Rising Ethereum Futures Open Interest Highlights Impact of SEC’s ETF Approval

Onchain Highlights

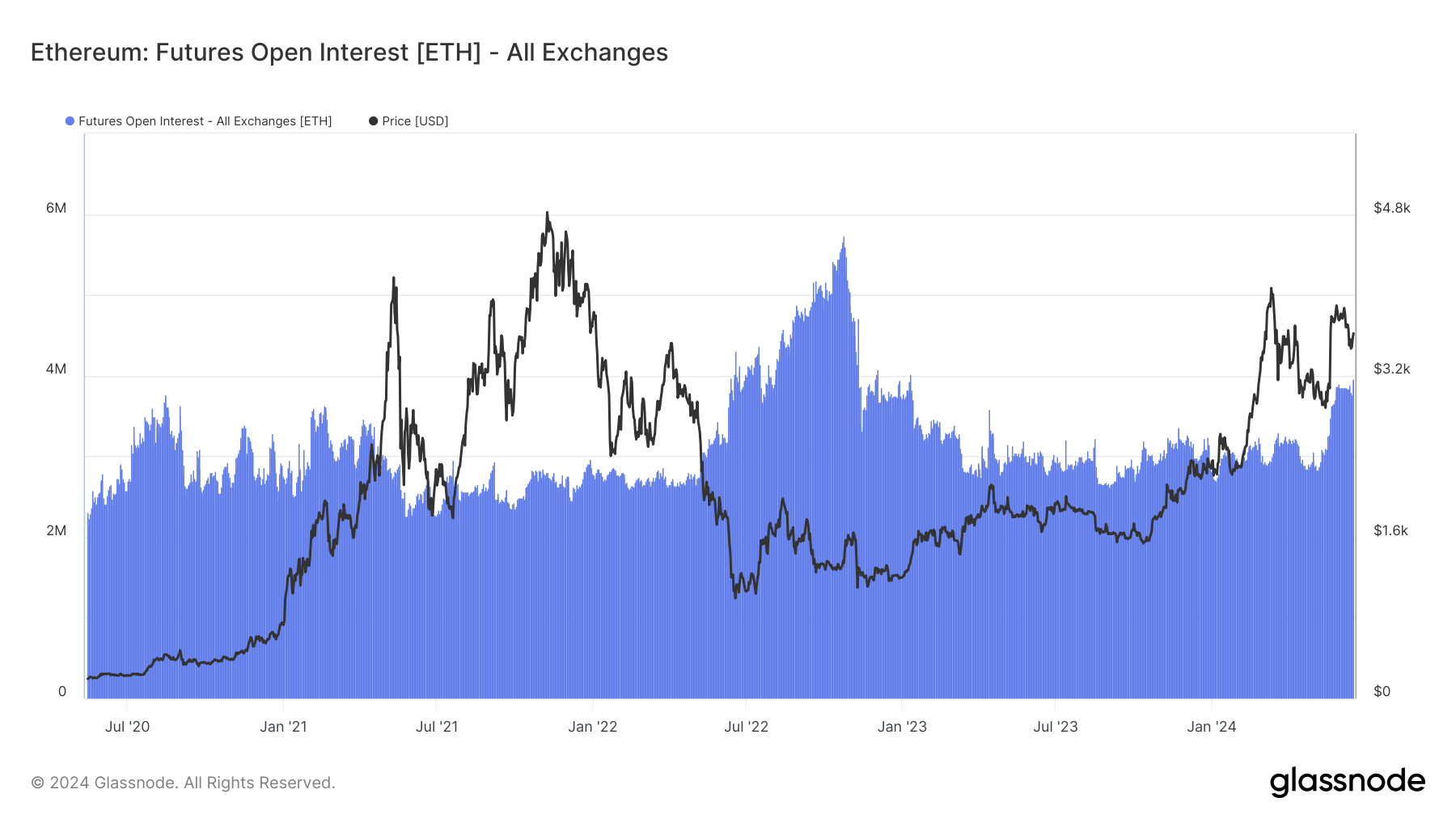

DEFINITION: The total amount of funds allocated in open futures contracts. Ethereum futures open interest has shown substantial volatility throughout 2024, significantly influenced by recent regulatory developments. Following the approval of spot Ethereum ETFs by the US Securities and Exchange Commission (SEC), open interest in Ethereum futures surged, reaching new highs.

On June 15th, the SEC announced its approval of spot Ethereum ETFs, a move that had been highly anticipated by the crypto community. This decision had a direct impact on the open interest in Ethereum futures, with traders flocking to the market to capitalize on the potential growth of the cryptocurrency.

How Does This Impact Me?

For individual traders and investors, the increase in Ethereum futures open interest provides an opportunity to participate in the market and potentially profit from the price movements of the cryptocurrency. With higher open interest, there is increased liquidity and trading volume, making it easier for traders to enter and exit positions.

How Does This Impact the World?

On a larger scale, the rising open interest in Ethereum futures demonstrates growing interest and confidence in the cryptocurrency market as a whole. The approval of spot Ethereum ETFs by the SEC is a significant milestone that could pave the way for further institutional adoption and investment in the space. This increased institutional participation could lead to greater market stability and legitimacy for cryptocurrencies.

Conclusion

In conclusion, the surge in Ethereum futures open interest following the SEC’s ETF approval is a positive sign for the crypto market. Individual traders have more opportunities to participate, while institutional interest could bring about greater legitimacy and stability to the industry. As regulations continue to evolve and adapt to the growing crypto market, we can expect to see more milestones like this that help shape the future of digital assets.