Bitcoin back above $66k after weekend of panic selling

Market Volatility

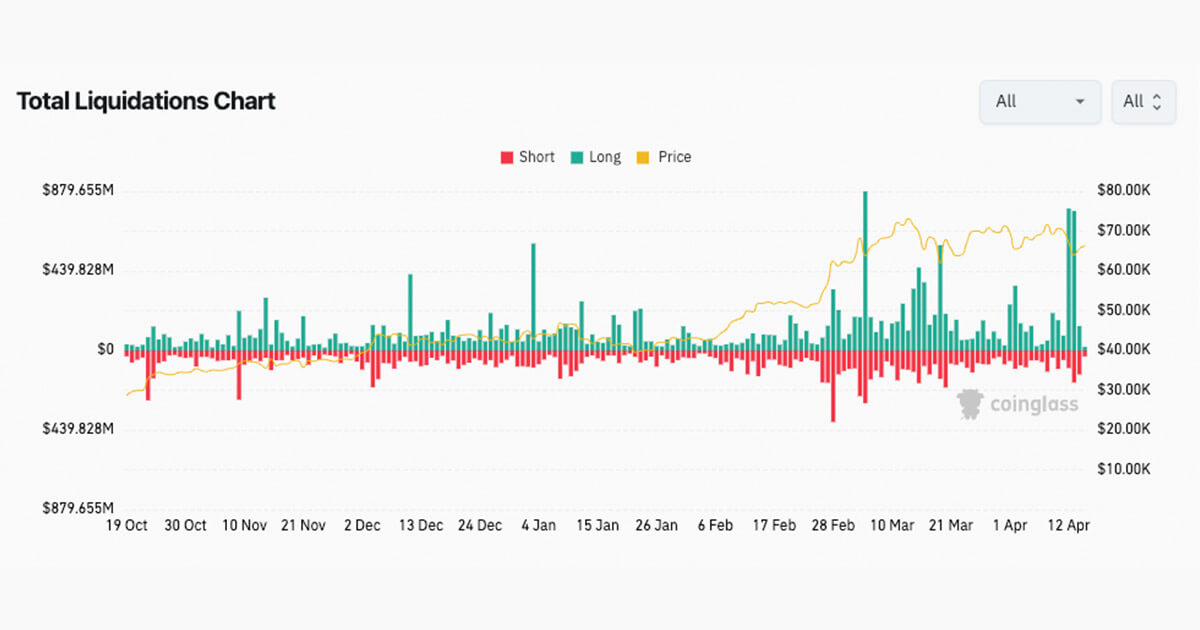

The digital asset ecosystem experienced a shaky weekend, with Bitcoin plummeting to around $65,000 from its $70,000 trading price on Friday, April 12. The downward trend continued into the weekend, with Bitcoin further declining to $60,800 amidst geopolitical tensions in the Middle East on Saturday evening.

Price Recovery

However, following a reduction in tension and positive news from regulatory authorities, Bitcoin has managed to bounce back above $66,000. This recovery has brought some relief to investors who were panicking over the weekend sell-off.

Despite the recent volatility, Bitcoin remains a popular choice for investors looking to diversify their portfolios and hedge against inflation. The cryptocurrency’s decentralized nature and limited supply have contributed to its appeal as a store of value.

Impact on Individuals

For individual investors, the fluctuations in Bitcoin’s price can lead to both opportunities and risks. Those who bought Bitcoin at a lower price during the weekend sell-off may have seen significant gains as the price rebounded. However, the market’s unpredictability can also result in substantial losses for those who bought at a higher price.

Global Implications

Bitcoin’s price movements can have far-reaching effects on the global economy. As the leading cryptocurrency, Bitcoin’s price is often seen as a barometer of market sentiment and risk appetite. A sharp drop in Bitcoin’s price can trigger sell-offs in other asset classes, leading to increased market volatility.

Conclusion

Despite the recent turbulence in the digital asset ecosystem, Bitcoin has managed to recover and is now trading above $66,000. The market remains highly volatile, presenting both opportunities and risks for investors. It will be crucial to closely monitor regulatory developments and geopolitical tensions that could impact Bitcoin’s price in the coming weeks.