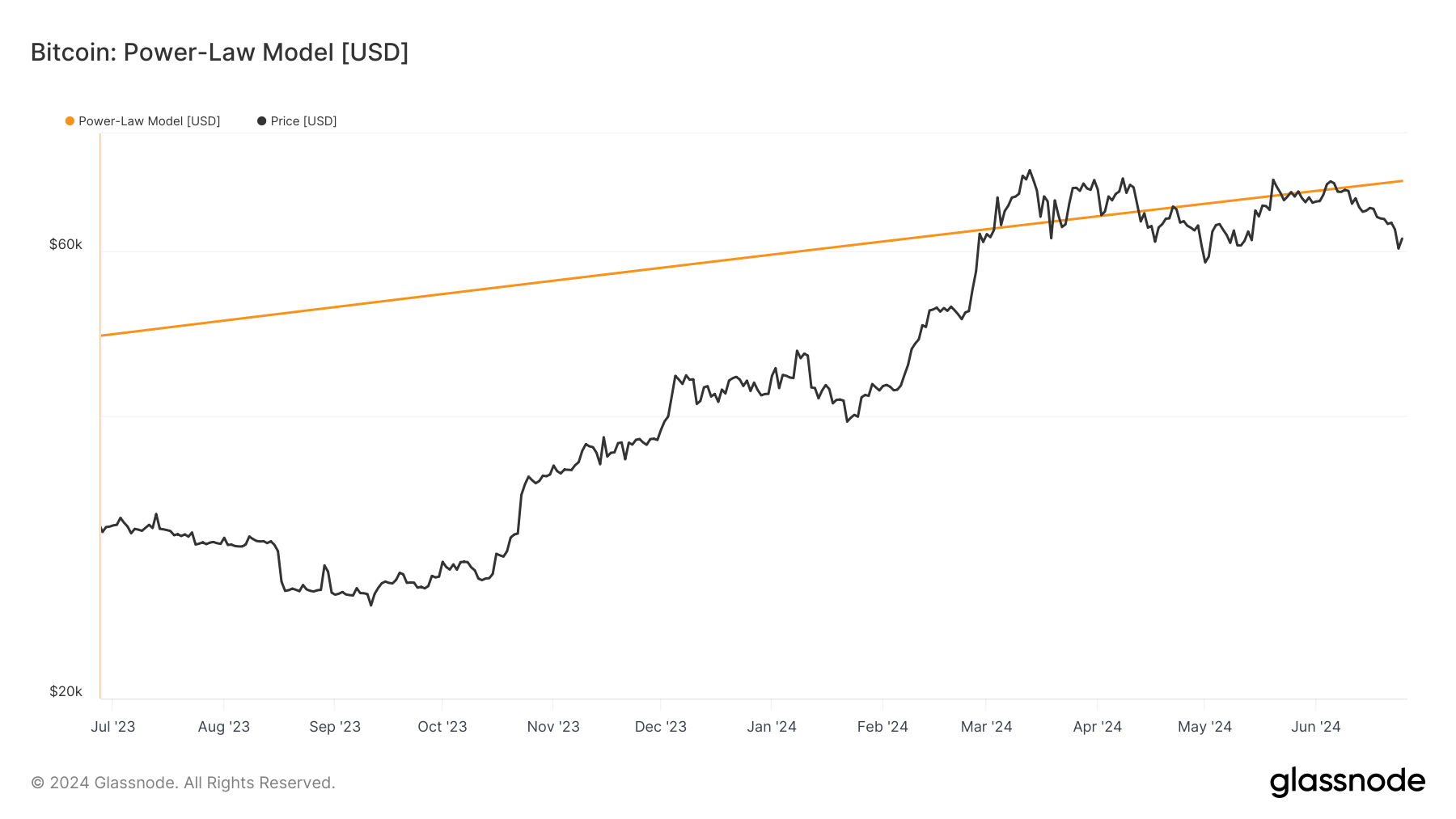

The Bitcoin Power-Law Model provides a mathematical description of Bitcoin’s historical price trends, revealing a power-law distribution on a log-log scale. This analysis suggests a correlation between time and price. However, the model’s foundation on historical data and the issue of non-independent sequential price points raise questions about its broader applicability.

Bitcoin’s volatility has been a topic of discussion among investors and analysts for years, with many trying to predict its future price movements. The Power-Law Model offers a unique perspective on Bitcoin’s price trends and potential future growth.

According to the model, Bitcoin’s price follows a power-law distribution, indicating that price changes are proportional to the time passed since the last halving event. This suggests that Bitcoin may experience periods of rapid growth followed by consolidation, as observed in previous halving cycles.

With the next halving event expected to occur in 2024, the model predicts that Bitcoin will enter a phase of maturity post-2024 halving. This could lead to more stable price movements and decreased volatility, making Bitcoin a more attractive asset for long-term investors.

How will this affect me?

As a Bitcoin investor, understanding the implications of the Power-Law Model can help you make informed decisions about your investment strategy. If the model proves to be accurate, you may need to adjust your expectations for Bitcoin’s future price movements post-2024 halving.

It is essential to consider the potential impact of decreased volatility on your investment portfolio and whether Bitcoin’s maturity could result in more stable returns over time. Keeping abreast of the latest research and developments in the cryptocurrency space can provide valuable insights into the future of Bitcoin and other digital assets.

How will this affect the world?

The implications of Bitcoin’s maturity post-2024 halving extend beyond individual investors to the broader financial landscape. A more stable and mature Bitcoin could attract institutional investors and large corporations looking to diversify their portfolios and hedge against traditional market risks.

Furthermore, the increased adoption of Bitcoin as a store of value could have a significant impact on global financial systems and central banks. As Bitcoin continues to gain mainstream acceptance, its influence on the traditional economic infrastructure may lead to a reevaluation of monetary policies and regulations.

Conclusion

In conclusion, the Power-Law Model provides a novel perspective on Bitcoin’s price trends and potential future growth. While its accuracy and applicability remain subject to debate, the model’s prediction of Bitcoin’s maturity post-2024 halving raises exciting possibilities for investors and the global financial community.