Recent Bitcoin buyers show unyielding optimism, pushing cost basis upward despite price surges

Utilizing data from Glassnode to estimate a market-wide cost basis reveals intriguing trends

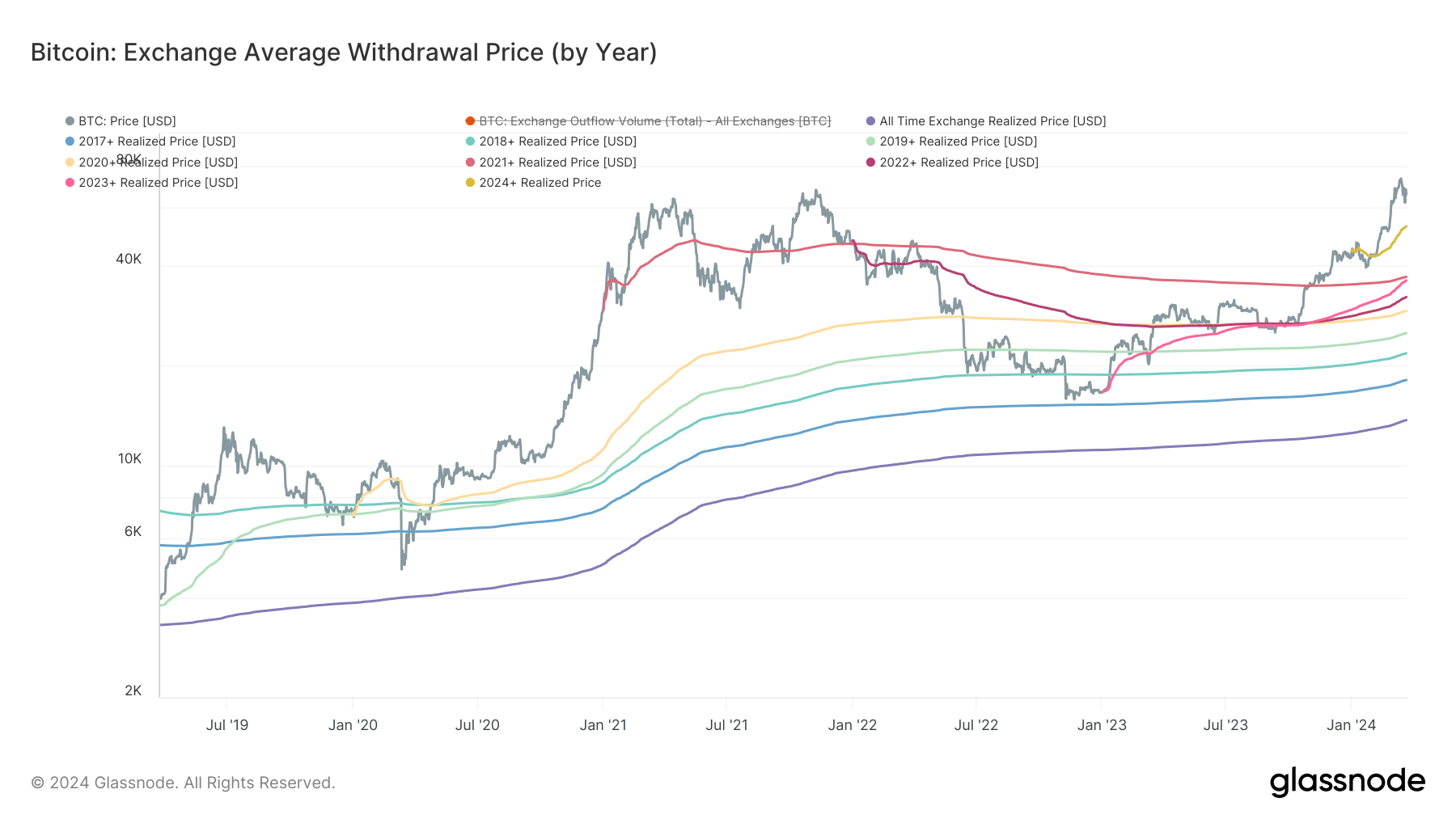

Utilizing data from Glassnode, we are able to estimate a market-wide cost basis which reveals interesting trends in the average price at which coins are withdrawn from exchanges. This information, segregated into cohorts, uncovers an upward trajectory on a cost basis, indicating a trend of purchasing Bitcoin at incrementally higher prices.

Bitcoin buyers remain optimistic despite price surges

One of the most fascinating insights from the data is that recent Bitcoin buyers are showing unyielding optimism, pushing the cost basis upward despite price surges. Even with the volatility in the market, these buyers continue to believe in the long-term potential of Bitcoin and are willing to pay higher prices to acquire it.

As we delve deeper into the cohorts, we see that the 2024 cohort, in particular, has experienced significant growth in their cost basis. This suggests that newer investors are entering the market with a bullish outlook, driving up the average price at which Bitcoin is being purchased.

Impact on individuals:

For individual investors, this trend could mean that the cost of acquiring Bitcoin continues to rise, making it more expensive to buy into the market. It may also indicate a shift towards a stronger belief in the future value of Bitcoin, leading investors to hold onto their assets for longer periods.

Impact on the world:

On a larger scale, this trend could signal a growing acceptance and adoption of Bitcoin as a legitimate asset class. As more investors continue to buy into Bitcoin at higher prices, it could lead to increased stability in the market and a broader recognition of cryptocurrency as a valuable investment opportunity.

Conclusion:

In conclusion, the data from Glassnode paints a picture of a market that is evolving and maturing, with investors showing unwavering confidence in the future of Bitcoin. Despite price surges and market fluctuations, buyers are willing to pay higher prices to acquire Bitcoin, indicating a strong belief in its long-term potential. This trend could have implications for individual investors looking to enter the market as well as for the wider financial landscape, signaling a shift towards greater acceptance of cryptocurrency as a valuable asset.