Unleashing the Power of Bitcoin: A Decade High in Accumulation Among the Elite Shark Community

Quick Take

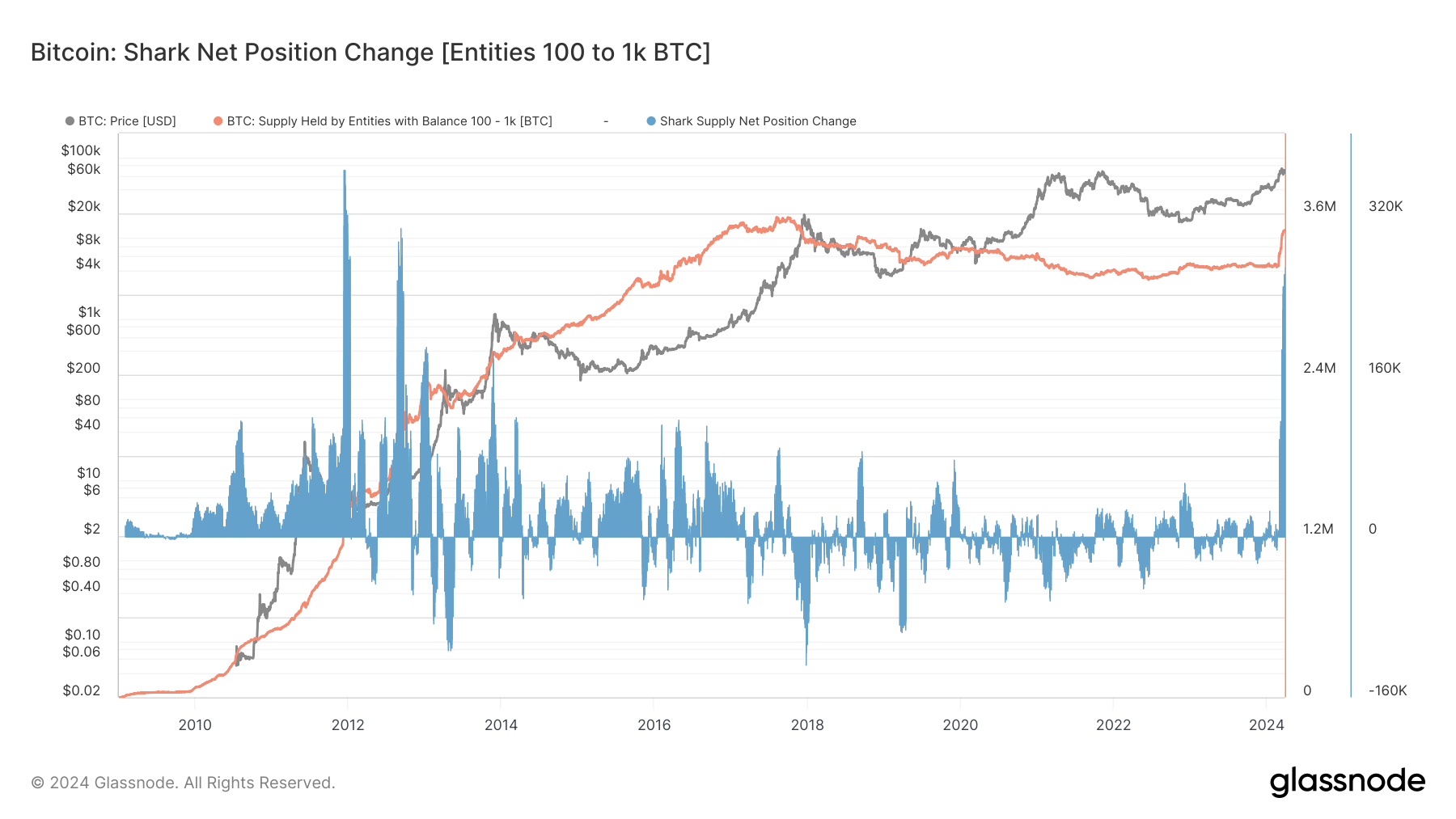

The digital asset market is witnessing an accelerated phase of Bitcoin (BTC) accumulation across two distinct cohorts: Shrimps and Sharks. The “Shrimp cohort” refers to retail investors holding less than one Bitcoin who have traditionally increased their holdings steadily. Currently, this group is exhibiting its most assertive accumulation since November 2023, expanding its presence in the cryptocurrency market.

The Rise of Bitcoin Accumulation

Bitcoin, the first cryptocurrency ever created, has been steadily gaining momentum and recognition over the past decade. Initially viewed as a novelty or a passing trend, Bitcoin has proven its staying power and resilience in the ever-changing landscape of digital assets.

Among the various groups of investors in the cryptocurrency market, two distinct cohorts have emerged: the Shrimps and the Sharks. The Shrimp cohort consists of retail investors who hold less than one Bitcoin, while the Shark cohort comprises high-net-worth individuals and institutional investors with larger holdings.

While both groups have been accumulating Bitcoin over the years, the Shark cohort is currently experiencing a decade-high in accumulation. These elite investors are increasing their stakes in Bitcoin, signaling a strong vote of confidence in the future of the digital asset.

Implications for Individual Investors

For individual investors, the increased accumulation of Bitcoin among the Shark cohort can have several implications. Firstly, it may indicate a growing recognition of Bitcoin’s value and potential for long-term growth. As high-net-worth individuals and institutions continue to invest in Bitcoin, it could lead to increased stability and liquidity in the market.

Additionally, the accumulation of Bitcoin among elite investors may also result in price appreciation, as higher demand for the digital asset can drive up its value. This could potentially lead to profitable opportunities for individual investors who hold Bitcoin as part of their investment portfolio.

Global Impact of Bitcoin Accumulation

On a larger scale, the decade-high accumulation of Bitcoin among the Shark cohort could have significant implications for the cryptocurrency market and the global financial system. As more high-net-worth individuals and institutional investors allocate resources to Bitcoin, it could further legitimize the digital asset as a mainstream investment option.

This increased institutional adoption of Bitcoin could pave the way for greater regulatory clarity and acceptance of cryptocurrencies in traditional financial markets. It may also contribute to the overall growth and maturation of the cryptocurrency ecosystem, attracting more interest and investment from a wider range of stakeholders.

Conclusion

In conclusion, the current trend of Bitcoin accumulation among the elite Shark community signals a turning point in the evolution of the cryptocurrency market. As high-net-worth individuals and institutional investors continue to increase their stakes in Bitcoin, it underscores the growing recognition of the digital asset’s value and potential for long-term growth.

Individual investors may benefit from this trend through potential price appreciation and increased market stability, while the global impact of institutional adoption could have far-reaching consequences for the future of cryptocurrencies and traditional financial systems.