The Evolution of Bitcoin’s Short-Term Holders

Introduction

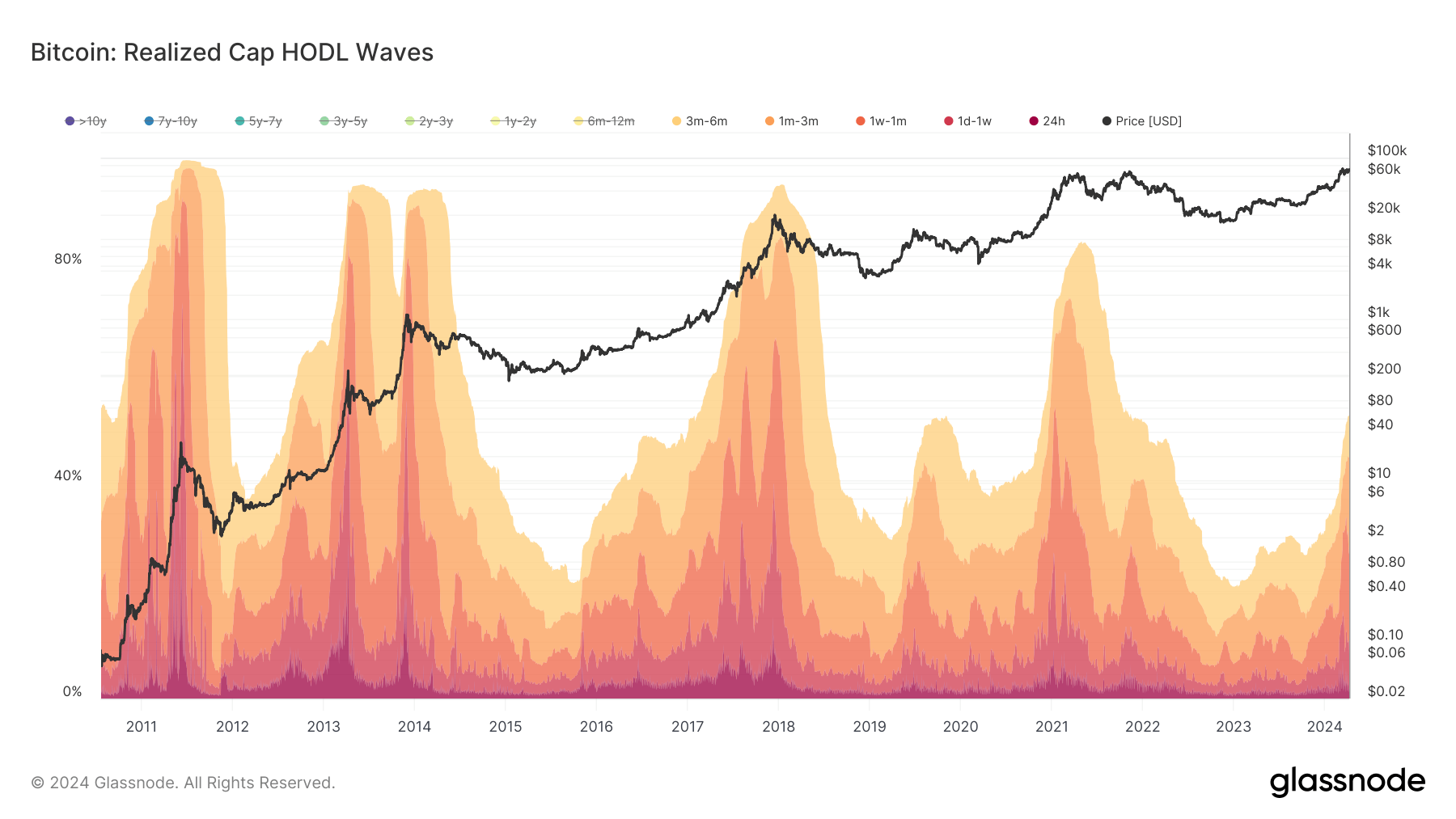

The behavior of short-term holders (STHs) has been a crucial barometer for Bitcoin’s price peaks and troughs. With Glassnode’s latest data revealing a striking pattern of STH supply control at key moments, a story of market evolution begins to unfold. From an almost total dominance during Bitcoin’s nascent stages to a markedly different landscape today, the shifts in holding durations mirror the broader narrative of Bitcoin’s journey.

The Rise of Short-Term Holders

During Bitcoin’s early days, short-term holders were the driving force behind price volatility. Their quick buying and selling tendencies created a market environment that was ripe for speculation. As the cryptocurrency gained mainstream attention, the number of short-term holders increased, amplifying the price swings even further. This cycle of speculation and profit-taking became a defining characteristic of Bitcoin’s price movements.

A Changing Landscape

However, as Bitcoin matured and established itself as a legitimate asset class, the behavior of short-term holders began to shift. Long-term holders started to dominate the market, holding onto their assets for extended periods of time. This shift from short-term to long-term holding signaled a more stable and sustainable market environment.

