Uniswap price jumps 20% as UNI hints at massive breakout

Introduction

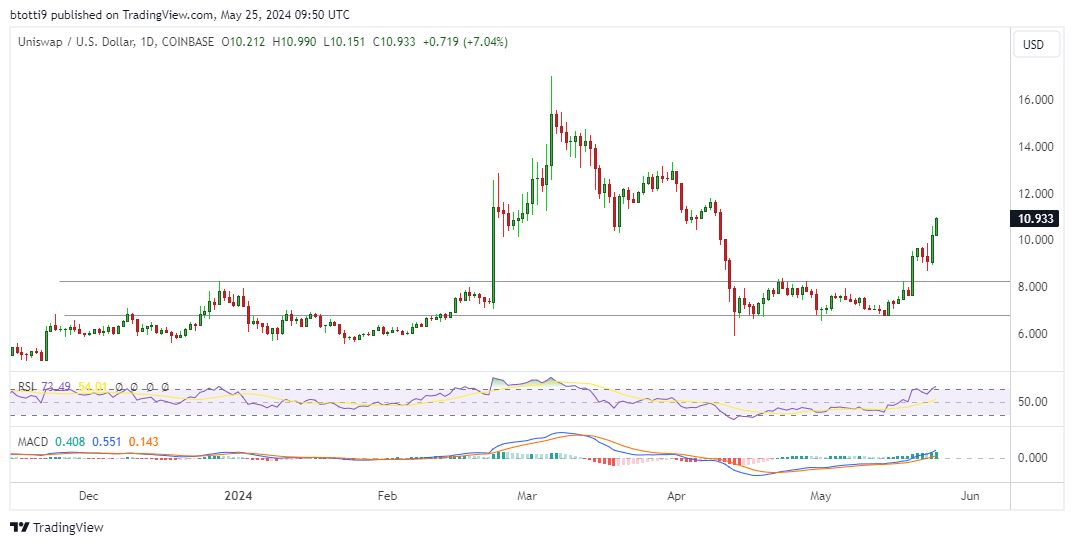

Uniswap price reached highs of $10.99 on May 25, rising more than 20% in 24 hours. This surge in price can be attributed to various factors such as whale activity, developments within the Ethereum ecosystem, and Uniswap Labs’ response to the SEC’s Wells Notice. The technical analysis also suggests a potential breakout that could propel UNI price towards $15.40 and even $20.

Whale Activity and Ethereum Ecosystem Developments

Whale activity has been a significant driver of UNI’s price surge. Large investors or “whales” have been accumulating UNI tokens, causing a supply shortage and driving up the price. Additionally, developments within the Ethereum ecosystem, such as the upcoming EIP-1559 upgrade and the growing popularity of decentralized finance (DeFi) projects, have also contributed to UNI’s price appreciation.

Uniswap Labs’ Response to SEC’s Wells Notice

Uniswap Labs’ response to the SEC’s Wells Notice has also been a positive catalyst for UNI’s price. The company’s commitment to regulatory compliance and transparency has reassured investors and helped boost confidence in the project. This regulatory clarity has played a key role in attracting new investors and institutions to the UNI ecosystem.

Technical Analysis and Potential Breakout

From a technical standpoint, UNI’s price chart shows signs of a potential breakout. The current price movement and bullish indicators suggest that UNI could reach $15.40 in the short term and potentially even surpass $20 in the near future. Traders and investors are closely monitoring these price levels for potential entry or exit points.

Effect on Me

As an investor in UNI tokens, the recent price surge has likely resulted in a significant increase in the value of my portfolio. This uptrend could present opportunities for me to take profits or reevaluate my investment strategy based on the unfolding market dynamics and price movements.

Effect on the World

The surge in Uniswap’s price and the potential breakout of UNI could have broader implications for the cryptocurrency market and the decentralized finance (DeFi) space. A strong performance by UNI could boost investor confidence in the DeFi sector and lead to increased adoption of decentralized exchanges like Uniswap. This, in turn, could drive further innovation and growth within the crypto ecosystem.

Conclusion

In conclusion, the recent price surge of UNI and the potential breakout offer exciting opportunities for traders, investors, and the broader cryptocurrency community. By closely monitoring market developments, regulatory updates, and technical indicators, individuals can make informed decisions to capitalize on the evolving trends in the crypto space.