Unlocking the Potential: How Institutional Involvement is Reviving the Bitcoin Futures Market

Onchain Highlights

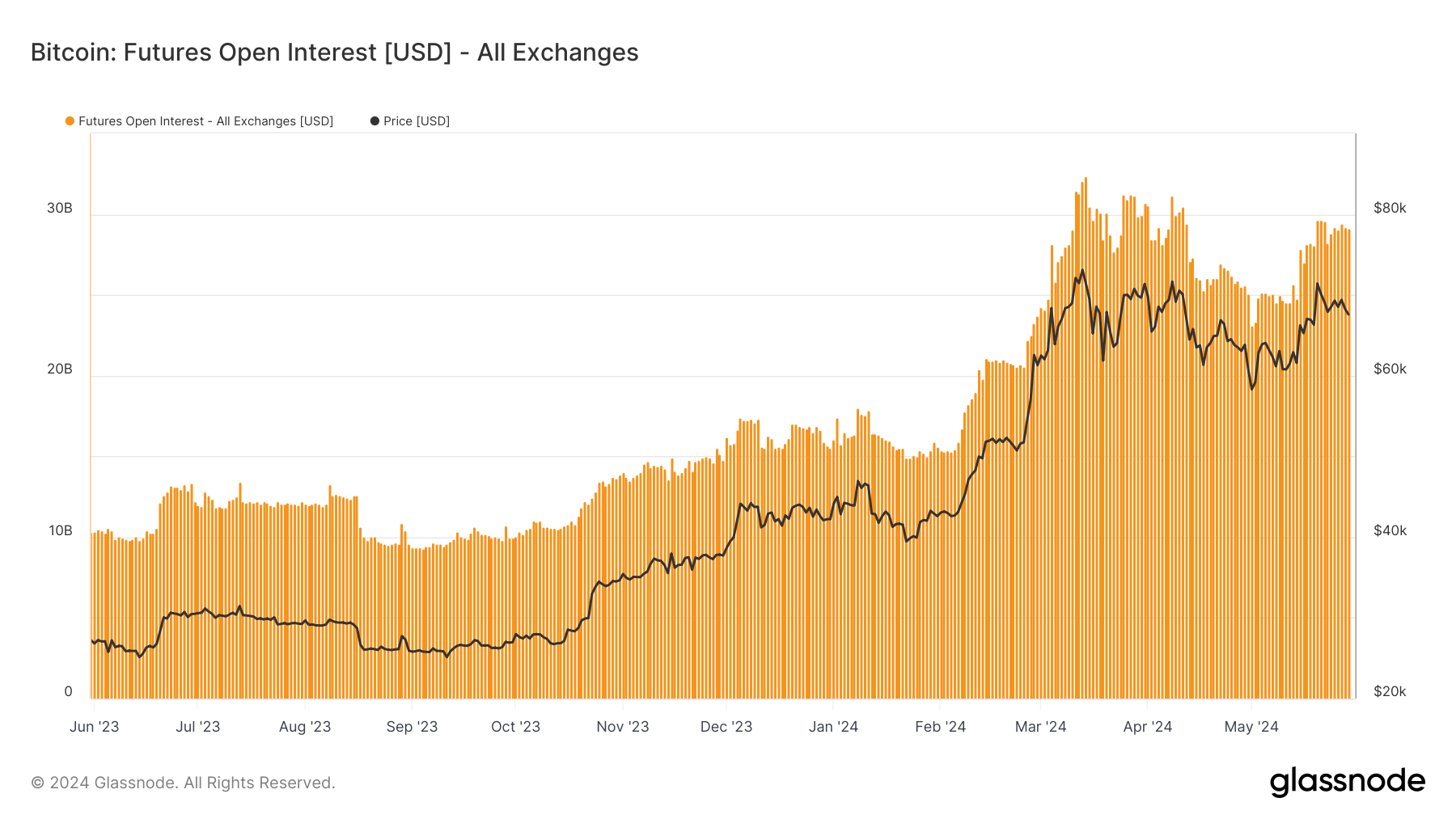

Bitcoin futures open interest (OI) is the total amount of funds allocated in open futures contracts. Bitcoin futures OI has seen a further rebound recently. As Bitcoin’s price approached $70,000 earlier this year, futures OI reached unprecedented levels, signaling renewed investor interest and market engagement. Past CryptoSlate insights highlighted that the uptick…

Imagine a world where Bitcoin futures are back in the spotlight, where institutional investors are at the forefront of driving market activity and increasing investor confidence. This is the reality that we are currently witnessing as institutional involvement is reviving the Bitcoin futures market.

For years, the Bitcoin futures market has been plagued by volatility, uncertainty, and a general lack of interest from institutional players. However, recent developments have shown that this is no longer the case. Institutional investors are flocking to Bitcoin futures, injecting much-needed liquidity and stability into the market.

The Impact on You

If you are a retail investor, this resurgence in the Bitcoin futures market could mean greater opportunities for profit. With institutional players back in the game, the market is likely to become more efficient and transparent, providing you with better trading conditions and potentially higher returns on your investments.

Furthermore, institutional involvement in the Bitcoin futures market could also have a positive impact on Bitcoin’s overall value and market capitalization. As more institutional investors enter the space, the legitimacy and acceptance of Bitcoin as a mainstream asset could increase, leading to greater adoption and higher prices.

The Impact on the World

On a larger scale, the revival of the Bitcoin futures market through institutional involvement could have far-reaching effects on the global financial system. As more institutions embrace Bitcoin and other cryptocurrencies, traditional financial markets may be forced to adapt and evolve to compete with this new asset class.

Additionally, the increased liquidity and stability brought about by institutional participation could help to reduce volatility in the Bitcoin market, making it a more attractive option for investors looking for safe-haven assets or long-term investment opportunities.

Conclusion

In conclusion, the resurgence of the Bitcoin futures market through institutional involvement is a positive development for both individual investors and the global financial system as a whole. As institutions continue to show interest in Bitcoin and other cryptocurrencies, the market is likely to see increased stability, liquidity, and legitimacy, paving the way for greater adoption and growth in the future.