Popular financial expert Peter Schiff questions crypto mogul Mike Novogratz’s bullish forecast for Bitcoin

The Debate: Schiff vs. Novogratz

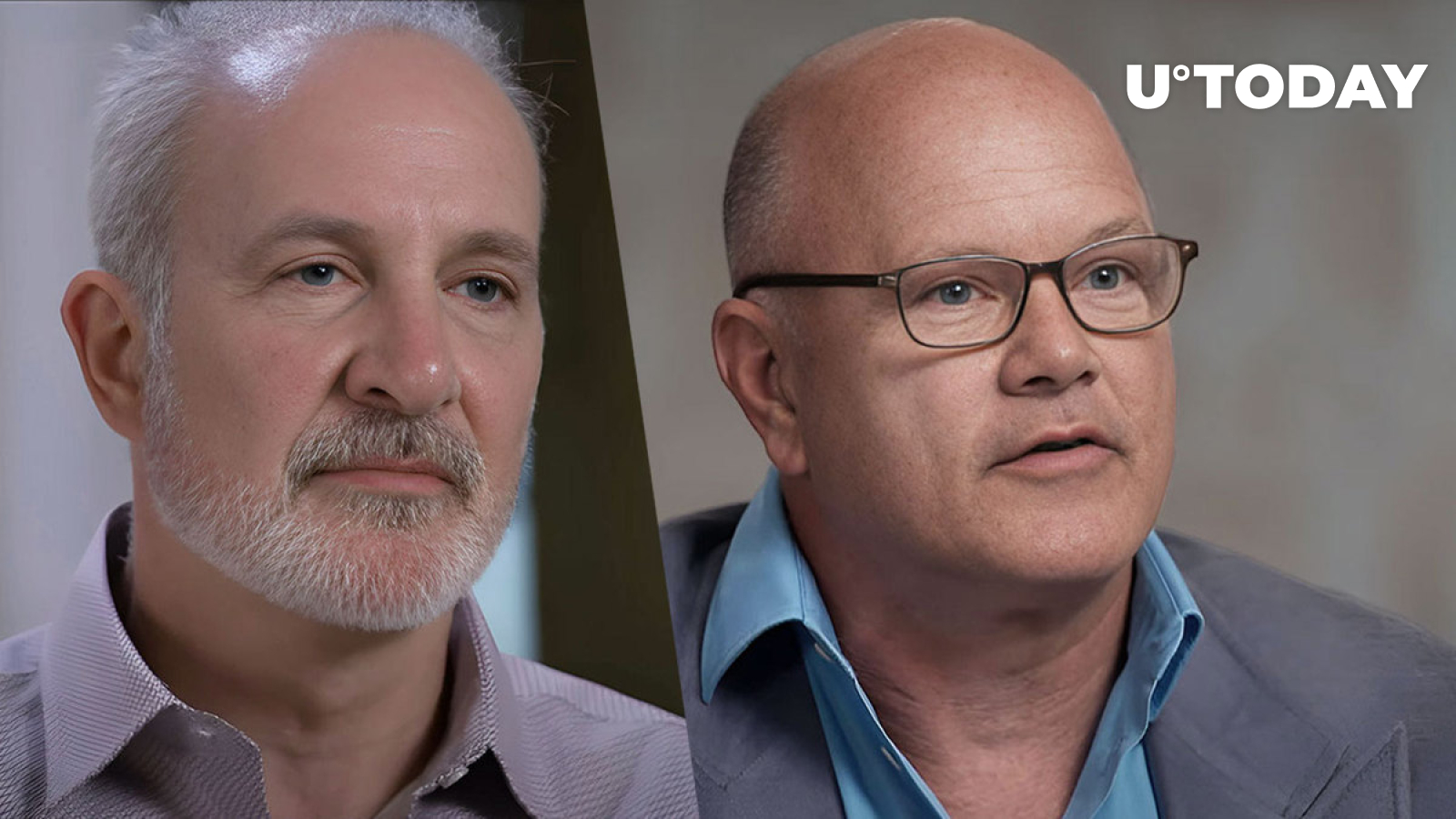

In the world of cryptocurrency, few figures loom larger than Peter Schiff and Mike Novogratz. Schiff, a well-known banker and financial commentator, is notorious for his skepticism towards Bitcoin and other digital assets. On the other hand, Novogratz, a prominent crypto investor and founder of Galaxy Digital, has long been a vocal supporter of Bitcoin.

Recently, Novogratz made headlines with his bullish prediction for Bitcoin, stating that the introduction of Bitcoin ETFs would lead to a significant increase in the value of the digital currency. However, Schiff was quick to challenge this forecast, calling into question the validity of Novogratz’s assertions.

Schiff’s Critique

Schiff’s main point of contention with Novogratz’s prediction is the idea that the influx of buyers through Bitcoin ETFs will drive the digital asset’s value to new heights. Schiff argues that Bitcoin’s value is inherently volatile and lacks the stability needed to sustain such growth. He also highlights the regulatory uncertainties surrounding Bitcoin ETFs as a potential obstacle to their success.

While Novogratz remains optimistic about the future of Bitcoin, Schiff’s skepticism serves as a reminder that not everyone is convinced of the cryptocurrency’s long-term viability.

Effects on Individuals

For individual investors, the debate between Schiff and Novogratz could have significant implications. Those who share Novogratz’s bullish outlook may see this as an opportunity to increase their investment in Bitcoin, hoping to capitalize on potential future gains. On the other hand, Schiff’s critique may give pause to those who are more cautious about the risks associated with cryptocurrency investments.

Effects on the World

On a larger scale, the debate over Bitcoin’s future could have ripple effects throughout the financial world. If Novogratz’s prediction proves to be correct and Bitcoin’s value does surge as a result of increased ETF activity, it could further legitimize cryptocurrency as a mainstream asset class. However, if Schiff’s skepticism is justified and Bitcoin fails to live up to its hype, it could impact the broader perception of cryptocurrencies and their role in the global economy.

Conclusion

As Peter Schiff and Mike Novogratz continue to spar over the future of Bitcoin, it’s clear that there is still much uncertainty surrounding the digital asset. Whether Bitcoin will fulfill its potential as a revolutionary financial instrument or fall short of expectations remains to be seen. In the meantime, investors would be wise to approach cryptocurrency with caution and carefully consider the differing perspectives of experts like Schiff and Novogratz.