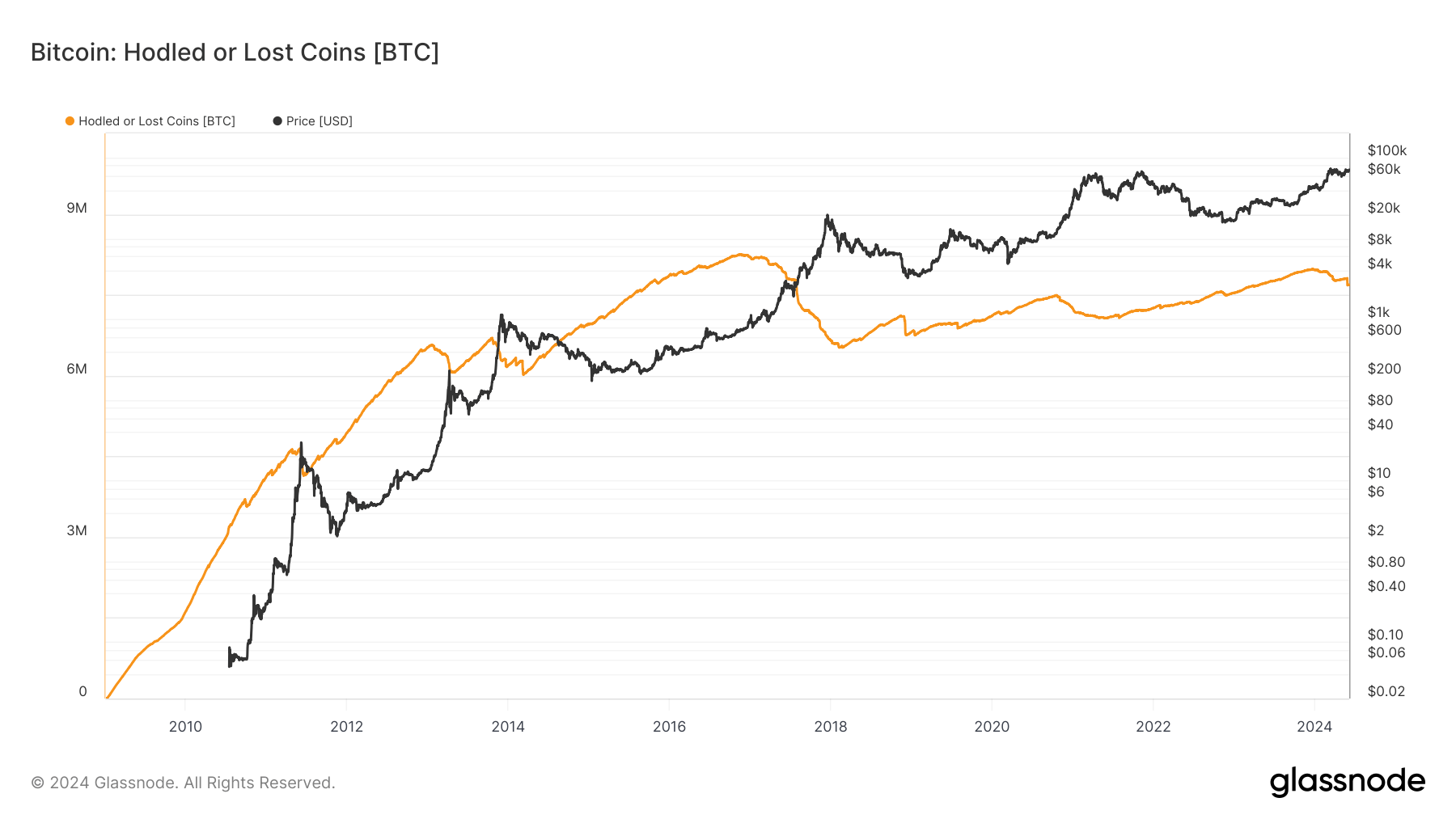

Bitcoin’s ‘hodled or lost coins’ metric falls to 7.7 million BTC

Understanding Lost or Hodled Bitcoins

Lost or Hodled Bitcoins refer to large and old stashes of Bitcoin that have not been moved in a significant amount of time. This metric is calculated by subtracting Liveliness from 1 and then multiplying the result by the circulating supply of Bitcoin. Glassnode, a leading cryptocurrency analytics platform, tracks this metric to analyze long-term trends in investor behavior.

Current State of Hodled or Lost Coins

According to Glassnode’s latest data, the Hodled or Lost Coins metric has fallen to approximately 7.7 million BTC. This decrease indicates that more Bitcoins are being moved or traded, suggesting a shift in investor sentiment and behavior. It is important to note that this metric is a key indicator of market activity and can provide valuable insights into the overall health of the Bitcoin network.

Impact on Individuals

For individual Bitcoin holders, the decrease in the Hodled or Lost Coins metric could signal increased volatility in the market. As more Bitcoins are being traded, prices may fluctuate more rapidly, presenting both risks and opportunities for investors. It is crucial for individuals to stay informed and educated about market trends to make informed decisions about their investments.

Impact on the World

The overall decrease in the Hodled or Lost Coins metric could have broader implications for the world economy. Bitcoin is often seen as a barometer of market sentiment and can influence other asset classes. Changes in the Hodled or Lost Coins metric may indicate shifts in global economic trends and behaviors, impacting everything from stock markets to currency exchange rates.

Conclusion

In conclusion, the decrease in Bitcoin’s Hodled or Lost Coins metric to 7.7 million BTC is a significant development in the cryptocurrency market. This metric provides valuable insights into investor behavior and market trends, both at an individual and global level. It is essential for investors to monitor these metrics closely and adapt their strategies accordingly to navigate the ever-changing landscape of the cryptocurrency market.