Bitcoin resilient above $64,000 as halving nears, defies broader market downturn

Quick Take

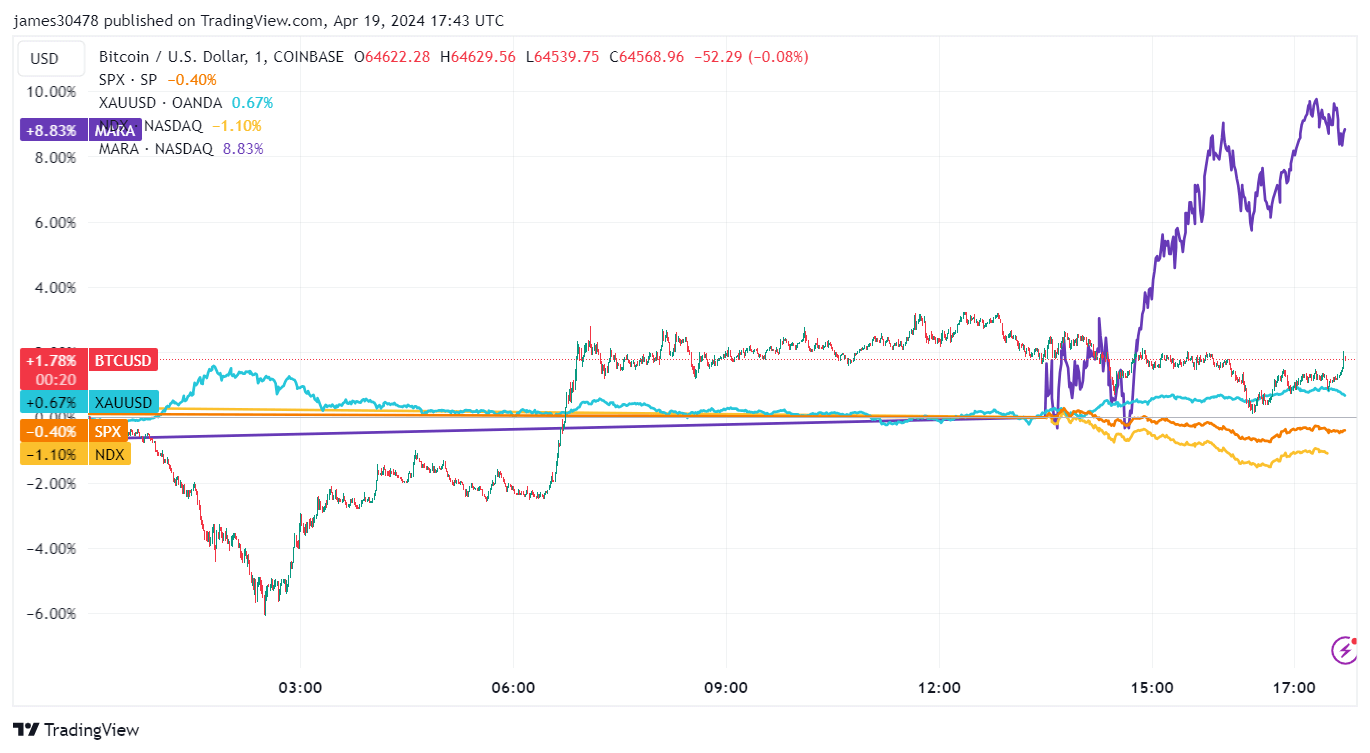

As the highly anticipated Bitcoin halving approaches, with less than 50 blocks remaining, the world’s largest digital asset is showcasing its resilience. Despite the broader market downturn, with US equities in the red and the Nasdaq down over 1%, Bitcoin has managed to hold its ground above the $64,000 mark. The Magnificent Seven

The Magnificent Seven

Bitcoin has long been referred to as the “Magnificent Seven” of the digital asset world. With its limited supply of 21 million coins, it is a rare and valuable asset that has captured the attention of investors around the globe. As the halving event nears, where the block reward for miners will be cut in half, there is a sense of anticipation and excitement in the crypto community.

Despite the recent market turbulence, Bitcoin has remained strong, defying the broader market downturn. This has led many to believe that Bitcoin may be entering a new phase of maturity and stability, where it is no longer as closely correlated with traditional markets.

As the halving event approaches, many are watching closely to see how Bitcoin will react. Will it continue to defy market expectations and maintain its resilience, or will it succumb to the pressures of the broader market downturn? Only time will tell.

How will this affect me?

As an investor or enthusiast in the crypto space, the Bitcoin halving event is a significant event that could have a direct impact on your holdings. The halving is expected to reduce the supply of new coins entering the market, which could potentially drive up the price of Bitcoin. This could result in increased profits for those holding Bitcoin, as well as increased interest and attention from the wider investment community.

How will this affect the world?

The Bitcoin halving event is not just a significant event for individual investors, but also has the potential to impact the wider financial world. As Bitcoin continues to gain mainstream acceptance and adoption, events like the halving can have ripple effects across the global economy. Increased interest in Bitcoin could lead to a more diversified investment landscape, as well as potential regulatory changes to accommodate the growing presence of digital assets.

Conclusion

As the Bitcoin halving event nears and the world’s largest digital asset continues to showcase its resilience, there is a sense of excitement and anticipation in the crypto community. Whether you are a seasoned investor or a newcomer to the space, the halving event is a momentous occasion that could have lasting implications for the future of Bitcoin and the wider financial world.