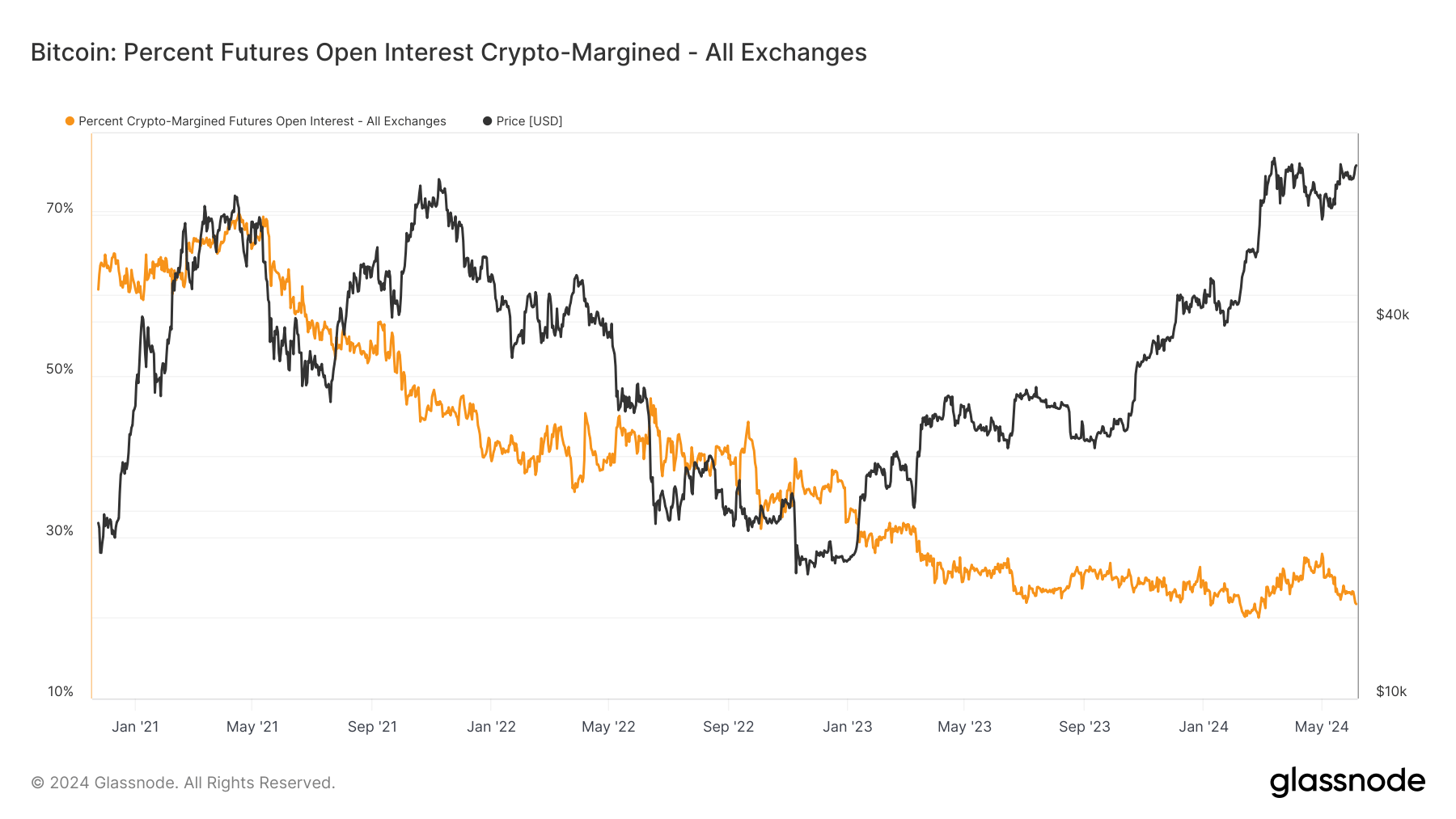

Decline in Crypto-Margined Futures Signals Shift Towards Stable Collateral

Onchain Highlights

Onchain highlights the definition of the percentage of futures contracts open interest that is margined in the native coin (e.g., BTC) and not in USD or a USD-pegged stablecoin. Bitcoin’s futures market is undergoing a notable shift, as reflected in the declining percentage of

crypto-margined futures open interest across all exchanges. Data from Glassnode showcases a significant…

Analysis of Market Trends

As the crypto market continues to evolve, we are witnessing a noticeable trend towards the use of stable collateral in futures trading. This shift away from relying solely on native coins like BTC for margining futures contracts reflects a growing preference for stability and reduced risk. Traders and investors alike are recognizing the benefits of using stablecoins or USD-pegged assets to mitigate volatility and minimize potential losses.

This move towards stable collateral signals a maturing of the cryptocurrency market, as participants seek ways to safeguard their investments and hedge against market fluctuations. By reducing exposure to the inherent volatility of digital assets, traders can better manage risk and protect their capital in the face of uncertain market conditions.

Impact on Individuals

For individual traders, the decline in crypto-margined futures and the shift towards stable collateral can have both positive and negative implications. On the one hand, using stablecoins as margin can provide a more stable trading environment and help protect against extreme price movements.

However, this shift may also limit the profit potential for traders who are accustomed to leveraging native coins for margin trading. As the market continues to evolve, individuals will need to adapt their strategies and consider the benefits of using stable collateral to navigate the changing landscape of cryptocurrency futures trading.

Global Implications

On a broader scale, the transition towards stable collateral in futures trading could have far-reaching implications for the global cryptocurrency market. As more traders opt for stablecoins as margin, we may see increased stability and reduced volatility in the market overall.

This shift could also lead to greater adoption of stablecoins and USD-pegged assets in the crypto space, as investors seek a more secure and predictable trading environment. Ultimately, the move towards stable collateral signals a growing maturity and sophistication in the cryptocurrency market, paving the way for increased mainstream adoption and institutional participation.

Conclusion

In conclusion, the decline in crypto-margined futures and the shift towards stable collateral represent a significant evolution in the cryptocurrency market. As traders and investors embrace the use of stablecoins for margin trading, we can expect to see increased stability and reduced risk in futures markets. This trend towards stable collateral not only benefits individual traders by offering a more secure trading environment but also has the potential to reshape the global cryptocurrency landscape, paving the way for greater adoption and institutional involvement in the market.