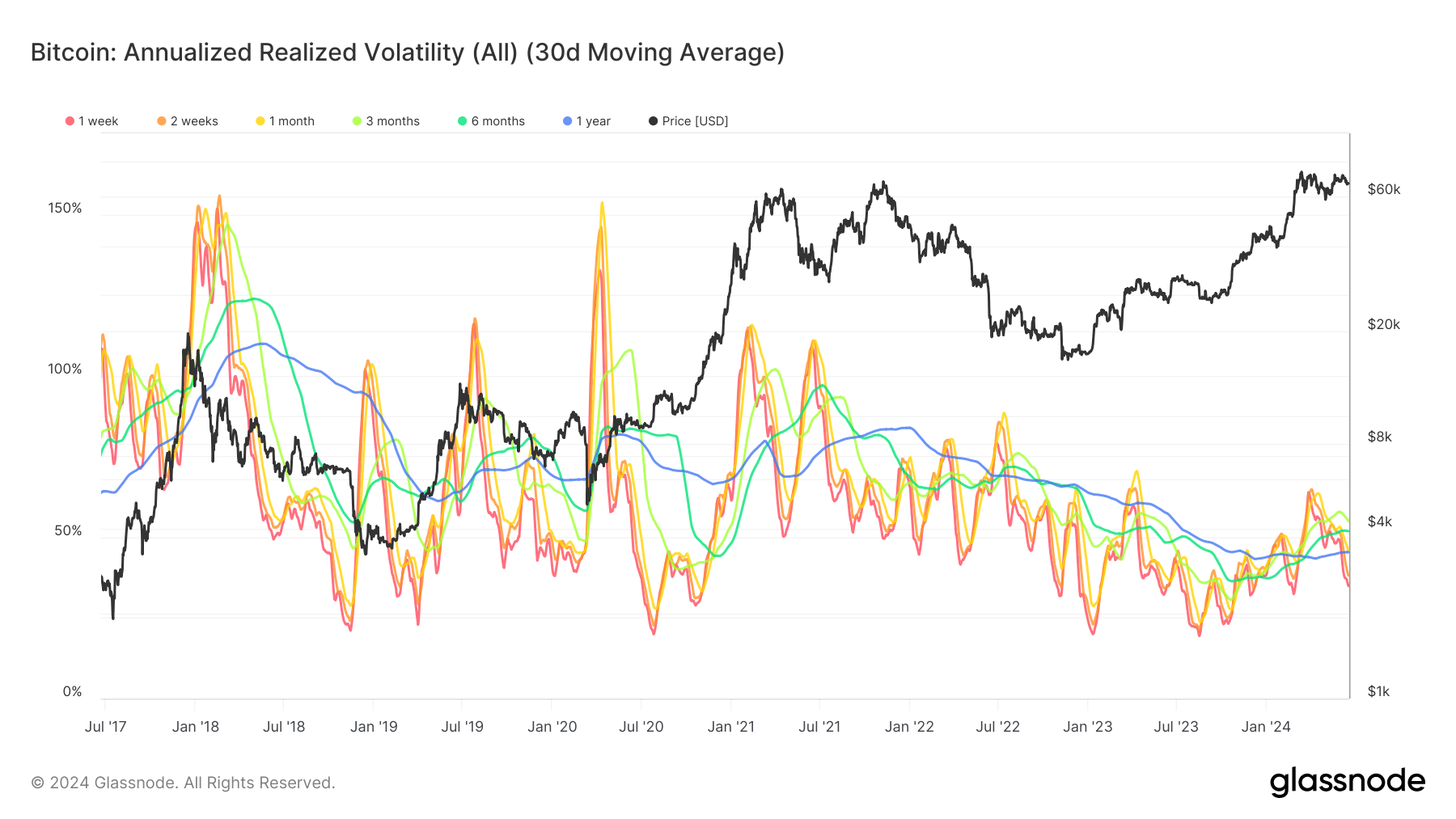

Get Ready for a Wild Ride: Bitcoin’s Volatility Reaches Record Lows During Extended Market Consolidation

Introduction

Are you a Bitcoin investor or enthusiast? If so, get ready for some exciting news! According to Glassnode, Bitcoin’s volatility has reached record lows during an extended period of market consolidation. But what does this mean for you and the world at large?

What is Realized Volatility?

Realized volatility is defined as the standard deviation of returns from the mean return of a market, indicating market risk. High values of realized volatility signal high-risk phases in the market. Unlike implied volatility, which predicts future market volatility, realized volatility measures past market fluctuations. It is calculated based on daily returns and annualized, offering insight into market behavior over time.

The Current Situation

Bitcoin’s volatility has hit new lows during a prolonged period of market consolidation. This means that the cryptocurrency is experiencing less price fluctuation than usual, leading to a more stable market environment. Investors may see this as an opportunity to enter or exit positions with less risk involved.

How This Affects You

For individual Bitcoin investors, low volatility can be both a blessing and a curse. On one hand, it reduces the risk of sudden price swings, making it easier to predict market movements. On the other hand, lower volatility can also lead to decreased trading opportunities and potentially lower profits for day traders.

How This Affects the World

In the larger context of the world economy, Bitcoin’s low volatility could have broader implications. A stable cryptocurrency market may attract more institutional investors and adoption by mainstream financial institutions. This could lead to increased legitimacy and acceptance of Bitcoin as a viable asset class.

Conclusion

In conclusion, Bitcoin’s volatility reaching record lows during an extended period of market consolidation is a significant development for both individual investors and the world at large. Whether you see this as a positive or negative development depends on your investment strategy and risk tolerance. But one thing is for sure – get ready for a wild ride in the world of Bitcoin!

How This Affects You:

For individual investors, this could mean fewer opportunities for short-term gains through trading. It may also signal a shift towards a more stable and mature market, attracting long-term investors seeking less volatility.

How This Affects the World:

On a global scale, Bitcoin’s reduced volatility could lead to increased adoption and acceptance by traditional financial institutions. This could pave the way for greater integration of cryptocurrencies into the mainstream economy, potentially reshaping the way we think about money and investments.