Hash Ribbon metric signals miner capitulation, possibly marking Bitcoin’s price bottom at roughly $56,500

Introduction

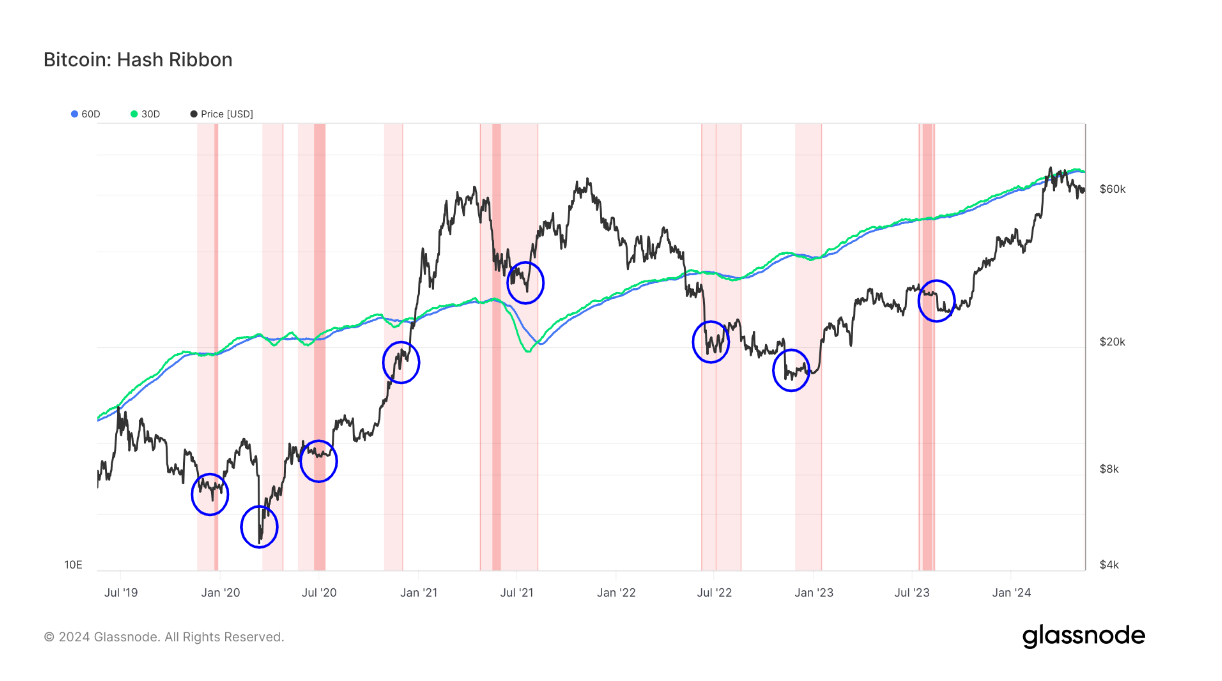

The Hash Ribbon metric by Glassnode, which has marked most of the bottoms in Bitcoin in the past five years, is finally signaling miner capitulation. This technical indicator assumes Bitcoin tends to bottom when miners are forced to capitulate due to mining becoming too costly relative to revenues. The Hash Ribbon compares the…

Exploring Miner Capitulation

Miner capitulation is not a new concept in the world of cryptocurrencies. It occurs when miners, who are responsible for processing transactions and securing the network, are no longer able to sustain their operations due to a drop in revenue or an increase in operational costs. This often leads to a significant sell-off in Bitcoin as miners are forced to liquidate their holdings in order to cover their expenses.

The Hash Ribbon metric, developed by Glassnode, analyzes the relationship between Bitcoin’s price and the hash rate of the network to identify potential bottoms in the market. When miners are unable to cover their costs and are forced to capitulate, the Hash Ribbon signal is triggered, indicating a possible price bottom for Bitcoin.

Impact on Individuals

For individual investors in Bitcoin, the signal of miner capitulation could potentially be a buying opportunity. Historically, when miners capitulate, it often marks a significant bottom in the price of Bitcoin, leading to a period of accumulation and eventual price growth. This could be a chance for investors to enter the market at a favorable price point before the next bull run.

Impact on the World

On a larger scale, the signal of miner capitulation could have broader implications for the cryptocurrency market as a whole. A bottom in Bitcoin’s price could signal the end of a bear market and the beginning of a new bullish cycle, attracting institutional investors and mainstream adoption. This could lead to increased interest and investment in blockchain technology and digital assets, further solidifying Bitcoin’s position as a dominant player in the financial market.

Conclusion

In conclusion, the Hash Ribbon metric signaling miner capitulation at roughly $56,500 could potentially mark a significant turning point for Bitcoin and the cryptocurrency market. Individual investors may see this as an opportunity to buy into the market at a favorable price, while the broader implications could lead to increased adoption and investment in digital assets. It will be interesting to see how this plays out in the coming months and whether Bitcoin’s price will indeed bottom out at this level.