The Current State of Affairs

Today, short-term holders still play a significant role in Bitcoin’s price fluctuations. However, their influence has waned compared to previous years. Long-term holders hold a larger share of the total supply, indicating a more cautious and strategic approach to investing in Bitcoin. As we stand at a pivotal point in Bitcoin’s journey, the behavior of short-term holders will continue to shape the market dynamics.

How This Affects Me

As a Bitcoin investor, the behavior of short-term holders can have a direct impact on the value of your holdings. Understanding their tendencies and patterns can help you make informed decisions about when to buy or sell Bitcoin. By keeping a close eye on the market evolution, you can navigate the ups and downs of Bitcoin’s price movements more effectively.

How This Affects the World

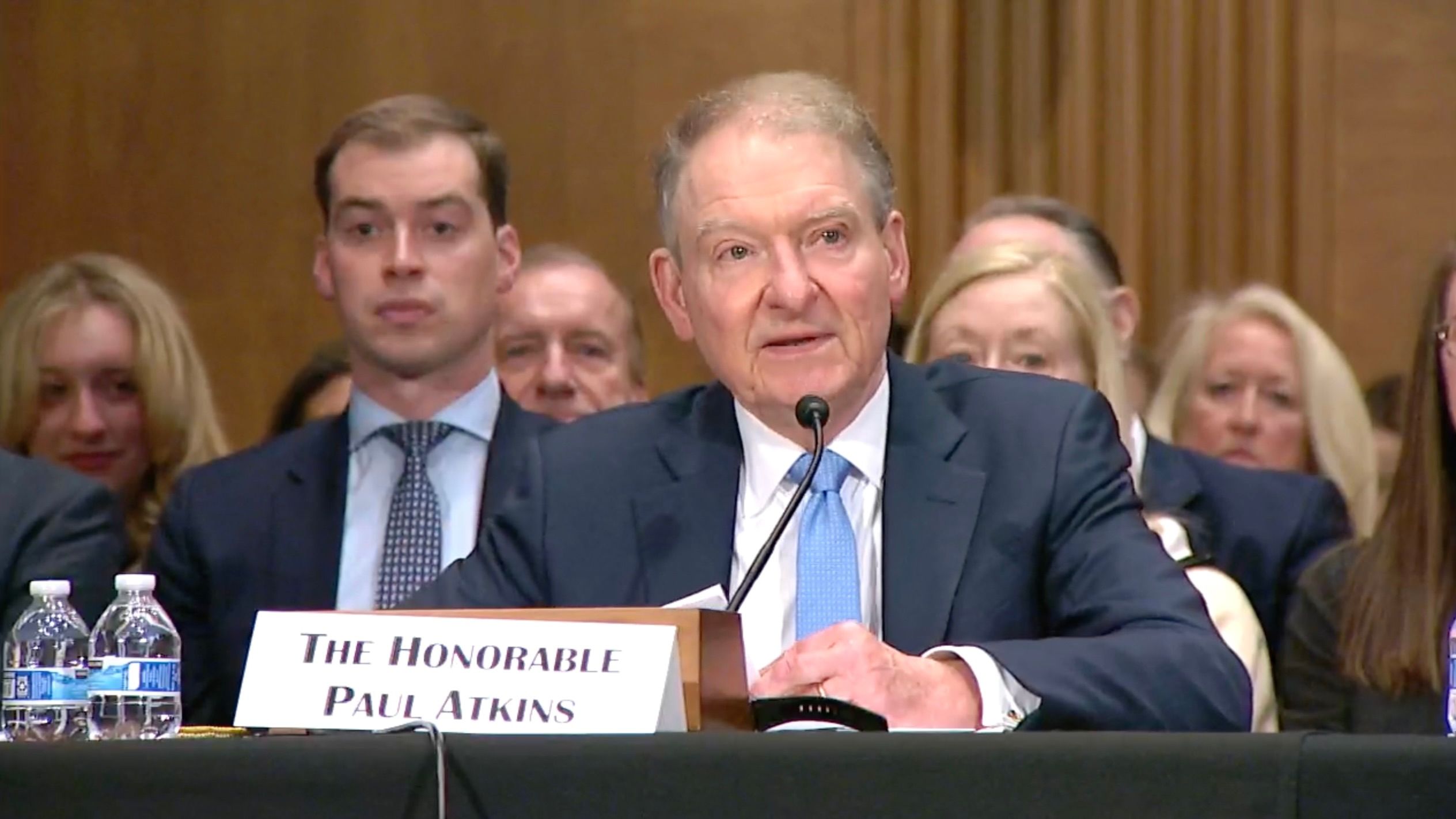

The behavior of short-term holders not only affects individual investors but also has broader implications for the global economy. Bitcoin’s price volatility can have ripple effects on other financial markets, making it a key indicator of overall market sentiment. As Bitcoin continues to gain mainstream acceptance, the behavior of short-term holders will be closely watched by regulators and policymakers around the world.

Conclusion

In conclusion, the evolution of Bitcoin’s short-term holders is a fascinating story of market dynamics and investor behavior. From the wild speculation of early days to the more strategic approach of today, the shifts in holding durations reflect the maturation of Bitcoin as an asset class. As we move forward, the behavior of short-term holders will continue to shape the future of Bitcoin’s market. Stay informed, stay vigilant, and stay ahead of the curve.